Editor's PiCK

'Driving in the fog' U.S. Fed…Global financial market uncertainty intensifies [Global Money X-File]

Summary

- The U.S. federal government shutdown has halted the release of key economic indicators, greatly increasing uncertainty around the U.S. Federal Reserve's (Fed) monetary policy decisions.

- The absence of official statistics has deepened differences within the Fed over the interest rate path, which could increase market volatility and investor anxiety.

- Such policy uncertainty could have wide-ranging effects on global financial markets and the monetary order, and act as a factor prompting capital outflows and exchange-rate volatility in emerging markets such as Korea.

Analysts say the U.S. central bank (Fed), which steers the direction of the global economy, is facing an unprecedented 'data drought.' This comes as a U.S. federal government shutdown (temporary work stoppage) has entered its second month. Key economic indicator releases needed for the Fed's monetary policy decisions have been halted entirely. This maximizes uncertainty in monetary policy and raises concerns that it could lead to unpredictable ripple effects in global financial markets.

'Data blackout' triggered by the shutdown

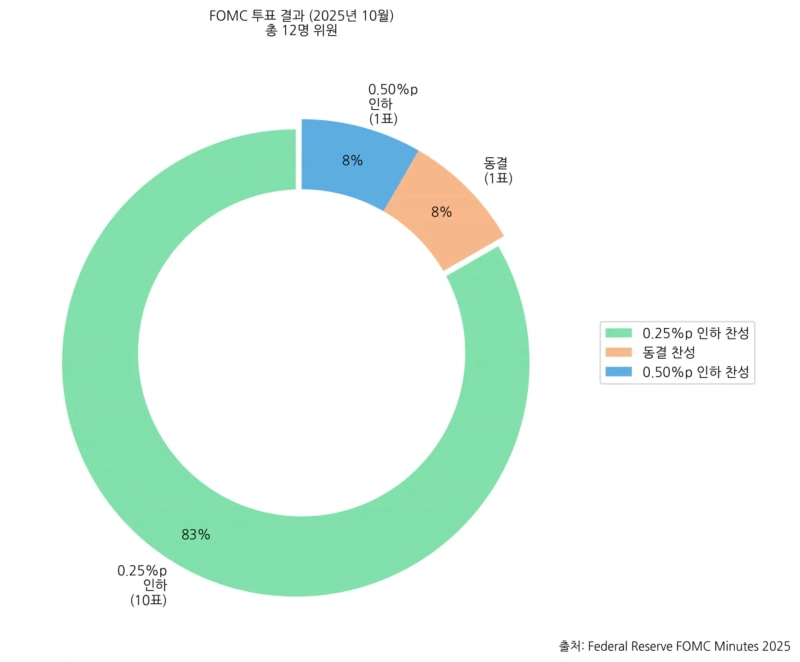

The U.S. Fed said in a statement at the Federal Open Market Committee (FOMC) on the 29th (local time) that it "decided to lower the federal funds rate target range to 3.75~4.0% by 0.25% percentage points." The decision matched market expectations. However, analysts say the background for this decision was opaque. Core government agencies that produce economic data, such as the U.S. Bureau of Labor Statistics (BLS) and the Bureau of Economic Analysis (BEA), have been paralyzed. The Fed had to make major decisions without being able to confirm official, up-to-date information on employment, inflation, and growth.

Fed Chair Jerome Powell likened the situation at a news conference to "driving in fog." He added, "In times like this you have to slow down." Some argued that the Fed chose a 'risk-management cut' based on uncertainty rather than clear data. Powell warned against excessive market expectations, saying "a further cut in December is not a forgone conclusion, far from it."

The cause of the Fed's dilemma is the U.S. Congress's failure to pass the fiscal 2026 budget. The shutdown that began on the 1st has threatened the operation of the U.S. economy itself. The BLS and BEA announced on the 1st that "all scheduled economic data releases will be suspended during the shutdown." Key indicators used to judge the Fed's twin mandates of maximum employment and price stability disappeared.

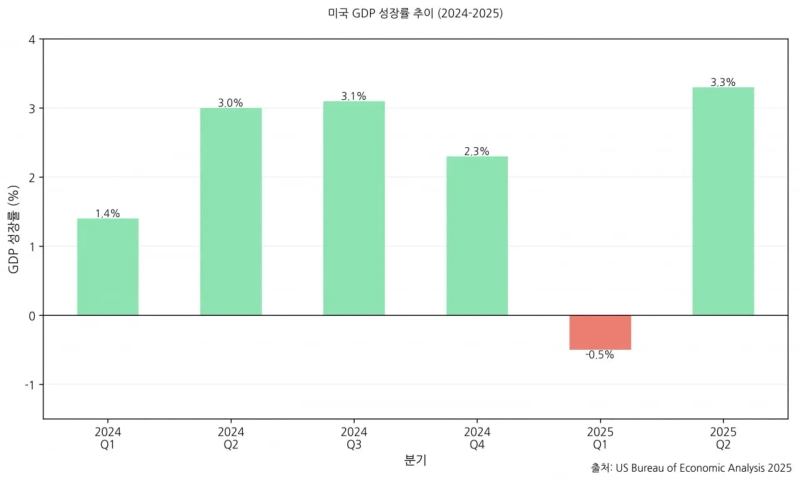

The September employment situation report was not released, and the personal consumption expenditures (PCE) price index — the Fed's preferred inflation gauge — and the preliminary third-quarter gross domestic product (GDP) release were postponed indefinitely. Even the Department of Labor's weekly initial jobless claims, which show short-term changes in the labor market, were halted.

