Editor's PiCK

Chuseok Holiday and Trump's Tariff Shock : Korean Crypto Weekly [INFCL Research]

Summary

- Major domestic exchanges such as Upbit and Bithumb reported that new listings and liquidity of major assets remained firm.

- On October 10, former President Trump’s tariff policy announcement led to large-scale crypto liquidations and a spike in the Tether premium.

- Korea's cryptocurrency capital outflows have been steadily increasing, and regulatory limitations are accelerating migration to foreign exchanges.

1. Market Overview

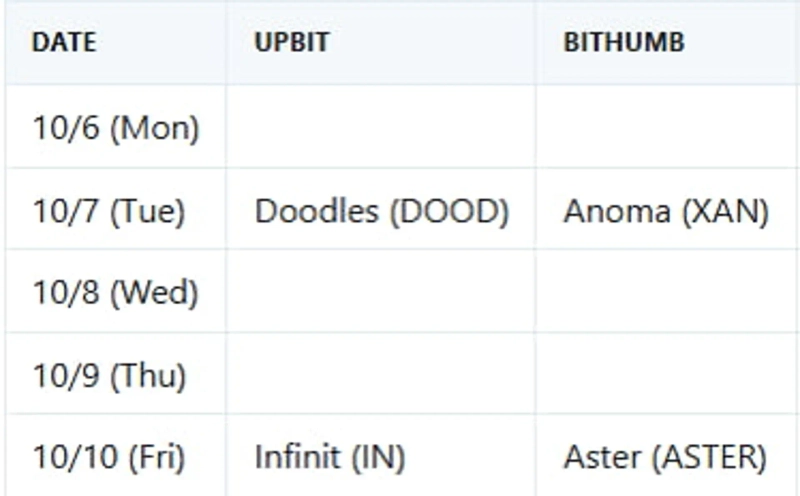

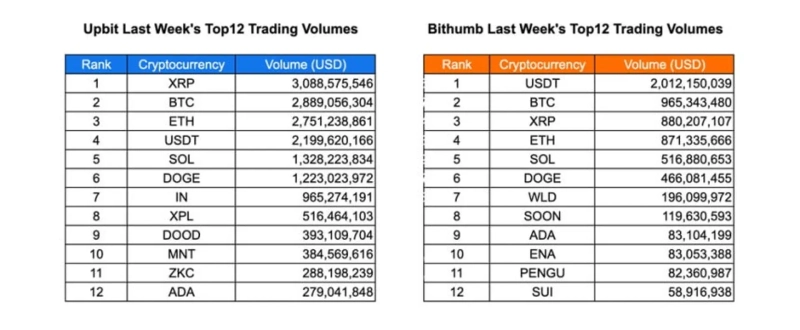

Last week, Upbit added Doodles and Infinit, and Bithumb listed Anoma and Aster, continuing a new listing parade. On Upbit, XRP ($3.09 billion), BTC ($2.89 billion), and ETH ($2.75 billion) accounted for the bulk of trading volume, maintaining a clear lead in market activity. Also among the top ranks were USDT ($2.2 billion) and SOL ($1.33 billion), while DOGE, IN, and XPL recorded trading volumes ranging from $516 million to $1.22 billion. Despite reduced volume due to the Chuseok holiday, activity was broadly distributed across large-cap and mid-cap assets such as DOOD, MNT, ZKC, and ADA, indicating steady retail participation.

On Bithumb, USDT ($2.01 billion) led volumes, followed by BTC ($965 million), XRP ($880 million), and ETH ($871 million). SOL, DOGE, and WLD showed moderate volumes, while tokens like SOON, ENA, PENGU, and SUI exhibited small but steady flows. Both exchanges experienced simultaneous spikes on the weekend of October 12, with Upbit outperforming Bithumb by a wide margin. Overall, liquidity at major exchanges remained at healthy levels, and investors favored stability-linked tokens and mid-cap assets. This suggests cautious yet active participation as markets resumed after the holiday break.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges announced several new listings.

Upbit listed Doodles and Infinit

Bithumb listed Anoma and Aster

Key Marketing Strategies and Highlights

Aster (ASTER)

Aster's marketing approach differed from other perpetual futures DEXs. Although it did not emerge during the heyday of the "puff DEX meta," it attracted significant demand in Korea. The core driver of this growth was likely the way it was introduced through KOL channels—positioned as a "BNB deficit" project on the BNB Chain. This indirectly (almost explicitly) suggested a high likelihood of a Binance spot listing.

Another element that appealed to Korean users was Aster's separation of trading points (Rh) and staking points (Au). The Korean community generally dislikes point dilution during airdrop farming, and this structure effectively addressed that concern. Additionally, following the existing "BNB deficit" principle, Aster provided Binance hodler airdrop rewards to users who staked BNB.

By leveraging this setup, Aster turned staking—whose demand might have been low due to relatively lower airdrop yields compared to trading—into an attractive opportunity. The Aster team actively propagated this narrative through KOL-centered, extensive marketing across the Korean crypto community.

2-2. Trading Volume

Upbit maintained a strong lead in last week's trading volumes. XRP ranked first with $3.09 billion, followed by BTC with $2.89 billion and ETH with $2.75 billion. USDT and SOL also recorded $2.2 billion and $1.33 billion respectively, demonstrating stable liquidity for major assets. DOGE, IN, and XPL recorded volumes ranging from $516 million to $1.22 billion, while smaller tokens like DOOD, MNT, ZKC, and ADA each recorded over $270 million, showing a diversified trading environment within Upbit.

