KGeN, Verified User Acquisition Infrastructure to Accelerate Web3 Mass Adoption [Jjanggle Research]

Summary

- KGeN stated that it provides an infrastructure for acquiring verified users through blockchain-based data management and the PoG engine.

- KGeN claimed to have proven its real user base and profitability by achieving 29 million cumulative wallets and $62 million in annualized revenue.

- KGeN said it has great potential to become core infrastructure that accelerates Web3 mass adoption through user data sovereignty and token incentive structures.

1. A business needs verified users to succeed

Verified users who use services and create value across various digital businesses such as games, shopping, and content are a core asset that determines corporate performance. Having a large number of sign-ups alone does not mean business success; growth occurs only when these users translate into actual revenue and traffic.

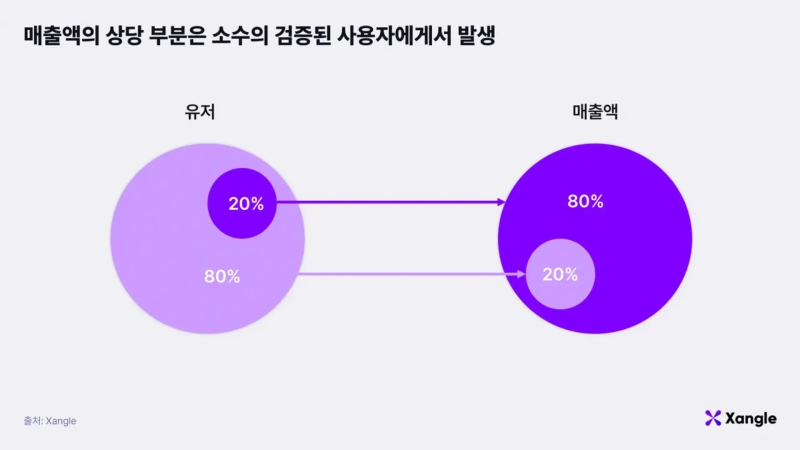

This importance is supported by data. According to a paper analyzing mobile game play data across 214 countries and regions, 44.83% of total playtime comes from the top 1% of players. Revenue shows a similar pattern: according to SuperData, in the mobile game market the top 1% of users account for more than half of total revenue, and the top 5–10% of paying users are responsible for 80–90% of total revenue. This phenomenon is not limited to the game industry. In e-commerce, streaming platforms, casinos, and other fields, a small number of verified users commonly generate most of the total revenue.

This pattern is called the Pareto Principle and explains the skewed distribution where most outcomes come from a small number of causes. Often described as the 20:80 rule, it can be concretized as the top 20% of customers generating 80% of total revenue. Companies have long applied this principle to customer analysis and marketing strategy and still use it today as a traditional but effective method to define and focus on core customer segments.

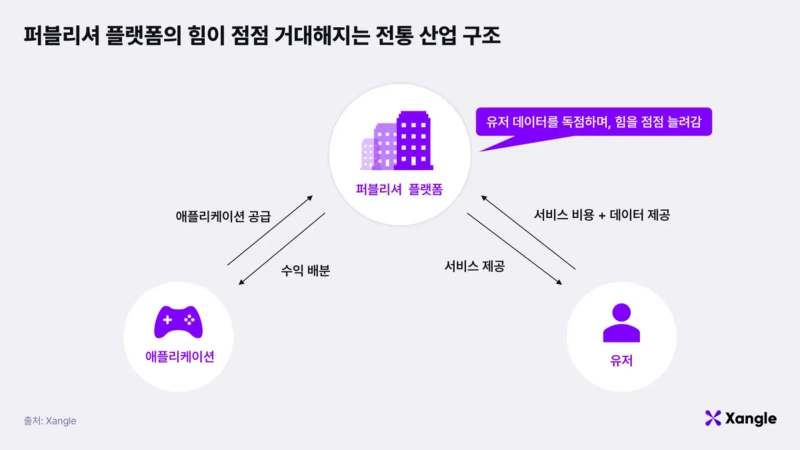

It is obvious that businesses need to secure verified users to succeed. However, because user data is mostly monopolized by specific centralized companies, it is not easy for companies to identify and reach verified users. For example, game usage data is held by game developers and publishers, consumer data is held by shopping platforms, and external companies must overcome the huge barriers of these platforms to access verified users. This deepens asymmetry in data access rights and results in companies having to spend excessive user acquisition costs (User Acquisition Cost, UAC) to secure verified users.

