Nvidia reaches $5 trillion market cap for the first time in history…surpasses Germany's GDP

Summary

- Nvidia has surpassed a market capitalization of $5 trillion for the first time in history.

- Nvidia announced various AI chip supply agreements, collaborations with technology companies, and large-scale investment plans.

- Nvidia's stock has risen by more than 1300%% since the end of 2022.

First-ever achievement of $5 trillion corporate value

Size surpassing Germany's GDP

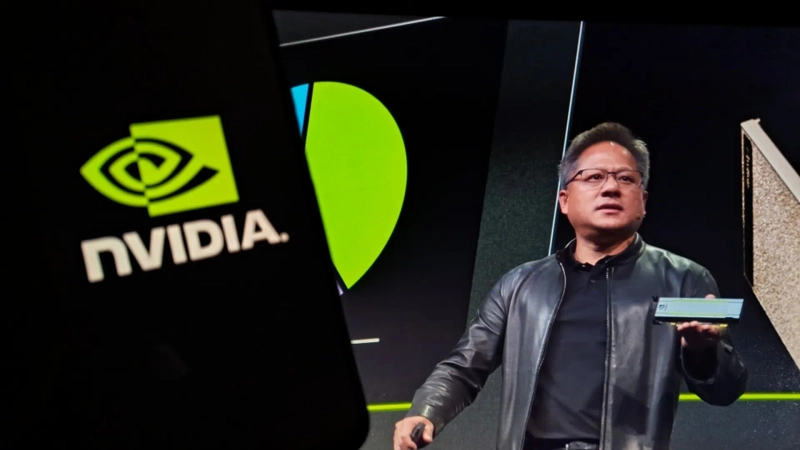

Nvidia, at the center of the artificial intelligence (AI) technology ecosystem, saw its market capitalization surpass $5 trillion (about 7,100 trillion won) for the first time on the 29th (local time).

On the New York Stock Exchange, Nvidia closed at $207.04, up 2.99% from the previous session. The closing price that day again set a new record high from the previous day. Intraday, it even surged to $212.19 at one point.

Based on the closing price, its market capitalization reached about $5.0311 trillion, making it the first company to reach a $5 trillion enterprise value.

Nvidia had first broken the $4 trillion market cap barrier on July 10 based on the closing price, and in just over three months it turned the $5 trillion figure into a reality. The $5 trillion market cap exceeds the nominal gross domestic product (GDP) of Germany, the world's third-largest economy.

The International Monetary Fund (IMF) projected Germany's nominal GDP this year to be $5.01 trillion.

Nvidia held a developer event (GTC) in Washington, D.C. the previous day, outlining large-scale investment plans and business prospects related to AI. Jensen Huang, CEO, expressed confidence that Nvidia's flagship AI chip, the Blackwell processor, and the new Rubin model would drive unprecedented revenue growth through next year, dismissing concerns about an 'AI bubble.'

Nvidia also announced collaboration plans with several technology companies, including Uber, Palantir, and CrowdStrike, emphasizing the AI partnerships it is building across the industry.

Bloomberg analyzed that the fact Nvidia is expected to soon sign chip supply contracts with Samsung Electronics, Hyundai Motor Group, and others also contributed to the stock price rally.

According to U.S. media, a remark that U.S. President Donald Trump would discuss Nvidia's Blackwell chips with Chinese President Xi Jinping at the first U.S.-China summit of his second term, to be held on the 30th, also influenced Nvidia's stock rise that day.

Markets are increasingly hopeful that President Trump may allow exports to China of a lower-performance version of Nvidia's Blackwell chips.

Due to the sharp rise in its stock that day, Nvidia's weight within the Standard & Poor's (S&P) 500 index reached about 9%.

According to Bloomberg, Nvidia's corporate value exceeds the combined market capitalization of the entire stock exchanges of the Netherlands, Spain, the United Arab Emirates (UAE), Italy, and Poland.

Also, compared with any stock market other than those of the United States, China, Japan, Hong Kong, and India, its value is larger than the total market capitalization of those markets. Nvidia's stock has risen more than 1300% since the end of 2022.

Min-kyung Shin, Hankyung.com reporter radio@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)