Editor's PiCK

Rapidly Changing Korean Crypto Market : Korean Crypto Weekly [INFCL Research]

Summary

- Recent aggressive new listings by Upbit and Bithumb have continued the market share competition, with large-cap trading occupying a leading position.

- The Financial Services Commission plans to shift listing reviews from self-regulation to public oversight and introduce disclosure standards to strengthen transparency and investor protection.

- There are growing concerns about money laundering and capital outflows related to a potential surge in dollar stablecoin flows in 2024–2025, and investors are urged to exercise caution.

1. Market Overview

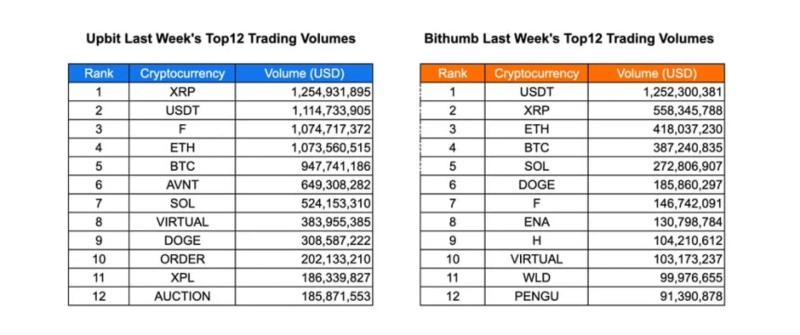

Last week, major Korean exchanges continued an aggressive listing pace. Upbit added SynFutures (F), Clearpool (CPOOL), and Orderly (ORDER), while Bithumb listed Zora (ZORA), Recall (RECALL), and Clearpool (CPOOL). Trading activity remained led by large-cap assets. XRP led Upbit with weekly trading volume of USD 1.25 billion, followed by USDT (USD 1.11 billion) and F (USD 1.07 billion). ETH, BTC, and AVNT each maintained robust liquidity of over USD 500 million. Mid-cap tokens such as SOL, ORDER, and VIRTUAL also drew steady interest, and despite overall reduced market volatility, continued retail speculation was reflected.

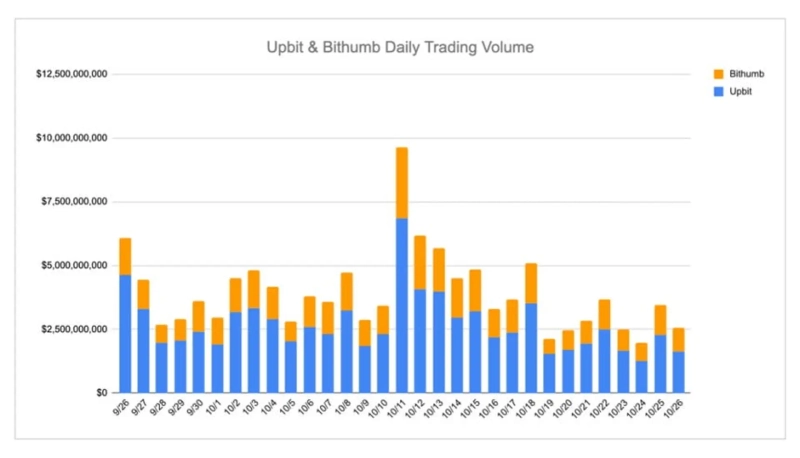

Bithumb's volume was likewise concentrated in top tokens, with USDT (USD 1.25 billion), XRP (USD 558 million), and ETH (USD 418 million) in the lead. While large-cap trading remained dominant, increased participation in altcoins such as ENA, H, and VIRTUAL indicated higher risk appetite among traders. Daily market volume fluctuated below USD 5 billion. Upbit once again accounted for the majority of total volume, reinforcing its position as Korea's representative retail exchange and a primary driver of domestic liquidity.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges announced several new listings.

Upbit listed SynFutures, Clearpool, and Orderly.

Bithumb listed Zora, Recall, and Clearpool.

