"If rates are cut during the AI rally, Goldilocks will come"… Q3 earnings the proving ground

Summary

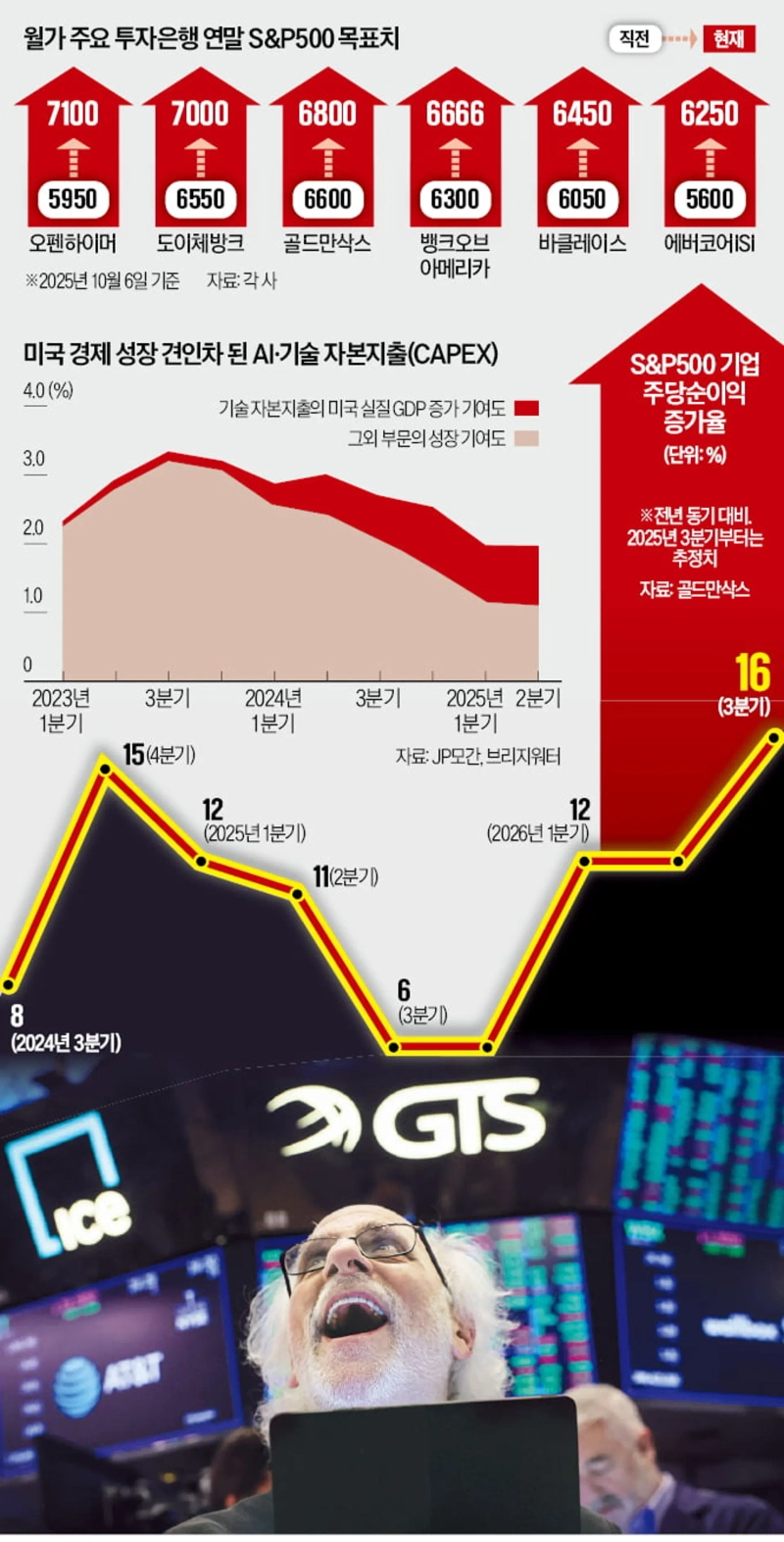

- Wall Street said that if the AI rally and rate cuts combine, a powerful upside momentum could form in the U.S. stock market.

- They said Q3 corporate earnings reports will be an important test for the year-end rally.

- Some said that a slowdown in AI capital expenditure and limits to rate cuts are short-term correction risk factors.