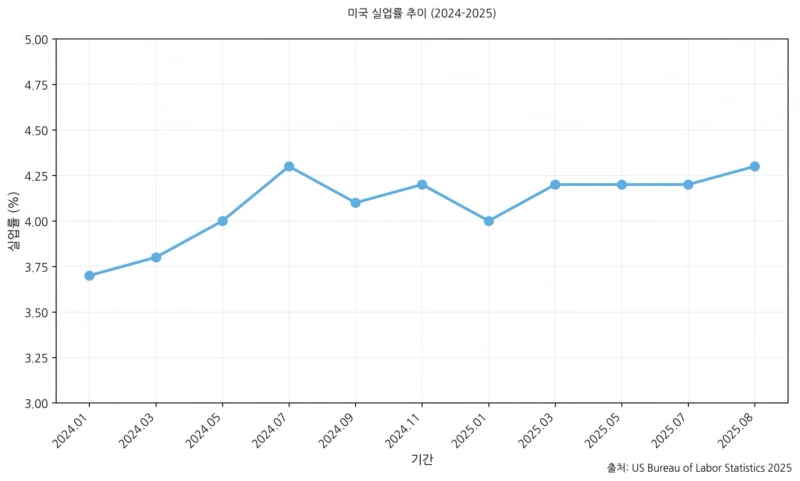

This information gap was noted in the October FOMC statement. The Fed stated that "the unemployment rate remained low through August." That indicates policy decisions were made without knowledge of September and October developments, after the last official unemployment rate release of 4.3% for August.

David Sype, chief economist at Nomura Securities, said, "Officials and economists alike are literally flying blind," adding, "the biggest question right now is what's happening in the labor market, and without official reports we don't know."

There was an exception. The September consumer price index (CPI) was released later than scheduled on October 24 for legal reasons necessary for social security cost-of-living adjustments. According to that data, the year-on-year core CPI for September rose 3.0%, slightly down from the previous month (3.1%). The disinflation trend continued. Reuters warned that "if the shutdown continues after this CPI release, future inflation indicators will also be blank."

A divided FOMC

The lack of reliable data has deepened differences of opinion within the FOMC. The 10-2 vote at the October FOMC was unusual. The two dissenting votes went in different directions. That has happened only three times since 1990. Jeffrey Schmid, president of the Federal Reserve Bank of Kansas City, argued to hold rates because inflation remains above target and the economy shows strong momentum. In contrast, Fed Governor Steven Myron argued for a 50 basis point 'big cut,' saying current policy is too restrictive.

Analysts say the split votes among Fed officials in the absence of data go beyond mere differences of opinion. With objective official statistics gone, monetary policy decisions are being influenced much more by each member's economic models and ideological leanings. The 'data gap' is creating an echo-chamber effect that reinforces preexisting views within the Fed. Normally, new economic indicators act as referees that reconcile differing perspectives, but that function is now paralyzed.

Ultimately, the basis for monetary policy is shifting in part from 'objective data' to 'subjective interpretation.' Powell acknowledged that "there were very strongly differing views within the committee." He also voiced the awkwardness that "with upside risks to inflation and downside risks to employment simultaneously present, the Fed cannot address both goals at the same time with a single tool (the policy rate)."

Fed Governor Christopher Waller expressed concern about contradictory signals, saying "private data still point to a slowing labor market, but economic growth appears to be accelerating." He also mentioned the current "bifurcated situation" that makes economic interpretation difficult.

Rise of whipsaw risk

There are inevitable concerns that the Fed's reliance on alternative indicators to make policy in a data blackout could lead to policy errors. In the absence of official statistics, decisions based on private surveys or real-time big data are unstable and could produce greater shocks to markets.

Experts warn that if the Fed sends premature policy signals in a 'data fog' — an opaque information environment — market volatility could spike. Hawkish comments or rate decisions made without clear data can unsettle investor sentiment and trigger sharp adjustments in asset prices.

For example, if private employment indicators create a temporary illusion while employment is actually slowing sharply, a late rate cut could prolong the recession. Conversely, if the Fed overreacts to short-term improvement in some data and lowers rates too quickly, persistent price pressures could reemerge and reignite inflation.