The reason the importance of verified users and the difficulty of securing them were emphasized at the beginning of this article is that KGeN has emerged to solve precisely this structural problem. KGeN aims to build an infrastructure on the blockchain that can manage user data—previously monopolized by centralized platforms—in a verifiable and transparent way. Through this, KGeN seeks to lower the connection barrier between companies and verified users and to ensure that users have sovereignty over the data they generate.

2. KGeN, a publisher platform for acquiring verified users

KGeN is a project building an infrastructure to acquire verified users, currently focusing on the game and AI sectors. KGeN’s co-founders Manish Agarwal and Ishank Gupta are respectively the former CEO of one of India’s largest gaming companies, Nazara Technologies, and a strategy professional with experience in global consulting and the consumer goods industry; they founded KGeN based on deep understanding of data and the gaming industry. KGeN initially targeted a game-specific publisher platform at launch, but recognizing the need and importance of verified users across the Web3 market, it is expanding its business direction into various sectors.

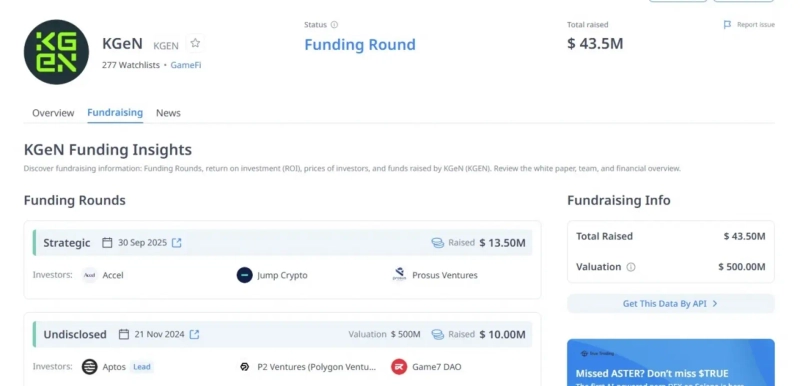

Based on strong founder backgrounds and vision, KGeN has raised about $43.5 million in cumulative investments from global VCs such as Accel, Prosus Ventures, and Jump Crypto, as well as strategic partners like Aptos Labs and Polygon, and in a recent round it was valued at approximately $500 million.

