U.S. September consumer prices fall short of expectations... Two consecutive rate cuts likely next week

Summary

- The U.S. September Consumer Price Index (CPI) increase was reported to be 0.1%%P lower than experts' forecasts.

- The market reflected a 98.9%% probability of two consecutive rate cuts at the Federal Open Market Committee (FOMC).

- While expectations for further year-end rate cuts rose amid worsening employment indicators, the pace of cuts next year could vary depending on variables such as oil prices.

Rose into the 3% range for the first time in 8 months, but

0.1%P below experts' expectations

Employment contraction concerns greater than inflation concerns

The U.S. September consumer price increase came in lower than market expectations. There is a prospect that the U.S. central bank (Fed) will implement an additional rate cut at next week's Federal Open Market Committee (FOMC) meeting.

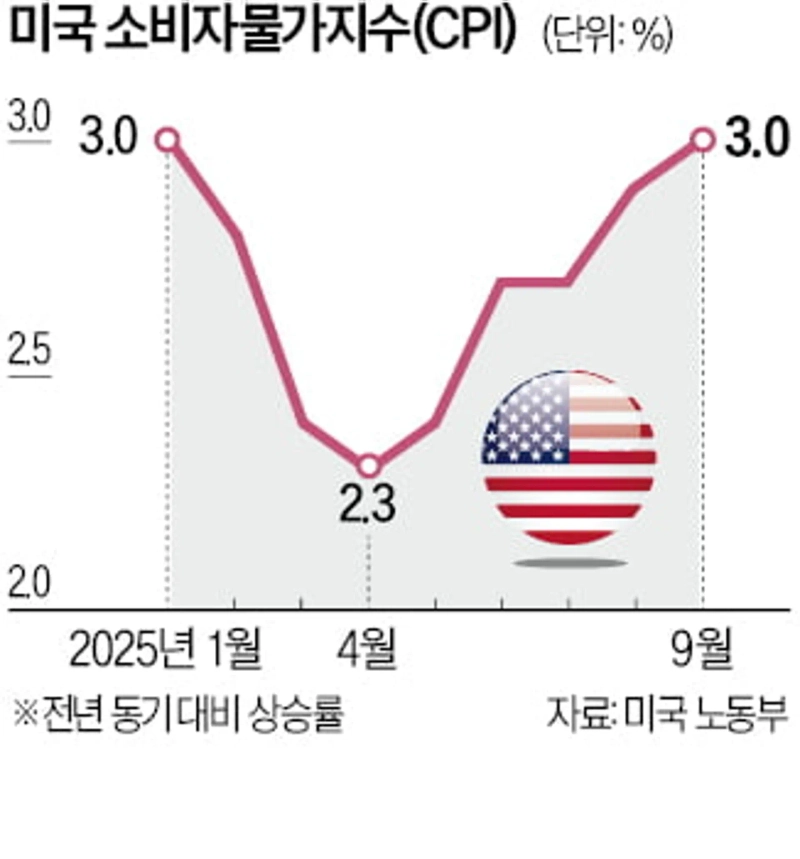

The U.S. Department of Labor said on the 24th that the September Consumer Price Index (CPI) rose 3.0% year-on-year. It was below the 3.1% expert forecast compiled by Dow Jones. The month-on-month increase was also 0.3%, lower than the 0.4% forecast. Core CPI, which excludes the volatile energy and food components, rose 3.0% year-on-year.

This CPI release drew attention as a major economic indicator ahead of the FOMC meeting on the 28th–29th. The September CPI report had originally been scheduled to be released on the 15th but was delayed due to the U.S. government shutdown (temporary halt of operations).

The CPI rise had recorded 2.3% in April, the lowest in four years since the COVID-19 pandemic. The increase then widened to 2.9% in August. Prices of tariff-sensitive goods rose, which is interpreted as having pushed up inflation. Reuters noted, "With inventories from the second quarter being rapidly depleted, retailers are restocking at prices that include tariffs." BNP Paribas Securities predicted that about 60% of total tariff costs would be passed on to consumer prices over the next six months.

Although inflationary pressure remains, the market sees the Fed as likely to cut rates next week because employment indicators are deteriorating. According to U.S. payroll processing firm Automatic Data Processing (ADP), private-sector employment in the U.S. fell by 32,000 in September compared with the previous month. The most recent U.S. government figure showed nonfarm payrolls for August increased by only 22,000 from the prior month.

According to the Chicago Mercantile Exchange (CME) FedWatch, immediately after the CPI release, the rate futures market priced a 98.9% probability of a 0.25%-point rate cut at this FOMC. The probability of an additional cut in December was seen at 96.5%. The Fed indicated at last month's policy meeting that there could be two additional rate cuts this year.

However, some say that if an unexpected inflationary trend continues, the pace of rate cuts next year could be slowed. Oil prices are cited as a variable. Although the recent oil price decline had pushed gasoline prices to their lowest level since last December, oil prices jumped about 6% after the U.S. on the 22nd imposed sanctions on a Russian oil company.

Reporter Han Myung-hyun wise@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Exclusive] FSS to examine ZKsync coin that surged '1,000%' in three hours](https://media.bloomingbit.io/PROD/news/1da9856b-df8a-4ffc-83b8-587621c4af9f.webp?w=250)