Editor's PiCK

Listing of ZeroBase and the Rise of the AI Theme: Korean Crypto Weekly [INFCL Research]

Summary

- Last week's new listings on Upbit and Bithumb, including ZeroBase (ZBT), concentrated investor attention on the domestic AI theme and TEE-based projects.

- Recent strength in mid-cap and small-cap tokens such as LA, AUCTION, META, and EDU highlighted cross-platform market sentiment alignment and increased retail investor participation.

- Korean financial authorities' approval of Binance's acquisition of Gopax is interpreted as a positive signal for potential global exchange expansion in the domestic market and a possible shift toward derivatives and futures-driven market growth.

1. Market Overview

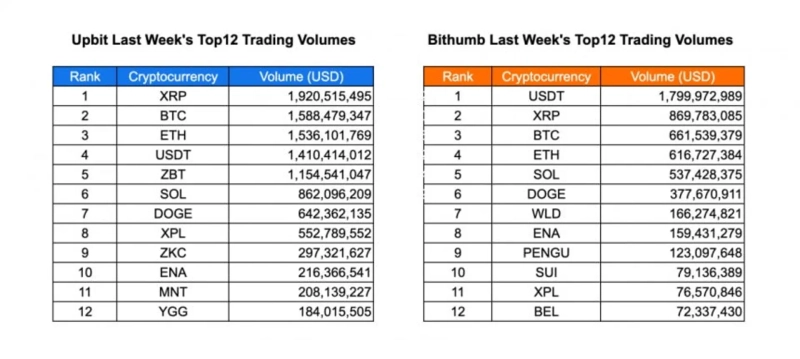

Last week several new listings were added to major Korean exchanges: Upbit listed Yield Guild Games and ZeroBase, and Bithumb listed Infinite, Doodles, Yield Basis, and ZeroBase. Upbit maintained leadership in overall trading activity thanks to major assets. XRP ($1.92 billion) led exchange volume, followed by BTC ($1.59 billion), ETH ($1.54 billion), and USDT ($1.41 billion). This suggested a continued focus on large-cap stability. Mid-tier tokens such as ZBT ($1.15 billion), SOL ($862 million), and DOGE ($642 million) saw steady participation, while new listings like ENA and MNT attracted notable retail investor interest.

On Bithumb, USDT ($1.8 billion) led trading, followed closely by XRP ($869 million), BTC ($662 million), and ETH ($617 million). Activity in SOL, DOGE, WLD, ENA, and PENGU indicated growing retail investor diversity, though on a smaller scale than Upbit. Total volume briefly exceeded $10 billion between October 10 and 12 before normalizing during the week, underscoring Korea's strong liquidity despite global market uncertainty. Notably, LA led weekly gains on both exchanges, surging 25~31%, while AUCTION, META, and EDU also strengthened, reflecting mid-cap momentum recovery and cross-platform market sentiment alignment.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges announced several new listings.

Upbit listed Yield Guild Games and ZeroBase.

Bithumb listed Infinite, Doodles, Yield Basis, and ZeroBase.

Key Marketing Strategies and Highlights

ZeroBase (ZBT)

ZEROBASE is a project that entered the Korean market between late December 2024 and early 2025. This was the period when AI narratives began to dominate the crypto space.

At the time, simple AI-related projects and AI agent concepts were popular, but given the Korean community's tendency to always look for the "next trend" for early exposure, interest soon shifted to the TEE (Trusted Execution Environment) area.

ZEROBASE effectively leveraged this dynamism by promoting itself as a TEE-based project through various KOL channels and encouraging stablecoin deposits during its beta phase.

While staking or deposit programs are generally considered to require significant capital, ZEROBASE emphasized accessibility by allowing deposits starting from $10 and offering a short 2-week staking period. This approach successfully attracted many users.

After being relatively quiet for more than 6 months, ZEROBASE re-engaged with the Korean community just before the TGE. Through KOL channels it indirectly alerted prior participants that the TGE was approaching and shared systematic updates covering topics such as participation in a Binance wallet booster program, mentions of Binance alpha, planned exchange listings, tokenomics, and airdrop details.

2-2. Volume

Last week Upbit's total trading volume continued to outpace Bithumb, maintaining a strong lead in major assets. XRP led Upbit at $1.92 billion, followed by BTC at $1.59 billion, ETH at $1.54 billion, and USDT at $1.41 billion, demonstrating investors' strong interest in large-cap assets. Mid-cap tokens such as ZBT ($1.15 billion), SOL ($862 million), and DOGE ($642 million) also recorded steady volumes, and emerging tokens like ENA and MNT ranked highly, reflecting ongoing retail interest in new listings.

On Bithumb, USDT topped the weekly chart with $1.8 billion in volume, followed by XRP ($869 million), BTC ($662 million), and ETH ($617 million). SOL and DOGE recorded modest but steady volumes, while increased participation from small-cap tokens like WLD, ENA, and PENGU suggested that investor interest was gradually diversifying beyond major currency pairs.

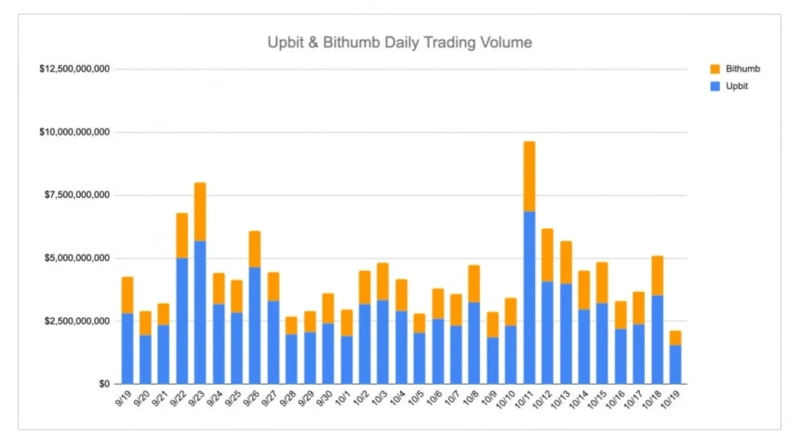

Overall, both exchanges experienced a surge in volume between October 10 and 12, when the combined daily volume briefly exceeded $10 billion before normalizing over the weekend. Upbit maintained a high contribution to trading throughout this period, reinforcing its position as the nation's largest retail-focused exchange. Bithumb's volume spike appeared concentrated around altcoin price movements and liquidity inflows.