"Wall Street confidence: 'S&P500 index will reach 7000 this year'"

Trump's tax-cut law, expectations for increased investment

Solid earnings outlook…supporting gains

"If volatility in the first half of this month is weathered

a strong rally through year-end is expected" the consensus

Concerns: "If gains occur without corrections, it's a bubble"

"Investors are facing a technological revolution opportunity that rarely comes twice in a lifetime."

Amid tariff uncertainty, a U.S. federal government shutdown replayed for the first time in seven years, and persistent debates over a tech-stock bubble, Wall Street investment banks' bullishness on the market is underpinned by optimism that artificial intelligence (AI) will drive a boom. Julian Emanuel, Evercore ISI's chief equity and quant strategist, who recently drew attention by forecasting the S&P500 could surge to 9000 by the end of next year, said, "We are now seeing another AI revolution rally, like the internet revolution 30 years ago," adding, "the tech revolution is lifting stock prices and overall societal growth rates to record highs."

◇ Rate cuts as the driving force for the stock market

The U.S. stock market, buoyed by AI optimism, has risen 31% in just five months since the April low. Excluding short-term rebounds during recessionary periods, this is the best performance in about 20 years. The key driver that could push the already steadily running U.S. market to even higher peaks is rate cuts by the U.S. central bank (Fed).

Having resumed rate cuts last month for the first time in eight months, the Fed is expected to cut rates again this month and in December. The U.S. economy, despite a cooling labor market, grew 3.8% in Q2 this year, temporarily averting recession risks. Competitive increases in AI infrastructure capital spending have acted as a growth driver. If the Fed's consecutive rate cuts join forces with this, a 'Goldilocks' scenario favorable to risky assets could unfold. Christy Muller-Gliszman, head of asset allocation strategy at Goldman Sachs, who recently upgraded the three-month outlook on global equities from 'neutral' to 'overweight' (buy), assessed, "Solid corporate profit growth, Fed rate cuts, and global fiscal expansion will provide sustained upward momentum for equities."

◇ Corporate earnings also support gains

The tax-cut law enacted by U.S. President Donald Trump in July is also a factor boosting expectations for economic improvement and stock gains. The law includes provisions that increase deduction limits and allow immediate expensing for companies' equipment, machinery, and research and development (R&D) spending. Dubravko Lakos-Bujas, JPMorgan's head of global market strategy, said, "It will help open the floodgates of corporate investment and partially offset the growth headwinds from tariff and immigration policies."

Rate cuts and tax cuts are positive for corporate earnings, which are directly linked to market fundamentals. Wall Street views the Q3 corporate earnings reporting season — kicking off with large banks on the 14th — as an important proving ground to gauge whether a year-end rally will materialize. Yardeni Research, which recently raised its S&P500 year-end target to 7000, predicted, "Stronger-than-expected corporate earnings in Q3 will underpin the market's record gains." Wall Street currently estimates that S&P500 companies' Q3 earnings per share (EPS) growth will be 6% year-over-year. Yardeni Research forecasts 10.7%.

Historically, the period from the second half of October to year-end has been the best-performing stretch for U.S. stocks. Since 1950, the S&P500 has recorded a median 4.9% return in the fourth quarter. The probability of gains was 81%. In particular, in years when the Fed began cutting rates from September — such as 1998 and 2024 — the average fourth-quarter gain reached 13.8%.

◇ Black swans for the U.S. stock market

Some voices point to the possibility of a short-term pullback. Barclays warned that the AI infrastructure investment that is the market's main engine could become the largest 'black swan' risk. Their analysis suggests that if AI model efficiency improves, or if power shortages or funding pressures cause data center capital expenditures to be 20% lower over the next two years than currently forecast, S&P500 companies' EPS could fall by 3–4%.

Wall Street also cautions against scenarios in which the U.S. economy is stronger than expected or inflation accelerates again, preventing the Fed from cutting rates as much as market expectations. Excessive optimism already priced into the market could be unwound, causing temporary shocks.

New York = correspondent Bin Nansae binthere@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.!["Will AI take our jobs?" Fear spreads…market rattled by a plunge in shares [New York Market Briefing]](https://media.bloomingbit.io/PROD/news/874408f1-9479-48bb-a255-59db87b321bd.webp?w=250)