Summary

- It said that if Naver Financial completes a share exchange with Dunamu, the IPO process is expected to intensify.

- It reported that Naver Financial is likely to pursue listing after incorporating Dunamu as a subsidiary to have its company value validated in the market.

- It evaluated that the governance structure change through the share exchange with Dunamu could resolve the controversy over duplicate listings.

A way to avoid the 'dual listing controversy'

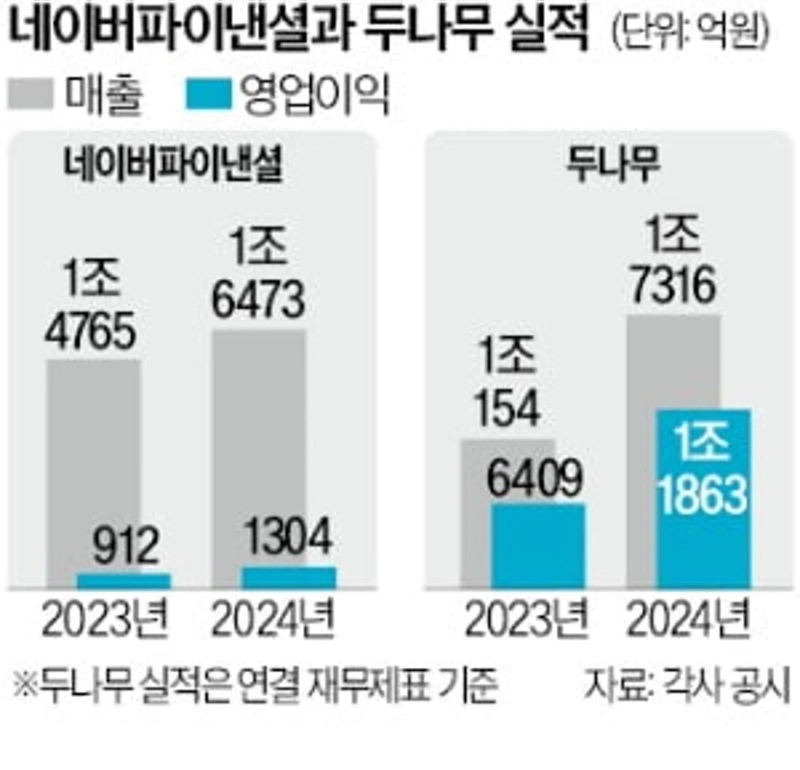

Naver Financial is expected to move forward with an initial public offering (IPO) in earnest after completing a share exchange with Dunamu. This is to have the company value of Naver Financial, which would have Dunamu under its umbrella before a mid- to long-term merger with parent company Naver, validated.

According to the investment banking (IB) industry on the 29th, if Naver Financial turns Dunamu into a 100% subsidiary through a share exchange, the listing movement is expected to accelerate.

If integrated Naver Financial remains unlisted and then merges with Naver, disputes over the company valuation could arise. Therefore, many view it as realistic to list the integrated company to have its company value validated in the market before merging with Naver.

There is also a possibility that Dunamu may present an IPO plan as a way to allow several financial investors (FIs) to recover funds and approve this share exchange with Naver Financial.

There had been considerable speculation that Dunamu would seek a listing on the U.S. Nasdaq market to help FIs recover funds. Choosing a Nasdaq listing could command a higher valuation in the global market. However, if the possibility of a mid- to long-term merger with Naver is kept in mind, there is an assessment that a domestic listing carries more weight. Considering future corporate governance restructuring, a domestic listing is easier than Nasdaq.

The duplicate listing issue also appears likely to be avoided. Under the current Naver system it may be difficult to escape controversy over duplicate listings, but if the governance structure is changed through a share exchange with Dunamu, the largest shareholder would become Dunamu Chairman Song Chi-hyung, and dependence on Naver for revenue would be significantly reduced.

Reporter Choi Seok-cheol dolsoi@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)