Key Marketing Strategies and Main Points

Orderly (ORDER)

Orderly Network has maintained a marketing campaign in Korea for over 17 months, and after previously listing on Bithumb, it secured an additional listing on Upbit. In 2024, Orderly appeared around the time when Perp DEX airdrop fever was at its height, similar to Hyperliquid, SynFutures, and LogX. The project primarily promoted trading campaigns through major Korean KOL channels, guiding users through Galxe, Zealy, and other quest missions, and many KOLs actively participated, generating strong user engagement across the Korean community.

After mainnet launch, Orderly conducted a TGE, but it did not list on the top-tier exchanges many investors had expected. Nevertheless, the team continued development and marketing efforts, emphasizing that token utility and benefits were designed to provide substantial rewards to stakers. They also maintained communication through partnership announcements, offline meetups, AMAs, and community events.

As a result, the project listed on Bithumb in December 2024 and has regularly visited the Korean market via AMAs, meetups, and regional events to share development and partnership progress. As the Perp DEX sector regained attention, this momentum led to Upbit's KRW listing.

Overall, Orderly is a strong case showing that sustained marketing and engagement in the Korean market, combined with sector timing, can open the path for additional exchange listings in the future.

2-2. Trading Volume

Upbit led overall trading activity last week, surpassing Bithumb, driven by strong demand for large-cap assets. XRP ranked first on Upbit charts with USD 1.25 billion in volume, followed closely by USDT (USD 1.11 billion) and F (USD 1.07 billion), all showing steady liquidity throughout the week. ETH and BTC were also among the most traded tokens, while mid-cap coins such as AVNT (USD 649 million) and SOL (USD 524 million) maintained moderate participation. Newly listed coins like VIRTUAL, ORDER, and AUCTION also secured notable positions, indicating continued retail interest in emerging tokens.

On Bithumb, USDT recorded the highest volume at USD 1.25 billion, followed by XRP (USD 558 million), ETH (USD 418 million), and BTC (USD 387 million). This shows that Bithumb's trading activity is concentrated in major market pairs. SOL and DOGE maintained steady gains, and ENA, H, and VIRTUAL entered the top 10, reflecting increased investment in new assets by Bithumb traders.

Daily volumes on both exchanges ranged between USD 3 billion and USD 9 billion, and on October 10 they briefly surged past USD 10 billion before adjusting over the following days. Upbit consistently recorded a high share of total volume, reaffirming its dominant role in Korea's spot trading market and its central role in expanding domestic market liquidity.

2-3. Top 10 Gainers

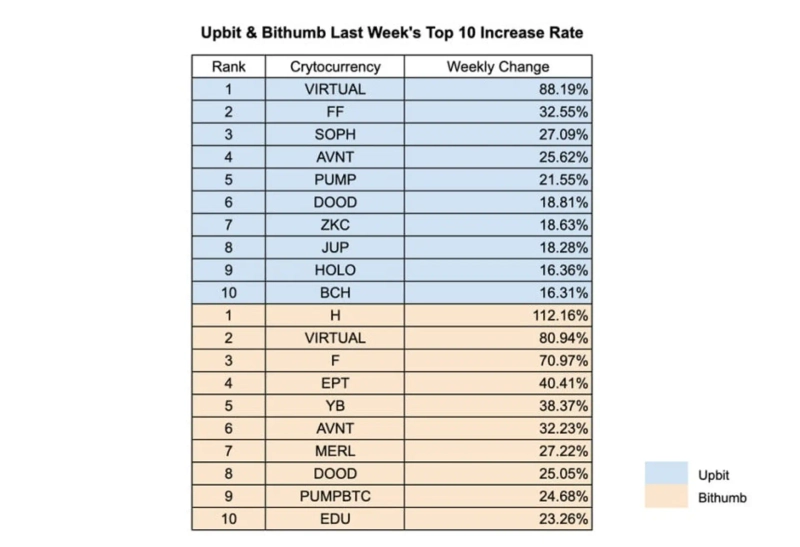

VIRTUAL recorded a weekly gain of 88.19%, dominating the Upbit market. This reflects strong retail interest and speculative trading momentum. FF (+32.55%) and SOPH (+27.09%) showed strength supported by steady volumes and short-term buying. Mid-cap tokens like AVNT (+25.62%) and PUMP (+21.55%) also posted notable gains, while DOOD, ZKC, and JUP showed modest but steady rises of 18–19% as liquidity rotated into small-cap assets. HOLO and BCH appeared in Upbit's top 10, suggesting a broader price recovery across altcoins.