2-3. Top 10 Gainers

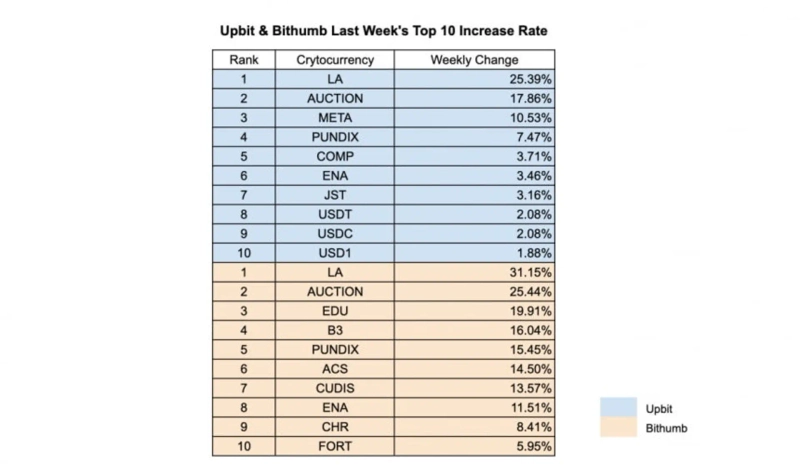

LA led both Upbit and Bithumb, posting the week's highest gains. Upbit recorded a 25.39% rise, and Bithumb recorded a 31.19% rise, driven by renewed retail speculation and increased liquidity inflows. On Upbit, AUCTION (+17.86%) and META (+10.53%) posted notable gains aided by steady volume and mid-cap momentum. Other tokens such as PUNDIX (+7.47%), COMP (+3.71%), and ENA (+3.16%) saw small gains, while stablecoin pairs like USDT, USDC, and USD1 showed modest increases reflecting market stability rather than speculative demand.

On Bithumb, AUCTION (+25.44%) and EDU (+19.91%) led the weekly gains alongside LA, followed by B3 (+16.04%) and PUNDIX (+15.45%). This indicates strong trader interest across exchanges. Small-cap assets such as ACS (+14.50%), CUDIS (+13.57%), and FORT (+5.95%) stood out, suggesting Bithumb's user base remains sensitive to new narratives and event-driven rallies. ENA appearing in the top 10 on both exchanges further emphasizes ENA's growing importance in the Korean retail market.

3. Korean Community

3-1. Palantir Opens First Pop-up Store in Seoul

Palantir held its first pop-up store in Seongsu, Seoul from October 14 to 15. This demonstrated Palantir's surging popularity among Korean investors. Korea now has the second-largest Palantir investor community in the world.

Eliano Yunis, Palantir's Head of Strategic Partnerships, said, "Palantir is growing rapidly in Korea, and this pop-up was organized to engage with Korean fans." Six types of merchandise were sold in total: sticker packs were sold for 30,000 won, and hoodies were sold for 215,000 won, with both products selling out after long lines of up to five hours.

The Korean crypto industry likened the event to a "Web2 meetup meta," joking that "KBW events are free, but in Web2 fans willingly buy hoodies." The event once again demonstrated the strong consumer power of Korea's retail investor base, whether in stocks or crypto.

3-2. Binance Officially Approved to Acquire Gopax

On October 16, Korean regulators approved Binance's long-pending executive change request, effectively completing Binance's acquisition of domestic crypto exchange Gopax. Binance had acquired a 67% stake in Gopax in February 2023, but the Financial Intelligence Unit (FIU) had delayed approval for over two years.

Analysts view this timing as a positive regulatory signal, suggesting that Korean authorities are becoming more open to global exchange participation as Binance mitigates overseas regulatory compliance risks. The community is generally optimistic. If Binance expands in the Korean market, it is likely to focus on derivatives and futures products rather than competing solely for existing users, which could expand the domestic market size by 4–5 times.

3-3. OpenSea Chest Opening Craze

In the ongoing OpenSea Season 2 event, Korean traders made headlines by opening chests and obtaining two out of three CryptoPunks. One winner, well-known NFT KOL Yobli, shared a video of the moment they opened the chest, which quickly spread on Telegram and received over 22,000 views, sparking waves of community congratulations.

However, as excitement spread, some users issued warnings: "These stories are fun but dangerous. 99% lose and 1% win. And FOMO can cause people to lose real money." The discussion highlighted growing community awareness of the thrill and risk of gamified NFT reward systems.

*All content is provided for informational purposes only and is not investment advice, a recommendation, or a solicitation to invest. The content does not take responsibility for any investment, legal, tax, or other outcomes.

INF Cryptolab (INFCL) is a consulting firm specialized in blockchain and Web3. It provides one-stop services including corporate Web3 market entry strategy, tokenomics design, and global market expansion. It offers strategy development and execution services to major domestic and international securities firms, game companies, platforms, and global Web3 companies, leveraging accumulated know-how and references to lead sustainable growth of the digital asset ecosystem.

This report is independent of media editorial direction, and all responsibility lies with the information provider.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io