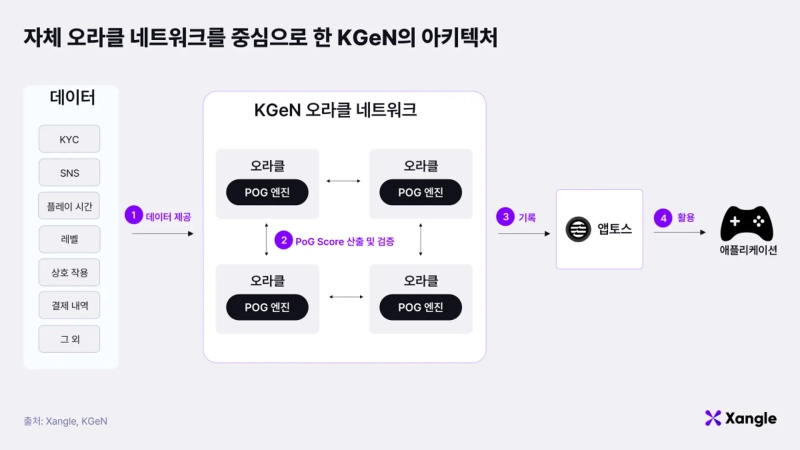

2-1. Analyzing verified users through its own oracle network and PoG engine

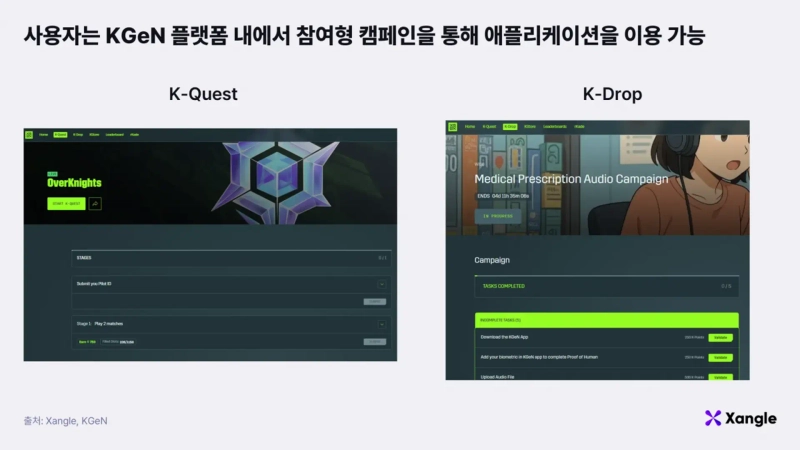

KGeN provides a platform where users can be active across various applications. Currently supporting services focused on games and AI, users can experience multiple projects and leave activity data through participatory campaigns called K-Quest and K-Drop within the platform. Both K-Quest and K-Drop are participatory quest campaigns, but they differ in verification methods. K-Quest is based on manual verification, while K-Drop automatically verifies activities through API endpoints and real-time integration.

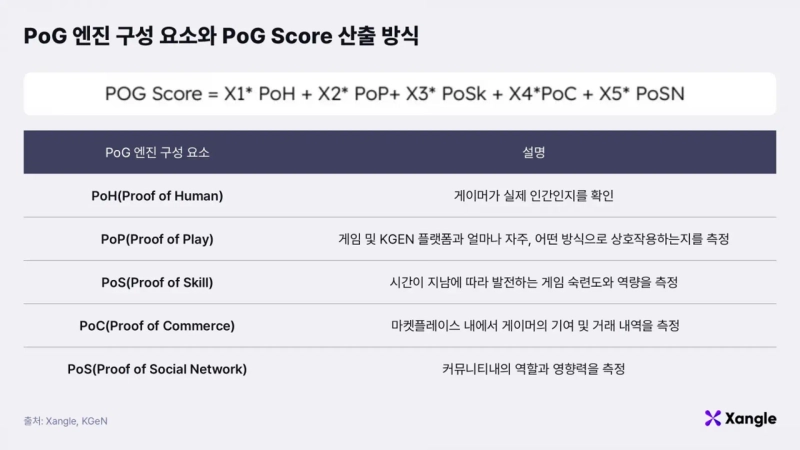

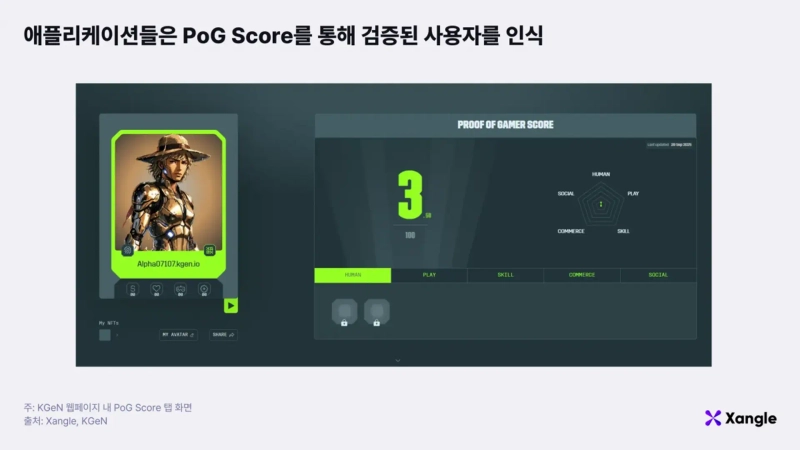

The collected activity data is analyzed by KGeN’s core mechanism, the PoG (Proof of Gamer) engine. The PoG engine goes beyond simple participation logs to analyze and quantify users’ behaviors and characteristics multidimensionally. The engine classifies data across five axes: first, Proof of Human to verify actual human users; second, Proof of Play to measure game play and engagement; third, Proof of Skill to evaluate proficiency based on tournament performance and in-game achievements; fourth, Proof of Commerce to reflect economic contribution; and finally, Proof of Social Network to measure social networks and influence. These five axes operate independently while complementing each other to produce a reputation metric called the PoG Score for each user.

The PoG Score is calculated by KGeN’s oracle network (KGeN Oracle Network) and, after verification, recorded on the blockchain network (Aptos).

