'Sorry I Didn't Recognize You' Flood of KOSPI Revaluation…"It Goes to 6000"

Summary

- J.P. Morgan forecasted that the KOSPI index could rise to as high as 6000 within 12 months and advised treating any correction as a buying opportunity.

- It analyzed that corporate governance improvements and other policy effects, inflows of foreign capital, and low valuation increase the likelihood of further revaluation of the Korean market.

- Major institutions such as J.P. Morgan and CLSA named semiconductors and high-dividend companies as attractive sectors, and recommended overweighting holdings, financials, and industrials related to shareholder returns.

J.P. Morgan "KOSPI Could Reach 6000"

"If a correction comes, treat it as a buying opportunity"

KOSPI up 70P to 4081, another record

Global investment bank J.P. Morgan has forecast that the KOSPI index "could reach the 6000 level within a year." This is the first time a reputable institution has mentioned 'KOSPI 6000.' J.P. Morgan assessed that the effects of policies such as corporate governance improvements have not yet been reflected in stock prices and advised, "If a correction comes, treat it as a buying opportunity."

In a report on the 29th titled 'KOSPI 5000 possible…corrections are additional buying opportunities,' J.P. Morgan said, "We raise our 12-month KOSPI index forecast to 5000," and "under a bull scenario it could reach as high as 6000."

J.P. Morgan emphasized, "There are opinions that the recent rise is excessive, but Korea remains the top-preferred market in Asia with significant upside potential." Although the KOSPI index has risen about 70% year-to-date, they analyzed that valuation (price relative to earnings) remains much lower than global and Asian averages.

J.P. Morgan cited policies such as the third revision of the Commercial Act and other corporate governance improvement measures as conditions for further KOSPI increases. Mixo Das, J.P. Morgan Asia equities strategist, said, "Korean market reforms are progressing smoothly," and evaluated that "policy makers appear sincere in implementing the new corporate governance standards." That day the KOSPI index closed at 4081.15, up 1.76%, setting a new record.

Overseas IBs still say K-market is cheap…'KOSPI revaluation' has begun

J.P. Morgan "Sufficient upside for KOSPI…6000 also possible"

"As global liquidity eases and equity values rise, the valuation of the Korean market (price relative to earnings) can also be re-rated. KOSPI reaching 6000 in a year is possible."(J.P. Morgan)

"It is very rare in Korea's market history for policy effects and corporate profit growth to appear simultaneously. We newly set a 5000 index target for next year."(KB Securities)

As the KOSPI index surpassed the 4000 level, domestic and foreign securities firms have been raising their forecasts one after another, emphasizing the possibility of a 'fundamental revaluation' of the Korean market. They explain that a structural virtuous cycle could soon occur—shareholder value expansion from revisions to the Commercial Act, additional inflows of foreign capital, and higher valuations. Securities firms expect that, following this trend, sectors related to shareholder returns such as holdings and financials, in addition to semiconductors, will benefit.

◇ "Policy tailwinds are a factor for further KOSPI gains"

In its report on the 29th, J.P. Morgan analyzed that "although the KOSPI index has risen sharply recently, discounts related to corporate governance are being resolved and this has not yet been reflected in stock prices," calling this "a reason why the Korean market still has significant upside." So far the market has relied on a memory semiconductor rally to break 4000, but there remains a 'tailwind' of corporate governance improvements and shareholder value enhancement.

J.P. Morgan diagnosed that "the Korean market has faced structural problems due to misaligned interests between large shareholders and minority shareholders." As a result, some companies have held excessive cash and kept low shareholder return rates or engaged in dual listings or excessive capital expenditures. If 'new standards' are established under market reform policies, such discount factors could be removed and a structural improvement that attracts foreign capital may occur.

Mixo Das, J.P. Morgan Asia equities strategist, said, "Except for cases of issuing exchangeable bonds (EB) backed by treasury shares, we have not seen corporate activities that are negative for shareholder value recently," and added, "Excessive equity issuance has reversed this year."

J.P. Morgan expects these policy effects to draw additional foreign capital. Despite the index surge in recent months, developed-market investors, except for emerging market funds, have hardly participated in the Korean market. Das said, "Most types of overseas investors still have low Korea weightings," and foresaw additional inflows of foreign capital.

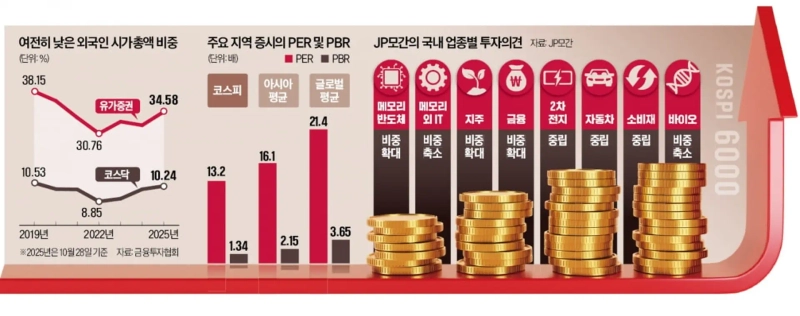

According to J.P. Morgan, the KOSPI's price-to-earnings ratio (PER) stands at 13.2x and price-to-book ratio (PBR) at 1.34x. These remain undervalued compared with the global average (21.4x, 3.65x) and the Asian average (16.1x, 2.15x). The share of foreign market capitalization in the securities market was 34.58% as of the previous day, not even reaching the end of 2019 (38.15%).

◇ "Memory, holdings, financials, and industrials are beneficiaries"

Hong Kong-based CLSA and KB Securities also forecast a fundamental revaluation of the Korean market. CLSA emphasized that "government officials have hinted at a cut in dividend income tax rates ahead of year-end," increasing the investment appeal of high-dividend companies. The institution said, "There is sufficient scope for additional inflows from both individuals and foreigners, making further re-rating of the KOSPI likely."

KB Securities became the first domestic securities firm to set a KOSPI target of 5000. They explained that simultaneous rises in net profit and valuation due to policy are very rare in Korea's market history.

These securities firms named semiconductors and high-dividend companies as promising sectors and stocks. J.P. Morgan recommended overweighting memory semiconductors and holdings, financials, and industrials (shipbuilding, defense, nuclear), while giving neutral ratings to secondary batteries and autos, and underweight to non-memory tech and biotech.

Among stocks, they recommended Samsung Electronics, SK Hynix, Hanwha Aerospace, and Hyundai Motor. CLSA said it "focuses on companies with high dividend stability and strong shareholder return commitments," listing LG, Hyundai Glovis, Woori Financial Group, and HD Korea Shipbuilding & Offshore Engineering as beneficiaries.

Reporter Han-shin Park phs@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)