Summary

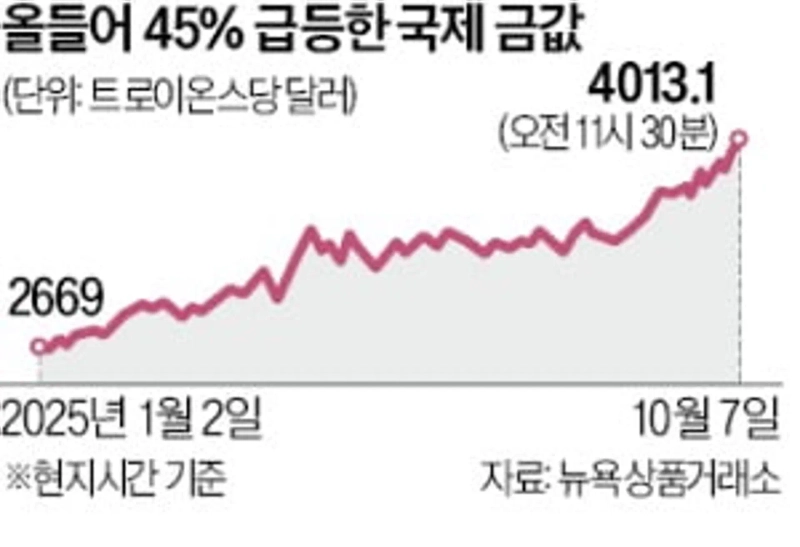

- It reported that gold futures prices surpassed 4000 dollars for the first time.

- Bitcoin also approached 125,000 dollars and recorded a new high.

- It said that demand for both safe assets and risky assets has risen simultaneously due to expectations of rate cuts and U.S. economic uncertainty.

Safe and risky assets rise at the same time

Gold and Bitcoin prices have surged day after day, setting record highs. Analysts say an 'everything rally' is continuing, with prices of safe assets and risky assets rising together due to expectations of rate cuts and other factors. On the 7th (local time) at the New York Mercantile Exchange, the December delivery gold futures price was 4013.10 dollars per troy ounce. It is the first time gold futures have exceeded 4000 dollars. Bitcoin also set a new record high that day.

The gold rally was driven by a U.S. government shutdown. Fears that a prolonged shutdown would shock the U.S. economy increased demand for gold as a safe asset. The dollar's weakness against major currencies also contributed to the rise in gold prices.

Growing expectations for a rate cut by the U.S. central bank (Fed) also helped boost gold prices. According to the CME FedWatch, the interest rate futures market is reflecting a 99% probability that the Fed will cut rates by 0.25% percentage points at this month's Federal Open Market Committee (FOMC) meeting.

Experts expect the bullish trend in gold to continue over the medium to long term. Goldman Sachs Research said in a September report that gold prices could rise an additional 6% by mid-2026.

Bitcoin, known as "digital gold," is also on the rise. Bitcoin approached 125,000 dollars that day, marking a record high. It has risen more than 8% so far this month. Analysts say Bitcoin's rally is linked to many of the same factors pushing up gold prices. Bloomberg analyzed that as debt increases in major countries raise fiscal concerns, a so-called 'debasement trade' is spreading as investors prepare for currency depreciation. Investors are moving into alternative assets such as Bitcoin, gold, and silver rather than major national currencies like the dollar. Some are even optimistic that Bitcoin could reach 140,000 dollars this month.

There are also significant concerns about overheating. They say one cannot rule out the possibility of a short-term sharp drop in Bitcoin, which has typically experienced cycles every four years.

New York = Shin-young Park, correspondent / Mi-hyun Cho, reporter nyusos@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.!["Will AI take our jobs?" Fear spreads…market rattled by a plunge in shares [New York Market Briefing]](https://media.bloomingbit.io/PROD/news/874408f1-9479-48bb-a255-59db87b321bd.webp?w=250)