On Bithumb, H surged 112.16%, leading the weekly rally and significantly outpacing the broader market. VIRTUAL followed closely at +80.94%, continuing its strength from Upbit and confirming enthusiastic responses from traders across exchanges. F (+70.97%), EPT (+40.41%), and YB (+38.37%) also posted double-digit gains, reflecting momentum-driven retail buying. AVNT (+32.23%), MERL (+27.22%), and DOOD (+25.05%) maintained upward trends, while PUMPBTC and EDU each rose over 23% to take the top spots. The overlap of tokens such as VIRTUAL, AVNT, and DOOD on both exchanges indicates synchronized market sentiment and common interest among Korean traders.

3. Korean Community

3-1. Financial Supervisory Service, Strengthening Public Oversight of Exchange Listings

The Financial Services Commission (FSC) announced plans to shift crypto exchange listing reviews from self-regulation to public oversight and to introduce disclosure standards similar to those used in the stock market. The goal is to enhance transparency and investor protection by mandating detailed criteria for listings, delistings, and trading suspensions.

The proposed framework is expected to be included in the soon-to-be-implemented "Virtual Assets Act 2.0," which will also cover stablecoin regulations and comprehensive guidelines for market operators and users. These measures respond to concerns over the "surge in listings" and lax internal standards. The FSC had previously proposed mandating a minimum circulating supply immediately after listing and limiting market orders, and these measures are now likely to be formalized.

Community reaction was immediate. Many traders interpreted the recent surge in Upbit and Bithumb listings as a "rush before regulation," and posts commented, "I now understand why listings surged."

3-2. Analysis of Upbit's Listing Strategy

Community discussion intensified over Upbit's recent listing patterns, particularly regarding tokens such as Orderly, SynFutures, and Bio, which had already been listed on Bithumb. Some speculated that Upbit might be expanding market share through an agreement with Naver and exchanges, aiming to outpace Bithumb's rapid growth.

Others argue that Upbit times its listings carefully, i.e., listing tokens only when vesting periods end and projects show sustained development activity. Many traders describe this as a "filtered second wave," suggesting it secures liquidity for trend assets while maintaining credibility.

3-3. Cambodia Crypto Crime Network Issues Red Flags

The National Intelligence Service released a report showing the scale of organized crime in Cambodia, estimating illegal proceeds at USD 12.5 billion, nearly half of Cambodia's GDP. Of roughly 200,000 implicated individuals, an estimated 1,000–2,000 are Korean nationals, and many of these are actively involved rather than victims.

The report surprisingly anticipates a surge in dollar stablecoin flows between Cambodian and Korean exchanges in 2024–2025, suggesting possible money laundering and illicit remittance routes. Several domestic companies, including Huiyuan and Prince Group, are currently under investigation for possible involvement. These revelations have reignited debates over regulatory gaps that could lead to restrictions on access to Korea's derivatives markets and capital outflows.

*All content is provided for information and delivery purposes only and is not intended as the basis for investment decisions or as investment advice or recommendations. We assume no responsibility for any aspects of investment, legal, tax, or other matters.

INF Cryptolab (INFCL) is a consulting firm specializing in blockchain and Web3, providing one-stop services such as corporate Web3 market entry strategy, token economy design, and global market expansion. We provide strategy development and execution services to major domestic and international securities firms, game companies, platforms, and global Web3 companies, and with accumulated know-how and references we lead sustainable growth of the digital asset ecosystem.

This report is independent of media editorial direction, and all responsibility lies with the information provider.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io