In short, data incompleteness increases policy uncertainty and carries the risk that small judgment errors could reverberate across the macroeconomy. David Wilcox of the Peterson Institute for International Economics, a former Fed economist, warned, "Over time, the foundation for policy decisions will become more shaky."

Some point out that this uncertainty is creating a new form of risk called 'whipsaw' risk. Whipsaw risk refers to a situation where markets build positions based on incomplete information, and then, when the shutdown ends and official statistics are released all at once, previous forecasts are completely overturned and asset prices sharply reverse.

Markets currently judge, based on various alternative data, that the U.S. economy has entered a phase of 'gradual slowdown' and have already priced in expectations that the Fed will shift to easing. However, if the employment and inflation indicators for September and October released after the shutdown are much stronger than expected, the October rate cut could be judged a clear policy mistake. In that case, markets could rapidly pivot to a hawkish re-pricing, causing sharp volatility in interest rates, the dollar, and equities.

Conversely, if official data disappoint expectations, debates about the Fed underestimating the slowdown and acting late 'behind the curve' could intensify, stoking investor anxiety. Ronald Temple, Lazard's chief market strategist, said, "Policy paths remain uncertain, and in the coming months inflation trends could lead to very different FOMC outcomes."

The weight of this shutdown is different from past ones

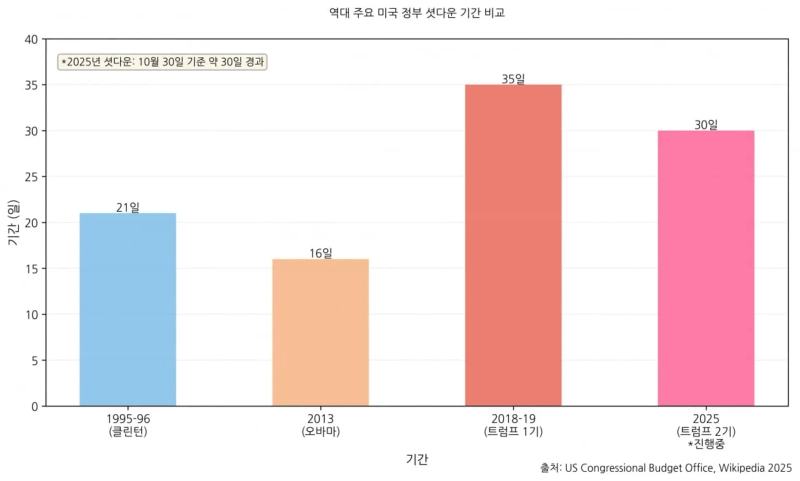

Analysts note that during past U.S. federal government shutdowns, financial markets were generally stable. There were short-term administrative interruptions, but policy uncertainty rarely translated into the real economy. This shutdown is different, they say. It occurred at a time when the compass for monetary policy has disappeared, not just a simple budget dispute.

Previous shutdowns mostly occurred when inflation was low and the economy was expanding. The Fed could maintain policy based on a clear economic direction and sufficient data. But the current shutdown happened under different conditions. Core CPI in September was 3.0%, still above target, and there are severe differences of opinion within the Fed over the interest rate path.

In this environment, the absence of official statistics is not merely inconvenient but could be a risk factor that leads directly to policy errors. Each decision by a 'dataless Fed' becomes a high-risk variable that can determine whether the economy tips toward recession or inflation.

The Fed's imperfect data-based policy also has complex effects on the real economy. If firms find it harder to predict the economic direction, they may delay investment, and consumers may hesitate to spend. The Fed's own reports showed some signs of weakening U.S. consumer and business confidence in October. Wage losses for federal employees due to the shutdown also directly hit the real economy.

Some fear the U.S. may be entering the early stages of stagflation, where slowing growth and rising prices occur together. Patrick Harker, former president of the Federal Reserve Bank of Philadelphia, said, "The situation feels like stagflation," adding, "Not to the extent of the 1970s, but it certainly feels that way." He said, "The labor market is noticeably weakening, and even without official statistics other indicators show that," and "at the same time inflation remains at a high level."

U.S. policy uncertainty is also spilling over into the global monetary order. The European Central Bank (ECB) and the Bank of Japan (BOJ) are closely watching the Fed's policy direction, particularly U.S. economic trends and dollar value swings, and are delaying or slowing their own monetary policy decisions.

The International Monetary Fund (IMF) said in its October World Economic Outlook (WEO) report that "the world economy shows weak resilience and overall risks are tilted to the downside." The IMF warned that U.S. policy uncertainty in particular could tighten global financial conditions and trigger capital outflows and exchange-rate volatility in emerging markets.

The Fed's monetary policy also significantly affects an open economy like Korea. The Fed's unpredictability constrains the Bank of Korea's policy space and can be a key factor increasing foreign exchange market volatility.

[Global Money X-File examines important but little-known flows of global money. To receive global economic news conveniently, please subscribe to the reporter's page]

Reporter Joo-wan Kim kjwan@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)