Summary

- Larry Fink, BlackRock CEO, said that gold and virtual assets are hedge assets for investors responding to asset devaluation.

- He cited the dollar-dependent funding structure as a key risk to the U.S. economy, saying a decline in foreign purchases of dollar assets would have a major impact on the overall U.S. economy.

- Fink said central banks are focusing on the role of tokenization and digitization, and that most countries are underestimating the speed of financial asset tokenization.

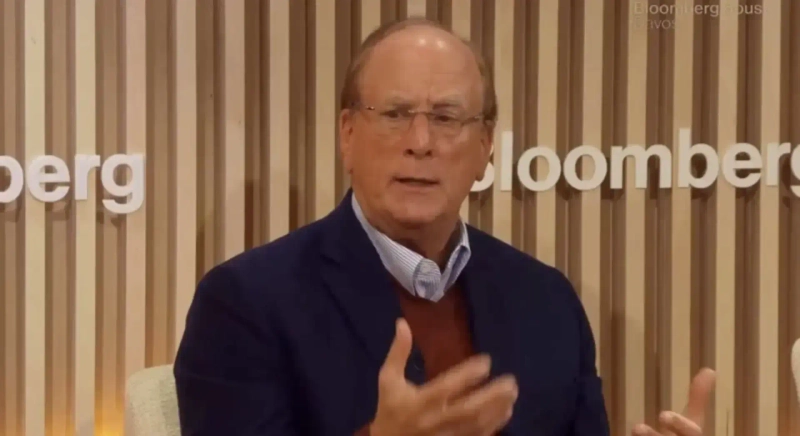

Larry Fink, BlackRock CEO, assessed that "investors are buying gold and virtual assets (cryptocurrencies) as 'assets of fear' amid fears of asset value declines."

According to CoinDesk on the 28th (local time), Larry Fink spoke at the Future Investment Initiative (FII) conference held in Saudi Arabia, saying, "The reason people hold gold or virtual assets is because they fear the devaluation of assets," and added, "This reflects anxiety about the stability of the financial system and the safety of real assets."

He identified the 'dollar-dependent funding structure' as a key risk to the U.S. economy. He said, "About 30~35% of U.S. Treasury sales depend on foreign investors," and added, "If this structure is shaken, a decline in foreign purchases of dollar assets would have a major impact on the overall U.S. economy."

In addition, Fink said, "The most common question asked by central banks that have recently been increasing gold purchases is 'what role will tokenization and digitization play?'" He continued, "Central banks are grappling with complex questions such as how quickly to digitize their currencies, the impact of that process on the dollar, and how to manage changes in payment infrastructure."

Fink added, "We spend too much time discussing artificial intelligence (AI), but in reality we are not sufficiently discussing how quickly all financial assets will be tokenized," and elaborated, "This will happen very quickly worldwide, and most countries are underestimating that change."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit