"Not waiting until house prices fall"…Lee leaves room for 'November rate cut'

Summary

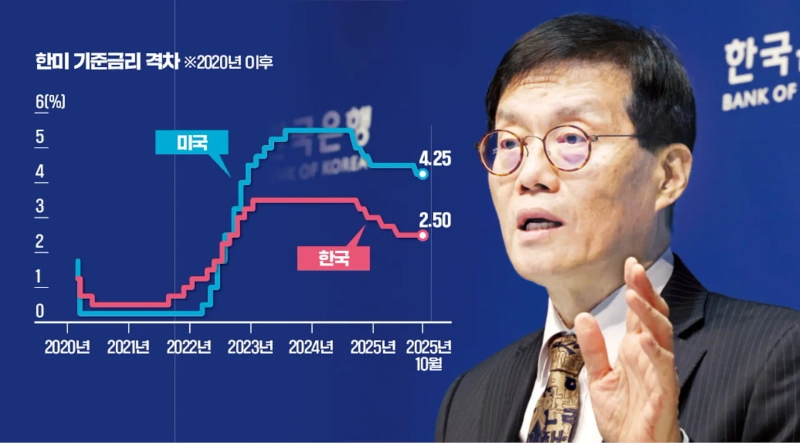

- The Bank of Korea froze the policy rate for the third consecutive time at an annual 2.5% and said that interest rates cannot perfectly control the real estate market.

- Governor Lee Chang-yong indicated that even if house prices do not fall, rate cuts could be resumed if the upward trend slows.

- While many expect rates to be held in November, some Monetary Policy Board members left open the possibility of a rate cut within three months and noted that attention to volatility is needed.

Bank of Korea freezes base rate for the third consecutive time at an annual 2.5%

"Interest rates cannot perfectly control real estate"

Even if house prices do not necessarily fall

Could lower rates if the pace of increase slows

Lee Chang-yong: "Decisions will be made comprehensively after watching the economy, etc."

Four Monetary Policy Board members suggested a 'cut within 3 months'

Half of securities firms forecast "hold in November as well"

There are counterarguments saying "a cut is needed from a growth perspective"

The Bank of Korea held a Monetary Policy Board meeting on the 23rd and kept the policy rate at an annual 2.50%. This is the third consecutive hold following July and August. The decision was based on the judgment that, with ongoing instability in the real estate market, a rate cut could not be allowed to spur further increases in house prices. However, Lee Chang-yong, governor of the Bank of Korea, said at a press briefing immediately after the Monetary Policy Board meeting that "the risks from household debt have largely disappeared." As a condition for resuming rate cuts, he said, "We cannot say it is stable only if house prices fall," and "we need to see signs that the pace of increases is slowing." Analysts suggested that the governor might have left room to cut rates next month.

◇ Relatively dovish remarks on real estate

The Bank of Korea cut rates by 0.25% percentage points in February and May, and has not lowered them since. With this hold, the policy rate remains at an annual 2.50% for six months until the next Monetary Policy Board meeting next month. Although the economy is weak and inflation is stable, overheating in the real estate market appears to be holding back rate cuts.

However, his remarks at the press briefing about financial stability that day were seen as somewhat dovish. He said that even if house prices do not shift into a downward trend, if the pace of price increases slows, rate cuts could be resumed.

He said in particular, "Interest rates cannot perfectly control real estate prices," and added, "If real estate prices are high, it does not mean we will just keep waiting (with rates on hold). We also have to look at the economy." He added, "We will judge whether a rate cut would further overheat the real estate market, but we must also consider whether not cutting rates would make the economy much worse."

"Even if next year's growth rate rises to the level of potential growth, because it has been low for some time, the growth rate should be above potential growth for a while," he said, adding, "We should continue to lower rates while following this 'output gap' (the difference between real and potential growth rates)."

Although many in the market had expected the Monetary Policy Board to unanimously hold rates, there were dissenting views. Monetary Policy Board member Shin Seong-hwan said, "While financial stability related to the housing market is a concern, given that the GDP gap rate remains significantly negative, it would be desirable to lower the policy rate at an early point if possible and then observe the effects on economic and financial stability while proceeding with future rate decisions."

◇ "Too many variables until November"

On the other hand, there are also many who predict that rates will be held in November. "It seems difficult to confirm a slowdown in the pace of real estate price increases by the next Monetary Policy Board meeting scheduled for the 27th of next month," said Min Ji-hee, a bond analyst at Mirae Asset. Yoon Yeo-sam, an analyst at Meritz Securities, also said, "I had expected one cut within the year, but after listening to the governor's remarks, I pushed back the expected timing of a cut to the first quarter of next year." About half of the securities firms that released related reports on the day forecast a rate hold in November.

The positions of the Monetary Policy Board members have also become somewhat more hawkish than before. In the 'forward guidance' forecasting rates three months ahead, four of the six members excluding the governor suggested that they should leave open the possibility of a rate cut within three months. The number of members forecasting a rate cut fell by one from five in August.

The governor did not give a clear answer on the timing of a rate cut. He said, "Seeing that the number of members forecasting a rate cut three months from now has changed, it is correct to view this as 'the easing stance continues but the size and timing of cuts have been adjusted,'" adding, "There are many variables until November — Korea-US relations, US-China tariff negotiations, the semiconductor cycle — making uncertainty large."

In Seoul's bond market that day, bond yields rose across the board (bond prices fell). The yield on the 3-year government bond closed at an annual 2.605%, up 0.033% percentage points from the previous day. It rose to its highest level since March 28 (annual 2.629%). A bond market specialist said, "Foreigners had recently bet that the Bank of Korea would signal rate cuts and bought large amounts of 3-year government bond futures, but they largely exited after the Monetary Policy Board meeting," and analyzed, "Domestic institutions may respond by buying."

Reporter Kang Jin-kyu josep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] FSS to examine ZKsync coin that surged '1,000%' in three hours](https://media.bloomingbit.io/PROD/news/1da9856b-df8a-4ffc-83b8-587621c4af9f.webp?w=250)