Editor's PiCK

[New York Market Briefing] Mixed on hawkish Powell… Nasdaq hits record high thanks to Nvidia

Summary

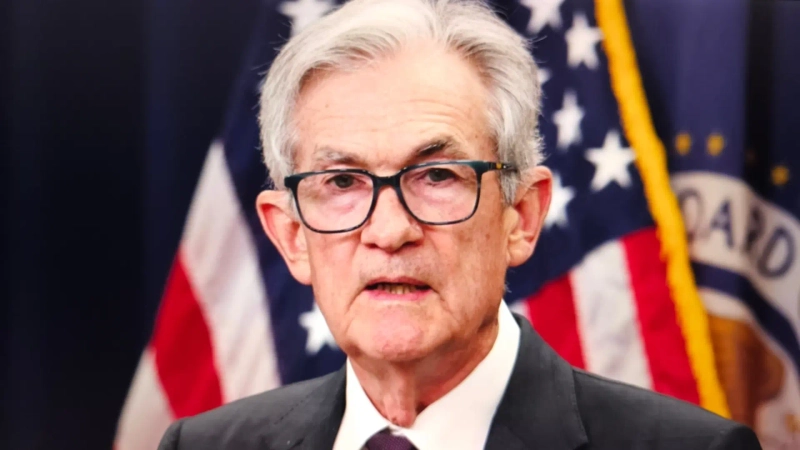

- Jerome Powell, chair of the U.S. central bank, said that an additional key rate cut in December "is not a foregone conclusion," dampening market expectations.

- The New York stock market gave up gains and closed mixed following Powell's hawkish remarks.

- The Nasdaq reached a record closing high thanks to Nvidia's AI-related optimism.

Expectations for additional rate cuts fall on Powell's 'hawkish' remarks

'King of the AI era' Nvidia becomes the first company to reach $5 trillion market cap

Jerome Powell, chair of the U.S. central bank (Fed), said on the 29th (local time) that an additional key rate cut in December "is not a foregone conclusion," contrary to market expectations. As a result, New York stocks gave back gains and closed mixed.

On the day in New York, the Dow Jones Industrial Average closed at 47,632, down 74.37 points (-0.16%) from the previous session. The Standard & Poor's (S&P) 500 closed at 6,890.59, down 0.30 points (0.00%), and the tech-heavy Nasdaq Composite closed at 23,958.47, up 130.98 points (0.55%).

The Nasdaq recorded a new all-time high on a closing basis with the gain.

The Dow and S&P initially showed strength, helped by Nvidia's surge amid optimism over an 'artificial intelligence (AI) boom,' but they fell as Powell's press conference remarks were interpreted as hawkish (favoring monetary tightening).

Powell said at the press conference, after the Fed met and the FOMC decided to lower the policy rate by 0.25% percentage points to 3.75∼4%, that "an additional rate cut at the December Federal Open Market Committee (FOMC) meeting is not a foregone conclusion."

Markets, which had largely regarded a December rate cut as a 'foregone conclusion,' took Powell's remarks, which could be seen as a principled stance, as hawkish.

Despite Powell's remarks, Nvidia, at the center of the artificial intelligence (AI) technology ecosystem, rose 2.99% on the day and became the first company ever to surpass a $5 trillion market capitalization.

Nvidia held its developer event (GTC) in Washington D.C. the previous day and reignited AI optimism by outlining large-scale investment plans and business prospects related to AI.

Jensen Huang, CEO, expressed confidence that Nvidia's flagship AI chip, the Blackwell processor, and the new Rubin model will drive unprecedented revenue growth through next year, and he dismissed circulating concerns about an 'AI bubble.'

Shin Min-kyung Hankyung.com reporter radio@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)