Summary

- "It reported that Ethereum (ETH) has recently shown signs of liquidity recovery in on-chain indicators."

- "It stated that buying by U.S. institutional investors is recovering and exchange holdings of Ethereum are declining."

- "It forecasted that if global liquidity expansion and the decline in holdings continue, Ethereum could enter a new revaluation phase."

Ethereum (ETH) has shown signs of liquidity recovery, and an upward reversal may be imminent, according to analysis.

On the 6th (local time), XWIN Research Japan of CryptoQuant said, "With the U.S. M2 money supply reaching an all-time high of about $22.2 trillion, Bitcoin (BTC) quickly reflected this liquidity expansion trend and has risen more than 130% since 2022. In contrast, Ethereum (ETH) only rose about 15% over the same period, showing a 'liquidity lag' phenomenon where the liquidity response is delayed."

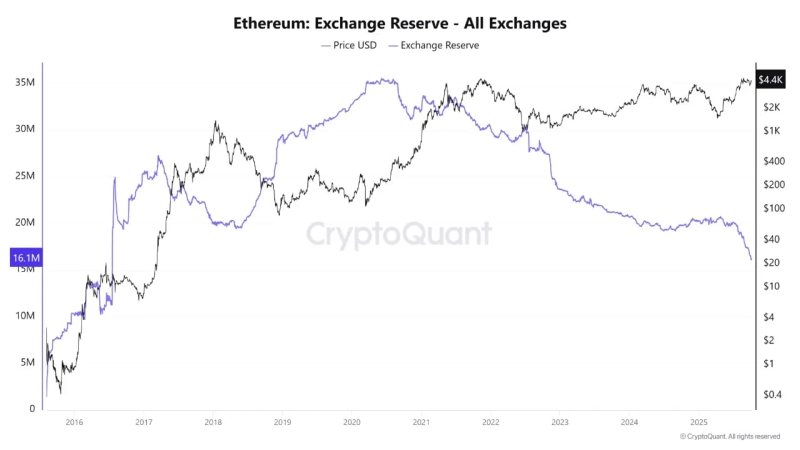

However, recent on-chain indicators suggest signs of liquidity recovery for Ethereum. The author emphasized, "Exchange holdings of Ethereum have decreased to about 16.1 million ETH, a decline of more than 25% since 2022. Exchange net inflows have also remained persistently negative, indicating that Ethereum is moving to self-custody or staking contracts."

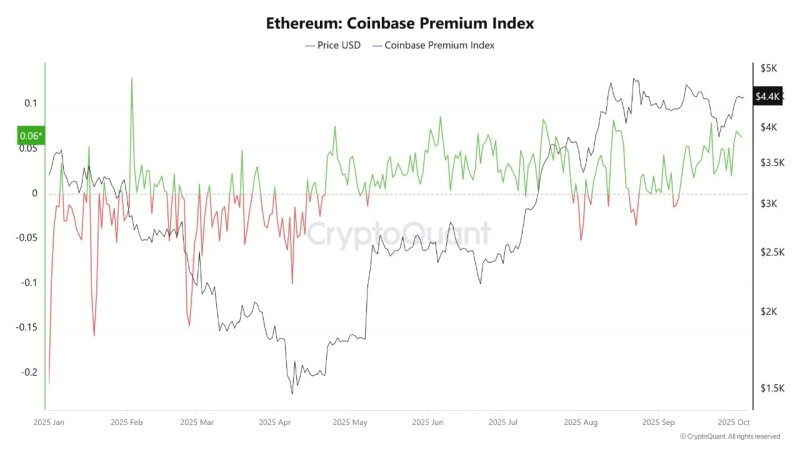

The Coinbase Premium Index has also turned positive again, signaling a recovery in buying by U.S. institutional investors. Regarding this, the author said, "This is a signal similar to the period before the large rallies of 2020 and early 2021, and the market could see a rotation focused on altcoins if Bitcoin dominance falls below 60%." He added, "If global liquidity expansion continues and exchange holdings of Ethereum keep declining, Ethereum could enter a new revaluation phase and a scenario of breaking through $10,000 could materialize."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)