Expectations of eased U.S.-China trade tensions… Shanghai Index also surpasses 4000 points

Summary

- The Shanghai Composite Index of China surpassed 4000 points for the first time in 10 years.

- Expectations of eased U.S.-China trade tensions and the possibility of extending tariff waivers ahead of the summit are driving an influx of buying demand.

- Global institutions and experts suggested the medium- to long-term growth of technology stocks and the Chinese stock market and the possibility of further stock price increases.

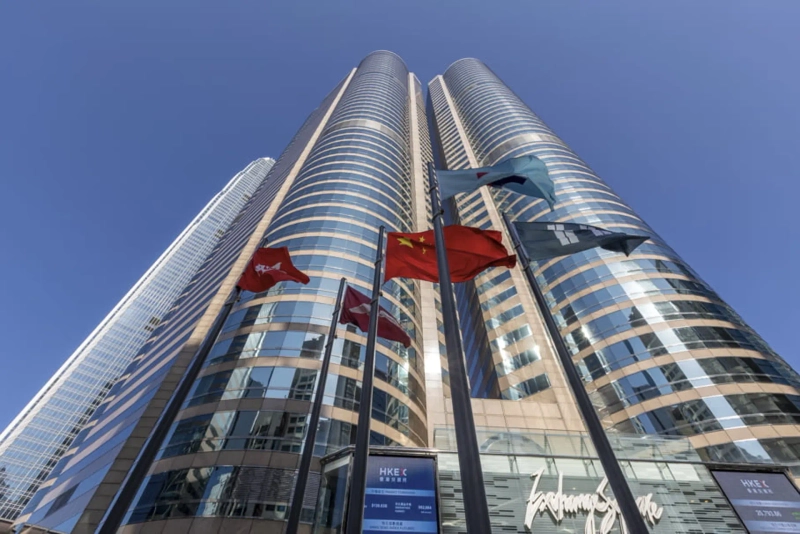

The Shanghai Composite Index in China has surpassed 4000 points. This is a recovery not seen in 10 years since 2015.

According to the Shanghai Stock Exchange on the 28th, at around 2:40 p.m. that day the Shanghai Composite Index was down 0.02% at 3995.98. The index, which started the day at 3986.89, widened its gains and surpassed the 4010.73 level during the morning session. It is the first time the Shanghai Composite, the representative index of the Chinese stock market, has crossed the 4000 level since August 19, 2015 — 10 years and 2 months ago. The index had fallen to the 3096 level in April due to the shock of the U.S.-China tariff war, but as signs of easing tariff tensions emerged, it has risen sharply since the second half of the year.

With the U.S.-China summit scheduled for the 30th, both countries have been showing moves to 'refrain from escalating,' raising the possibility that the suspension of retaliatory tariffs between the two countries, which expires on November 10, could be extended again. The day before, Chinese Foreign Minister Wang Yi, in a phone call with U.S. Secretary of State Marco Rubio, said, "Xi Jinping, China's jukga Chairman, and President Donald Trump are both world leaders," and described the relationship between the two leaders as "the most precious strategic asset in U.S.-China relations." U.S. Secretary of State Marco Rubio said, "U.S.-China relations are the most important bilateral relationship in the world," adding, "I hope high-level exchanges will send a positive signal to the world." Earlier on the 26th (local time), U.S. Treasury Secretary Scott Besant suggested that China would postpone for one year the strengthening of rare earth export controls and that the United States would withdraw the 100% additional tariffs planned to be imposed on China. If final approval is given at the summit, it is expected that trade tensions between the two countries will move toward resolution, drawing buying demand.

It is also positive that China's 15th Five-Year Plan (hereinafter the 15th plan), which outlines policy directions for the next five years (2026–2030), was released. At the Fourth Plenum held from the 20th to the 23rd, "new quality productive forces" were adopted as an official framework, designating advanced technology sectors as future growth drivers. In the medium to long term, with government support for growth in tech areas such as artificial intelligence (AI) and robotics, there is expectation that earnings and stock prices will also improve.

Yang Delong, chief economist at Chen Haikai Kaiyuan Fund, said, "Unlike the bubble-like rise ten years ago, this year a bull market is showing as investment funds concentrate on technology stocks," and evaluated, "The breakthrough of 4000 points is not the end of the rally but the starting point of a new ascent."

Foreign investors foresee that China's stock market will trend upward in the long term. Goldman Sachs recently released an optimistic outlook on China's semiconductor industry and raised the target prices for SMIC and Hua Hong Semiconductor. Goldman Sachs expects major Chinese indices to rise by about 30% by 2027. JP Morgan also expects the CSI300 index to rise 24% and the MSCI China Index to rise 35% by the end of next year.

China Inhe Securities said, "Currently, the valuation (price-to-earnings level) of mainland China's consumer goods companies remains at historically low levels," adding, "It is advantageous from an investment perspective to pay attention to areas such as alcoholic beverages, home appliances, and feed."

Reporter Jo Ara rrang123@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[New York Stock Market Briefing] Rebound on bargain hunting in blue chips…Apple jumps 4%](https://media.bloomingbit.io/PROD/news/3710ded9-1248-489c-ae01-8ba047cfb9a2.webp?w=250)