Summary

- Reported that NVIDIA's market capitalization surpassed $5 trillion, exceeding the total of the global cryptocurrency market.

- Jensen Huang, CEO, said he dismissed AI bubble theories, emphasizing unprecedented revenue growth driven by the flagship AI chip and collaboration plans.

- Some pointed out concerns of overvalued stock prices and the possibility of ceding market share to competitors.

Bigger than the total of all cryptocurrencies

Jensen Huang dismisses AI bubble theories

Strengthening alliances with Uber, Palantir, etc.

Some say "current stock price is overvalued"

NVIDIA's market capitalization surpassed 5 trillion dollars (about 7,100 trillion won) for the first time ever on the 29th (local time). This figure exceeds the gross domestic product (GDP·4.7 trillion dollars) of Germany, the world's third-largest economy.

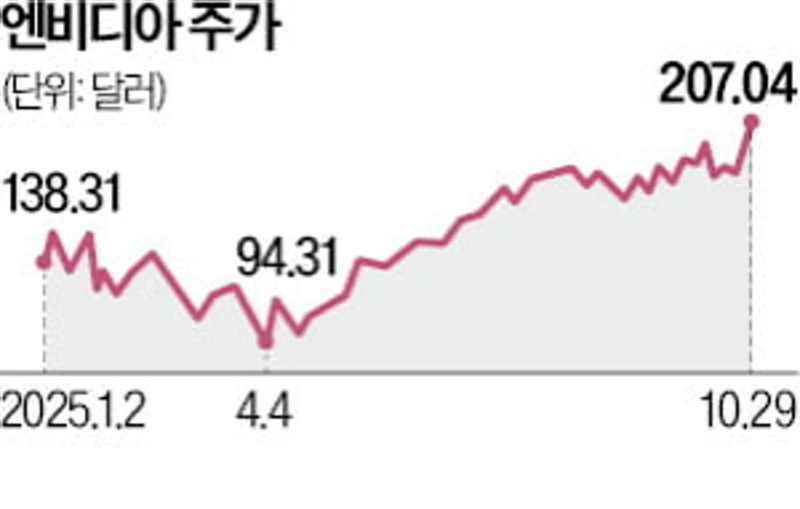

NVIDIA closed on the U.S. New York Stock Exchange that day at $207.04, up 2.99% from the previous day. It renewed the record high set the previous day. Intraday, it even climbed as high as $212.19.

The market cap stood at 5.0311 trillion dollars, making it the first publicly traded company in history to reach a $5 trillion valuation. NVIDIA surpassed $4 trillion in market cap for the first time on July 10 and exceeded $5 trillion about three months later. Apple and Microsoft (MS) also reached the $4 trillion market-cap range as their stocks rose in recent months. Reuters reported, "$5 trillion is larger than the total market value of the global cryptocurrency market" and "about half the level of Europe's major index STOXX 600."

Jensen Huang, NVIDIA's chief executive officer (CEO), dismissed AI bubble theories at the developer event (GTC) held in Washington, D.C., saying, "Our flagship artificial intelligence (AI) chip, the Blackwell processor, and the new Rubin model will drive unprecedented revenue growth through next year." At the event he highlighted AI partnerships being built across the industry, announcing collaboration plans with several companies including Uber, Palantir, and CrowdStrike. Bloomberg analyzed that NVIDIA's plans to sign chip-supply contracts with Samsung Electronics and Hyundai Motor Group also influenced the stock rally.

NVIDIA's stock price has risen more than 1300% since the end of 2022. On Wall Street, the outlook that NVIDIA's stock will rise further is prevalent. Of the 80 analysts surveyed by Bloomberg, more than 90% gave it a buy rating or equivalent.

However, Dan I, chief investment officer (CIO) of Portfite Capital Group, pointed out, "There is a possibility that NVIDIA will cede some market share to competitors such as AMD or Broadcom," adding, "The current stock price reflects excessive expectations."

Reporter Mansu Choi bebop@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)