Editor's PiCK

[Analysis] "Bitcoin surged at the end of September, triggered by rate cuts and regulatory easing"

Summary

- CryptoQuant contributor said Bitcoin's rally was triggered by a combination of factors such as rate cuts and regulatory easing.

- He said U.S. ETF listing rule easing, institutional inflows, and supply-demand stabilization after long-term holders realized profits were notable.

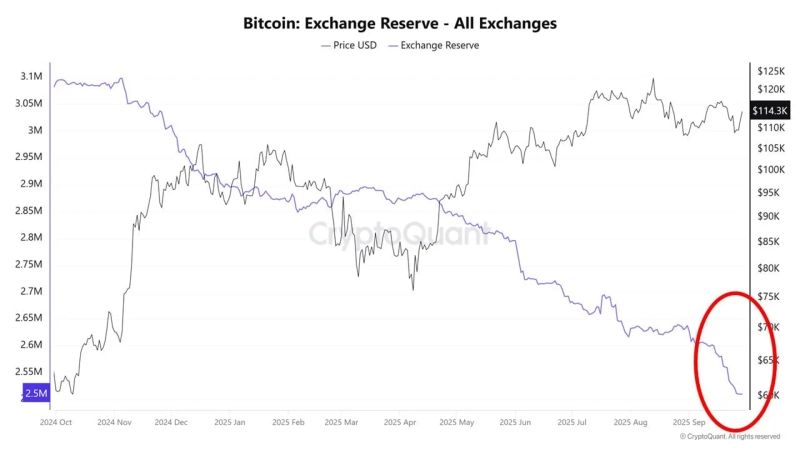

- He said Bitcoin is being recognized again as an undervalued asset due to confirming a strong support line and decreasing exchange reserves.

This week the leading cryptocurrency Bitcoin (BTC) has shown a pronounced uptrend. Various factors are believed to have driven this rally.

On the 30th (KST), CryptoQuant contributor 'XWIN Research Japan' wrote in a report that "Bitcoin's rebound at the end of September was the result of several factors occurring simultaneously."

He listed the rebound factors as △rate cuts, △regulatory easing, △technical rebound, and △positive on-chain indicators.

First, he analyzed that rate cuts caused gold prices to soar and funds then flowed into Bitcoin. The contributor explained, "After the Fed cut rates on the 17th and the dollar weakened, gold prices reached an all-time high," adding, "It is often observed that money initially flows into safe-haven assets like gold and, after some time, moves into risk assets like Bitcoin." He also added that "concerns over the widening U.S. fiscal deficit contributed to a preference for Bitcoin as an inflation hedge."

The contributor said that the effects of regulation and institutional funds were also clear. He said, "As the U.S. Securities and Exchange Commission (SEC) eased listing rules for exchange-traded funds (ETFs), new products based on XRP and Dogecoin (DOGE) were launched, and large funds such as BlackRock's IBIT and Fidelity's FBTC saw steady inflows," emphasizing that "with long-term holders having already realized profits and short-term investors' sell-offs ending, supply-demand also stabilized."

Technical factors and on-chain indicators added strength to the rally. The contributor said, "Bitcoin confirmed a strong support line in the $108,000~$110,000 range, and short covering continued as prices rose." He added, "A sharp drop in exchange reserves and an MVRV rebound indicate easing selling pressure," and analyzed that "this means Bitcoin is beginning to be seen again as an undervalued asset."

As of 10:32 a.m. that day, Bitcoin was trading at $114,617, up 2.25% from the previous day, according to CoinMarketCap.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)

![[Today’s Key Economic & Crypto Calendar] US January Manufacturing PMI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[Market] Bitcoin breaks below $76,000 as selloff shows no sign of easing](https://media.bloomingbit.io/PROD/news/0b328b54-f0e6-48fd-aeb0-687b3adede85.webp?w=250)