Specifically, each oracle collects data from various sources such as game activity logs, APIs, and internal metrics, and calculates the PoG Score based on this. The calculated scores are finalized and recorded on the blockchain network through a BFT (Byzantine Fault Tolerant) consensus mechanism. At least 67% of the entire oracle set must submit scores for consensus to be reached, and the network finalizes the PoG Score by taking the median or weighted average of the submitted values. Nodes that submit incorrect results or have signing errors are excluded from consensus and, in severe cases, receive slashing penalties on staked assets.

Currently, the KGeN Oracle Network operates on a PoA (Proof of Authority) basis, where KGeN selects trusted operators and grants node permissions. PoA is a transitional device to secure stability and security in the network’s early stages, and it is planned to transition to PoS (Proof of Stake) in the future so that anyone can participate in the oracle network by staking tokens.

PoG Scores recorded on the blockchain can be utilized by various ecosystem actors. DApps can design user-tailored rewards or compensation structures based on them and execute efficient user acquisition strategies to lower acquisition costs. Furthermore, Layer 1 chains can integrate PoG Scores into functions such as identity verification or reputation-based governance.

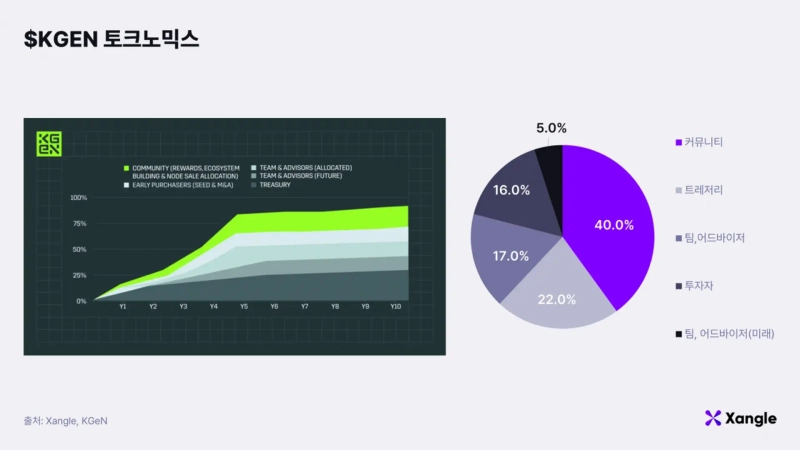

2-2. Tokenomics and incentive structures to accelerate user inflow

Today, it is increasingly difficult for new publisher platforms to acquire users. A few large companies already hold a substantial share of the market, and they have built strong network effects based on vast user data and financial resources accumulated over many years. According to udonis’ 2024 data, among 46 game publishers, the top 10 publishers account for 78% of total revenue. In such a structure, new platforms must provide huge marketing costs and incentives to acquire users, but it is practically difficult to do this sustainably.

KGeN seeks to overcome these limitations through token incentive structures. Instead of centralized companies monopolizing data, KGeN returns data ownership to users and designs a structure in which users and the platform grow together through a transparent reward mechanism. Specifically, KGeN accelerates user acquisition through the following three incentive structures:

1. Data-based rewards

Users own their activity data and directly share in the revenue generated when that data is traded with advertisers or publishers. Through this, users can be rewarded as participants in the data economy rather than mere participants. See section 3-1 for related details.

2. Participation and performance rewards

Applications and advertisers grant various benefits such as grants, reward multipliers, and airdrops to users with high PoG scores to secure verified users. Through this, applications can acquire verified users more efficiently, and users can earn more rewards the more they participate and are active.

3. Token incentives

KGeN provides direct incentives to users through two token structures: rKGEN and $KGEN. rKGEN is an initial reward token fairly distributed based on platform activity before TGE. rKGEN can be converted 1:1 to $KGEN after TGE and can also earn additional returns through staking. This functions as a powerful incentive device to promote user participation in the early stage.

While rKGEN is a short-term incentive for initial network bootstrapping, $KGEN aims to provide a long-term reward structure to users. Users can stake $KGEN to expand quest participation limits or receive reward multipliers, and they can also participate exclusively in certain campaigns or events. Furthermore, by participating in oracle verification through staking, users can generate ongoing revenue, ensuring not only short-term rewards but also stable long-term compensation. Ultimately, rKGEN and $KGEN operate as core incentive mechanisms that span from initial user acquisition to long-term network expansion.

