Editor's PiCK

Last week global crypto asset investment products saw a net outflow of $513 million

Summary

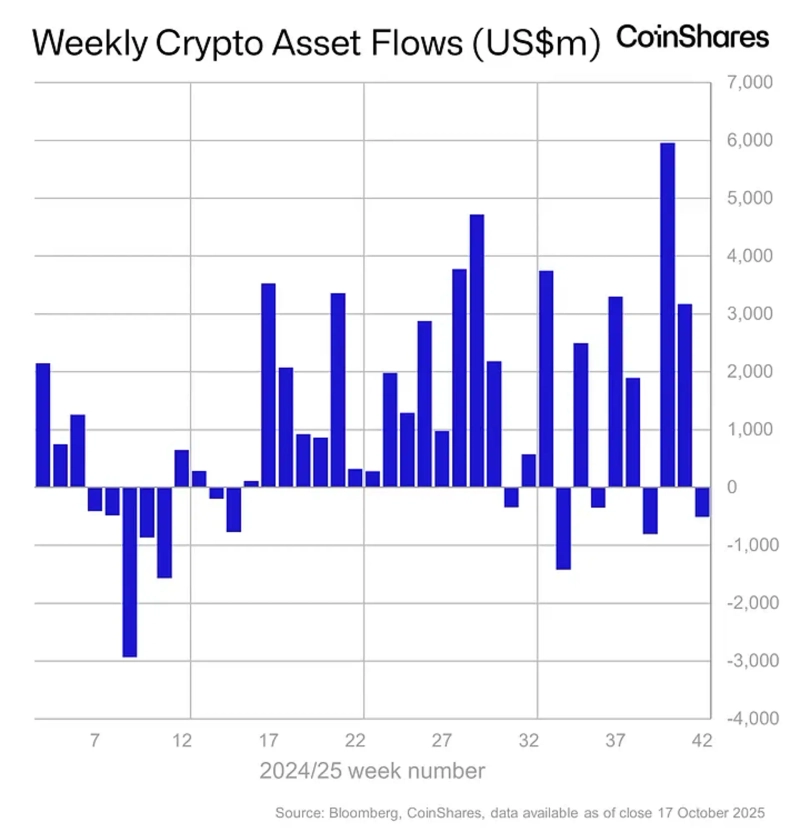

- Last week, global crypto asset investment products had net outflows of $513 million, CoinShares said in a report.

- Major Bitcoin products saw $946 million flow out, significantly reducing year-to-date inflows.

- By contrast, Ethereum, Solana, and XRP showed inflows, and notably $457 million went into 2x leveraged Ethereum ETPs.

Last week, global crypto asset (cryptocurrency) investment products saw an outflow of $513 million (KRW 730.3 billion).

On the 20th (local time), CoinShares said in a report, "Last week $513 million flowed out of crypto investment products," adding that "the market moved sharply following the large-scale liquidation event that occurred on the 10th." However, it added, "ETP investors were not greatly concerned about the event," noting that "weekly crypto ETP trading volume was $51 billion, twice the average this year."

By asset, bitcoin (BTC) products recorded the largest outflows. Bitcoin saw $946 million leave, bringing year-to-date (YTD) inflows down to $29.3 billion. This is lower than last year's inflows ($41.7 billion).

By contrast, ethereum (ETH) and major altcoins recorded inflows. Ethereum ETPs saw $205 million in inflows. The report said, "Investors view ethereum's decline as a buying opportunity," and "particularly, 2x leveraged ETPs received $457 million." Solana (SOL) and XRP also saw $156 million and $73.9 million, respectively, amid expectations for ETP launches.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)