Summary

- Bitcoin prices have recently become more volatile due to the U.S.-China tariff war and troubles at U.S. regional banks.

- The $110,000 level acts as a psychological resistance for Bitcoin, and it is expected to trade sideways in the $100,000–$110,000 range in the short term.

- Whether the U.S. interest rate will be cut in the future is expected to be an important variable for the Bitcoin market.

Mixed price outlook

Record highs earlier this month

but tariffs war and financial market jitters

wiped out 10% in a week

large-scale liquidations also played a role

$110,000 is a psychological resistance

sideway movement likely to continue for now

Bitcoin prices are on a rollercoaster. Earlier this month, expectations of rate cuts pushed Bitcoin to record highs in domestic and international crypto markets, but as U.S.-China tariff tensions and global financial market instability spread, it has struggled. With increased price volatility, analyses diverge over whether this signals entry into a bear market or merely a short-term correction.

Uncertainty grows as tariff war expands

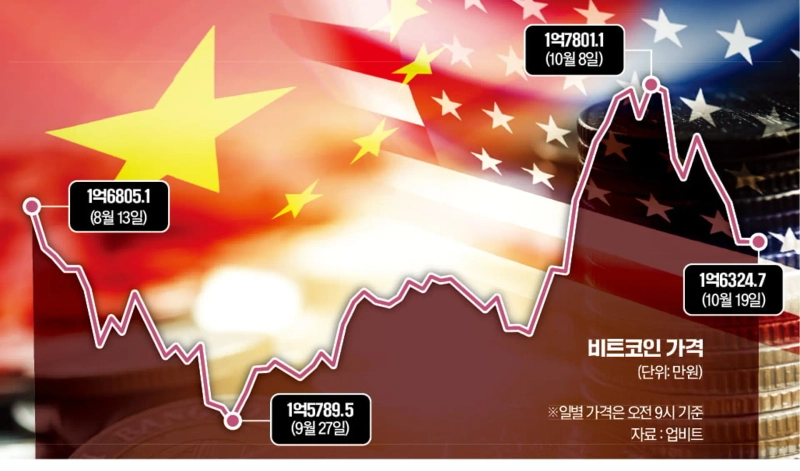

According to domestic cryptocurrency exchange Upbit on the 19th, Bitcoin is trading below the 170 million won level. It surged to the 178 million won level on the 8th but fell to the 160 million won level from the 15th. Overseas markets show a similar picture. According to CoinMarketCap, Bitcoin is trading around $106,000–$107,000. It recorded a new high earlier this month, surpassing $126,000. However, it fell more than 10% over a week.

Bitcoin showed clear strength earlier this month as expectations grew that the timing for additional U.S. rate cuts had arrived. Generally, rate cuts reduce the appeal of safe assets like deposits and bonds and increase appetite for risk assets such as crypto. Seasonal factors also played a role. October often sees rising Bitcoin prices and is called "Uptober" (Up+October). For example, Bitcoin closed higher in October nine times over the past 10 years.

But U.S. President Donald Trump’s renewed intent to wage a tariff war with China acted as a negative factor. When President Trump threatened on the 10th to slap an additional 100% tariff on China in response to controls on rare earth exports, Bitcoin prices swung. Risk-off sentiment strengthened and prices slid below $110,000. Not only Bitcoin but altcoins such as Ethereum, XRP and Solana also plunged. In addition, concerns over bad loans at U.S. regional banks surfaced, further weighing on global financial market stability.

An unusual large-scale liquidation event also occurred following the unexpected crash in crypto assets like Bitcoin. According to crypto data analytics firm CoinGlass, forced liquidations in the crypto futures market on the 10th amounted to 19.156 billion dollars (about 27 trillion won). Liquidation means investors' positions are forcibly closed when margin is lost due to a sudden price drop.

◇ $110,000 is Bitcoin's "psychological resistance"

As Bitcoin faltered, liquidity quickly moved into gold, a representative safe-haven asset. The international spot gold price briefly surged to $4,300 per troy ounce intraday on the 17th. U.S. investment bank Bank of America even projected that next year gold could reach $5,000.

The market expects Bitcoin price volatility to remain high through the end of the year. This means concerns that a full-fledged bear market has begun coexist with views that it will be only a short-term correction. In particular, the $110,000 level is expected to act as a psychological resistance for Bitcoin. Crypto-focused media Cointelegraph said, "Bitcoin prices are likely to trade sideways in the $100,000–$110,000 range for the time being."

Whether interest rates are cut is also a factor to watch. The market has raised the possibility that the U.S. central bank (Fed) could cut its policy rate at this month's and the upcoming December Federal Open Market Committee (FOMC) meetings. Recently, Fed Chair Jerome Powell has also made dovish remarks, leading some to interpret that the case for rate cuts is gaining strength.

Reporter Jang Hyun-joo blacksea@hankyung.com

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)