Bithumb's volume was led by USDT at $2.01 billion, with BTC at $965 million and XRP at $880 million. ETH and SOL held notable positions at $871 million and $517 million respectively, and DOGE, WLD, SOON, and ADA recorded moderate volumes between $83 million and $467 million. ENA, PENGU, and SUI each recorded under $85 million, indicating more conservative participation in altcoins compared to Upbit.

Daily volume trends at both exchanges were synchronized and surged, with a significant spike observed on the weekend of October 12. Upbit consistently outpaced Bithumb in total volume, suggesting active retail participation and increasing liquidity flows. Overall, trading momentum in major assets remained solid, with XRP, BTC, and ETH still dominant on both platforms, while mid-cap tokens continued to make steady contributions to overall market volume.

2-3. Top 10 Gainers

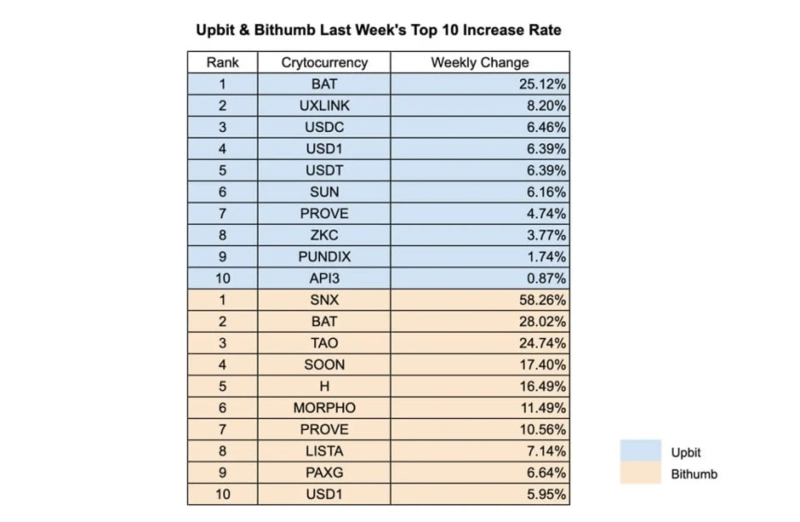

Last week, the Upbit market showed a modest upward trend led by BAT (25.12%), followed by UXLINK (8.20%) and USDC (6.46%). Stablecoins such as USD1 and USDT both rose 6.39%, reflecting continued demand for on-chain liquidity. SUN, PROVE, and ZKC also showed positive momentum with gains between 3.77% and 6.16%, while PUNDIX and API3 recorded limited increases under 2%, indicating selective buying interest in utility and DeFi-related assets.

Bithumb experienced greater market volatility. SNX surged 58.26%, and BAT rose 28.02%, closely following. TAO and SOON posted weekly gains of 24.74% and 17.40% respectively, while H and MORPHO rose 16.49% and 11.49%. Mid-to-low cap tokens such as PROVE, LISTA, PAXG, and USD1 saw modest but steady gains between 5.95% and 10.56%, reflecting speculative activity around new and existing listings.

Overall, Bithumb showed short-term rallies especially in DeFi- and AI-linked tokens, while Upbit displayed steady gains concentrated in stablecoins and utility assets. This contrast highlights differences in investor preferences: Bithumb traders tend to favor higher-volatility assets, whereas Upbit investors gravitate toward more stable and liquid assets.

3. Korean Community Buzz

3-1. A Week-Long Holiday

Last week was one of Korea's longest holiday stretches. With National Foundation Day (October 3), Chuseok (October 5–8), and Hangul Day (October 9) overlapping, the entire week was mostly off. Trading and community activity were relatively quiet, though several listings still took place. During the holiday, Bitcoin reached an all-time high, which helped restore overall investor sentiment, and Korean crypto users enjoyed a pleasant holiday.

3-2. Trump's Tariff Shock and the Korean Market's Reaction

On October 10, former U.S. President Donald Trump announced an additional 100% tariff on Chinese goods, triggering the largest cryptocurrency liquidation event in history. Total damage amounted to $19 billion. The news broke around 6 AM on Saturday (Korean time), startling many Korean investors. Some KOLs reportedly woke up after receiving warnings and called peers to alert them.

Tether's price spiked to KRW 1,653 on Upbit and KRW 5,400 on Bithumb, and urgent live streams and analysis videos flooded YouTube and Telegram over the weekend. With the won weakening and premiums exceeding 5% through October 13, users debated whether this was a "buy-the-dip" opportunity or a warning sign of deeper structural risks.

3-3. Capital Outflows and Regulatory Pressure

According to the Financial Supervisory Service, crypto assets worth 101 trillion won (about $73 billion) flowed overseas in the first half of 2025. Experts say that limited access to derivatives and margin trading in Korea is driving investors to foreign exchanges.

This figure has steadily increased from 29.7 trillion won in early 2023 to 101.6 trillion won in mid-2025, reflecting an acceleration of capital outflows. Industry insiders argue that restrictive regulations are weakening domestic competitiveness. One analyst noted, "The U.S., EU, and Japan have institutional frameworks that support corporate crypto trading, whereas Korea remains isolated, further entrenching its status as a 'crypto Galapagos.'"

*All content is provided for informational purposes only and is not the basis for any investment decision nor investment advice or recommendation. We take no responsibility for any investment, legal, tax, or other outcomes arising from the use of this content.

INF Crypto Lab (INFCL) is a consulting firm specialized in blockchain and Web3, offering one-stop services such as corporate Web3 strategy formulation, token economy design, and global market entry. We provide strategy development and execution services to major domestic and international securities firms, game companies, platforms, and global Web3 companies, leveraging accumulated know-how and references to lead the sustainable growth of the digital asset ecosystem.

This report is independent of media editorial direction, and all responsibility rests with the information providers.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)