2-3. KGeN ecosystem already has many verified users

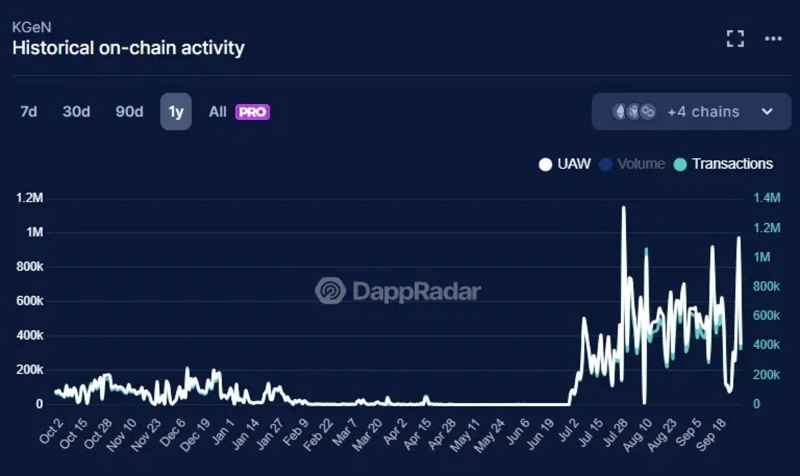

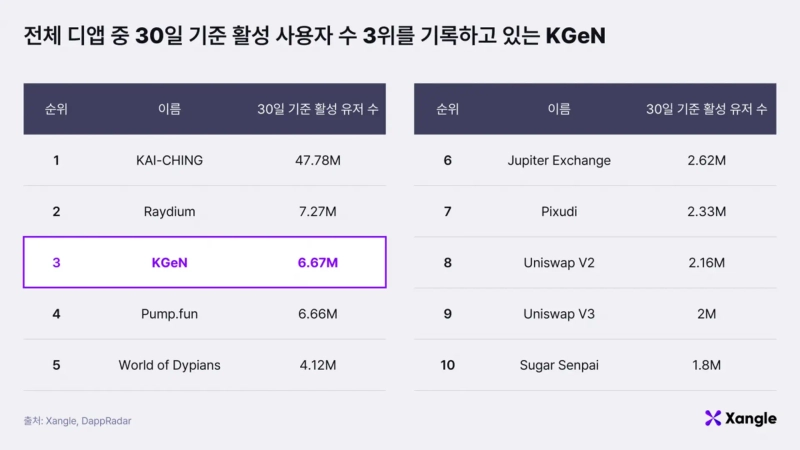

KGeN has driven rapid mainstream adoption by producing meaningful growth indicators within two and a half years of launch. According to data from Dune Analyst(@kgen), as of October 2, the cumulative number of wallets that have interacted with KGeN at least once exceeded 29 million. Also, according to DappRadar, the number of active wallets in the past 30 days is about 6.8 million, ranking third among all blockchain dApps.

Transaction activity is also rapidly expanding. The cumulative number of transactions on the KGeN network over the past year is about 153 million, and there were 4.3 million transactions in the most recent month, showing steady on-chain activity.

These figures indicate that KGeN has secured a large base of real users participating in the network, not just sign-ups, demonstrating that KGeN is already among the top tier in user scale within Web3.

Revenue indicators are also growing sharply. As of October 2, according to DeFiLlama, KGeN’s revenue over the past 7 days was $1.8M, ranking 17th among all protocols. Annualized, this amounts to about $62 million. This indicates that revenue generated from actual service usage and transaction activity is accumulating stably, not solely dependent on token incentives.

In sum, KGeN has produced clear results through three axes: (1) securing millions of real users, (2) explosively increasing on-chain transactions, and (3) achieving top global revenue scale. This shows that KGeN is not merely blockchain infrastructure but a protocol with a sustainable user network and a real revenue model.

3. Opportunities and potential of KGeN

3-1. KGeN guarantees data sovereignty and innovates value capture structures

One of the biggest problems of the current Web2 digital ecosystem is the monopolistic structure of data. Centralized companies or publisher platforms store vast amounts of user-generated data on their centralized servers and exclusively utilize it to create added value. Data such as when users connect, which services they mainly use, and how much they consume is held by companies, while users are not granted data sovereignty.

This structure causes several problems. First, an imbalance of benefits. Although users are the ones who create data and traffic, the actual economic rewards concentrate with companies. Users know that the data they generate is used for ad optimization, revenue enhancement, and service improvement, yet they are not recognized with any rights in that process. Second, a lack of transparency in data utilization. Users cannot verify how their data is collected, stored, or used, and companies operate it unilaterally according to internal strategies.

