Summary

- It reported that expectations for newly elected party president Takaichi's proactive fiscal policy and monetary easing pushed the Nikkei to a record high.

- Markets said the 'Takaichi trade'—yen weakness accompanied by purchases of Japanese stocks—spread rapidly after Takaichi took office.

- However, it noted that fiscal expansion and monetary easing could heighten inflationary pressure and raise concerns about higher government bond yields in an era of inflation.

'Abenomics'‑supporting Takaichi

Advocates proactive fiscal policy and monetary easing

Nikkei index breaks through 47,000 for the first time

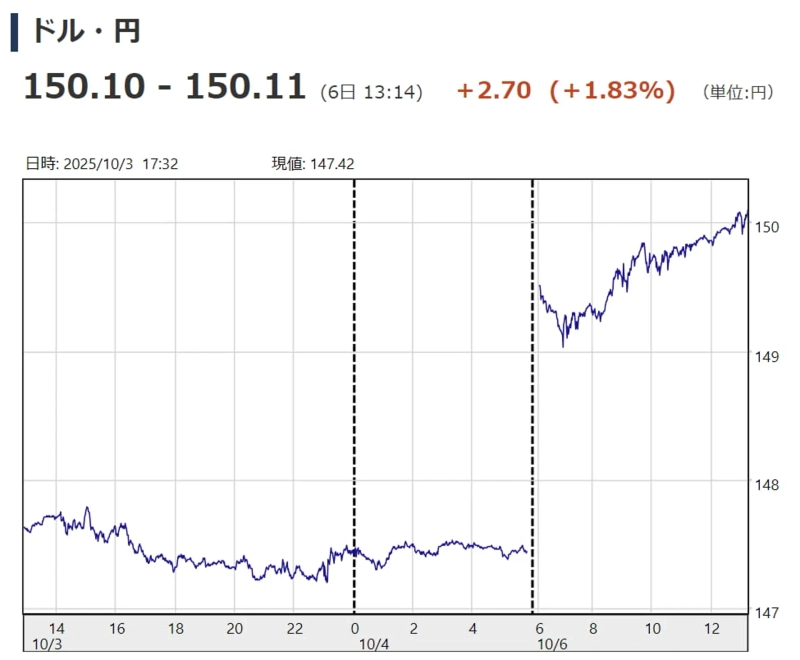

Yen‑dollar rate in the 150 yen‑per‑dollar range

Abenomics is a policy to overcome deflation

"Not suited to an era of inflation," critics say

Sanae Takaichi, who is expected to push for "fiscal expansion" and "monetary easing," was elected the new president of the ruling Liberal Democratic Party, prompting a surge in the Nikkei and a plunge in the yen on the 6th.

On that day at the Tokyo stock market, the Nikkei surged and closed morning trading at 47,835, up 4.51% from the previous session. It far exceeded the previous record high of 45,769 set on the 3rd. This followed Takaichi's election in the LDP presidential race on the 4th. Buying interest spread to stocks related to policies Takaichi promoted, such as defense, nuclear fusion and space. Defense stocks including Mitsubishi Heavy Industries, IHI, Fujitsu and Mitsubishi Electric all hit new highs.

Earlier, many in the market had expected Shinjiro Koizumi, the Minister of Agriculture, Forestry and Fisheries, to win. The unexpected result led to a rapid spread from the morning of the 6th of the 'Takaichi trade'—buying stocks and selling the yen. About 90% of Prime‑listed stocks in the Tokyo market rose that morning. There are also widespread expectations that overseas investors' purchases of Japanese stocks will accelerate on hopes of reform following the LDP's first female president.

The yen‑dollar rate surged as the yen's value plunged. At one point that morning, the yen‑dollar rate rose to the 150 yen‑per‑dollar range for the first time in about two months. Against the euro it also briefly climbed to the upper‑175 yen‑per‑euro range, hitting a record high. Market views spread that it would be difficult for the Bank of Japan to raise its policy rate further this month, which led to selling pressure on the yen.

Takaichi's fiscal and monetary policies model themselves on former Prime Minister Shinzo Abe's economic policy "Abenomics." She aims for proactive fiscal policy and monetary easing. However, critics warn there is a risk of conflict with measures to curb price rises in an inflationary phase. At a press conference after her election on the 4th she emphasized, "I want to concentrate efforts on measures to raise prices."

During the campaign Takaichi advocated "responsible proactive fiscal policy." She indicated that, if necessary, issuing deficit‑financing government bonds to fund measures to raise prices could be unavoidable. She has followed former Prime Minister Shinzo Abe, who is close to her in conservative political beliefs, and has proclaimed herself a successor to Abenomics.

On monetary policy she is regarded as dovish and favoring easing. At the 4th's press conference she said, "The government is responsible for both fiscal and monetary policy," appealing that "the Japanese economy is in a precarious state." In the past she also made remarks seen as pressure on the Bank of Japan. In last year's presidential race she said of the Bank of Japan, "I think raising rates now would be a foolish thing."

Takaichi's policies carry the risk of increasing household burdens. Abenomics was a policy to overcome deflation. Critics say it is not suited to an era of inflation because it is likely to push up prices further. Concerns about fiscal deterioration could push up government bond yields.

U.S. President Donald Trump is expected to visit Japan on the 27th, and is likely to hold summit talks with Takaichi. The Nihon Keizai Shimbun said, "Takaichi's economic policy is prone to a weak yen," and warned that "there is concern Trump may judge that Japan is inducing a weak yen to expand exports."

Tokyo = Kim Il‑gyu, correspondent black0419@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Did it crash because of Trump?…The 'real reason' Bitcoin collapsed [Hankyung Koala]](https://media.bloomingbit.io/PROD/news/d8b4373a-6d9d-4fb9-8249-c3c80bbf2388.webp?w=250)