Summary

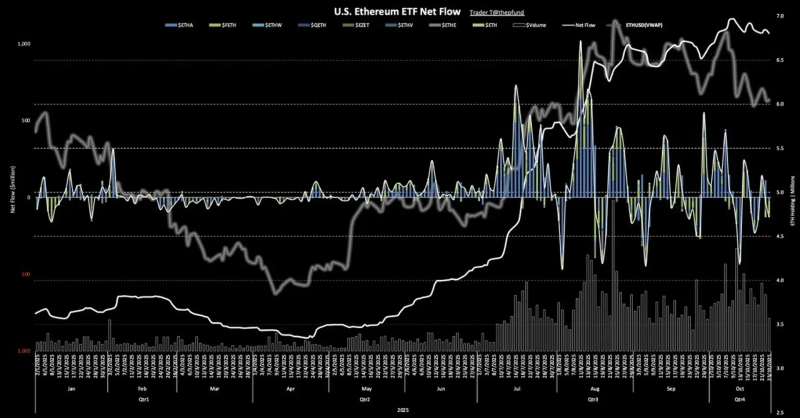

- U.S.-traded Ethereum spot ETFs reportedly recorded a total net outflow of $127,470,000 over two consecutive days.

- In particular, Fidelity's FETH had the largest net outflow at $77,040,000, and BlackRock's ETHA and Bitwise's ETHW saw outflows of $23,310,000 and $8,850,000, respectively.

- Funds also flowed out from VanEck, Grayscale, and certain other ETFs, while some ETFs such as 21Shares, Invesco, and Franklin had no fund flows.

U.S. Ethereum (ETH) spot exchange-traded funds (ETFs) saw funds flow out for two consecutive days.

On the 23rd (local time), according to TraderT, Ethereum spot ETFs traded in the United States recorded a net outflow of $127,470,000.

By ETF, Fidelity's FETH showed the largest net outflow at $77,040,000. Next were BlackRock's ETHA with $23,310,000 and Bitwise's ETHW with $8,850,000 flowing out.

Also, VanEck (ETHV), Grayscale (ETHE), and Grayscale Mini (ETH) recorded net outflows of $5,650,000, $5,710,000, and $6,910,000, respectively. In addition, there were no fund flows for 21Shares (CETH), Invesco (QETH), and Franklin (EZET).

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)