KGeN plans to solve these problems by designing a structure that returns data sovereignty to users based on blockchain infrastructure. Specifically, all user data will be stored as encrypted metadata on IPFS, and data access will be controlled via a multisig mechanism between KGeN and the user. If advertisers or publishers request data access, they can view it only with the user’s consent, and the revenue generated in return will be shared between the user and the platform via smart contracts. In addition, KGeN enables users not only to protect their data but also to exercise control over how their data is used. Users can choose which data to disclose externally, whether to record it on-chain or off-chain, and, if necessary, are guaranteed the right to delete data.

Ultimately, KGeN proposes a new value capture structure in which the value generated from user data is directly attributed to users, beyond mere data protection. Through this, users secure tangible rights and economic rewards for their data and obtain much greater utility than before. This can be seen as an innovative shift that reverses the structure where a few centralized companies monopolized most of the value and returns that value to users. This structural shift is a key driving force that allows the KGeN ecosystem to rapidly acquire many users and record steady revenue performance.

3-2. The key to Web3 mass adoption is ultimately users, and KGeN is expected to be the core infrastructure for user acquisition

For Web3 to become mainstream, users are ultimately necessary. Looking back at the IT industry development cycle, infrastructure was always built first, and applications emerged on top of it, leading to full-scale growth. This can be seen in cases where infrastructure such as Ethernet, TCP/IP, and Java was established first, and then applications like Amazon, Facebook, and Uber were launched, driving mass adoption.

Web3 follows the same path. Various infrastructure layers such as Ethereum, Solana, Sui, and Aptos have already been built, and recently applications like Hyperliquid have appeared, growing the ecosystem. However, for Web3 to take another step forward, more applications are needed, and the success of these applications will depend on how effectively they can secure and retain verified users.

This is precisely where KGeN’s opportunity and potential become clear. By transparently managing user data on the blockchain and providing infrastructure to secure verified users, KGeN lays the foundation for the stable growth of the entire Web3 ecosystem. Using KGeN’s infrastructure, applications can easily identify verified users and execute more efficient user acquisition strategies. Furthermore, from the user’s perspective, a new world opens where they are guaranteed sovereignty over the data they generate and can directly capture additional value from that data.

Ultimately, for Web3 to leap forward, application success is necessary, and for applications to succeed, acquiring verified users is key. KGeN has significant potential to establish itself at the center of this and become core infrastructure driving Web3 growth.

4. Conclusion - Can KGeN accelerate Web3 mass adoption?

As mentioned above, Web3’s leap depends on applications, and a necessary condition for launching killer applications is securing verified users. However, the important question is how to realize this, and this is where KGeN’s opportunity and potential become apparent.

By providing transparent data management based on blockchain and a user reputation metric via the PoG engine, KGeN enables applications to access a pool of users they can trust. At the same time, users secure data sovereignty and economic rewards and obtain differentiated utility compared to existing centralized platforms. This briefly explains why attention should be paid to KGeN.

What is particularly striking is that KGeN has already proven itself in the market. Metrics such as 29 million cumulative wallets, 6.8 million active wallets in the past 30 days, and annualized revenue of $62 million show that KGeN is not just a vision but a protocol with an actual user network and revenue model.

In conclusion, KGeN is building infrastructure that can accelerate Web3 mass adoption, and its innovative significance is clear. It will be important to watch how KGeN expands its ecosystem and what changes it brings to the Web3 market.

Disclaimer

The content in this article reflects the author’s opinions and was written without undue pressure or interference. The views expressed are those of the author and do not represent the official position or opinion of Crossangle Co., Ltd. This article is distributed for informational purposes. It does not constitute investment advice or solicitation. Unless otherwise stated, decisions and responsibility for investments, investment strategies, or use of other products and services rest with the user, and users should make investment decisions themselves considering investment objectives, personal circumstances, and financial situation. Please consult financial professionals for more details. Past returns or forecasts do not guarantee future returns. This article was written at the request of KGeN. All content of this article was written independently by the author, and Crossangle Co., Ltd. or the client did not influence content or editing. The author may hold virtual assets mentioned in this article.

This report is independent of the media’s editorial direction, and all responsibility rests with the information provider.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)