Summary

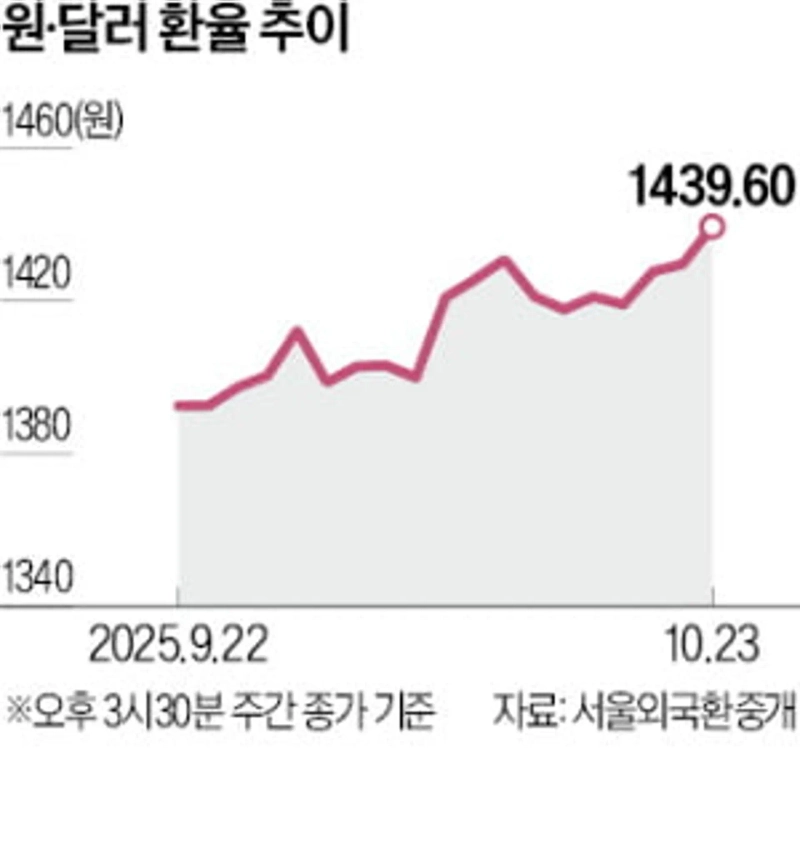

- won-dollar exchange rate topped 1,440 won intraday, marking the highest level in six months.

- The main causes of the exchange rate rise were cited as dollar strength and uncertainty over a $350 billion U.S.-bound investment package.

- The government and the Bank of Korea said they expect the exchange rate to stabilize if the Korea-U.S. tariff talks are concluded.

Rose by nearly 10 won despite rate hold

Dollar strength and concerns over U.S.-bound investment

Governor Lee: "Will fall and stabilize if tariff deal is reached"

The won-dollar exchange rate surged past the 1,440 won level intraday on the 23rd, reaching its highest level in six months. Dollar strength and worries that Korea-U.S. tariff talks could be prolonged affected the market. The government and the Bank of Korea expect the won-dollar exchange rate to fall and stabilize if the tariff talks are concluded.

On the day, the won-dollar exchange rate began rising immediately after the foreign exchange market opened and climbed to 1441 won 50 jeon around 1 p.m. It was the highest level since April 28 (1442 won 80 jeon). The weekly trading closing price rose by 9 won 80 jeon to 1439 won 60 jeon. The weekly close is also the highest since April 28. The large rise in the exchange rate despite a rate hold that day is analyzed to be due to increased uncertainty surrounding the composition of a $350 billion U.S.-bound investment package.

President Lee Jae-myung said in an interview with U.S. CNN about Korea-U.S. tariff talks, "It seems it will take a little time," suggesting the timing of an agreement could be delayed. A report the day before that the U.S. government is considering restricting software exports to China also pushed up the dollar and strengthened risk-aversion. The dollar index, which shows the value of the dollar against the currencies of six major countries, rose from the high 98s to the 99 level the previous day. The shift by foreign investors to net selling in the domestic stock market was also cited as a factor in the exchange rate rise.

Bank of Korea Governor Lee Chang-yong explained that the rise in the won-dollar exchange rate over the past three months since the previous monetary policy meeting (August 28) was due to a combination of factors. He explained, "About one-quarter is due to dollar strength, and three-quarters are due to yuan fluctuations from U.S.-China tensions, concerns over expansionary fiscal policy by Japan's new prime minister, worries about the tariff talks and how to raise $350 billion." He also said, "Overseas securities investment is acting as upward pressure on the exchange rate," adding, "So far this year, the securities we send abroad are about four times those we bring in from overseas." The won-dollar exchange rate has risen by 52 won since August 28 (1387 won 60 jeon).

Regarding the future exchange rate outlook, he said, "If the uncertainty over the tariff talks disappears in a favorable way, the exchange rate will fall," and "we are working to reduce volatility." This means that the won-dollar exchange rate could stabilize if Korea-U.S. tariff talks are concluded.

Deputy Prime Minister and Minister of Economy and Finance Koo Yoon-chul also said in an interview with Bloomberg TV that "the recent weakness of the won largely reflects market anxiety that the Korea-U.S. investment agreement has not yet been finalized," adding, "if the tariff issue is resolved, the uncertainty will ease."

Reporter Kang Jin-kyu josep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] FSS to examine ZKsync coin that surged '1,000%' in three hours](https://media.bloomingbit.io/PROD/news/1da9856b-df8a-4ffc-83b8-587621c4af9f.webp?w=250)