Editor's PiCK

Annual $20 billion investment to the U.S. makes exchange rate rise inevitable

Summary

- An analysis raised that annual $20 billion direct investment to the U.S. will inevitably affect the foreign exchange market in the medium to long term.

- It stated concerns that domestic export declines and weakening fundamentals of the Korean economy could lead to a fall in the won's value.

- Experts pointed to risks such as a deterioration in national credit due to a decrease in foreign exchange reserves, rising CDS premiums, and foreign capital outflows, and expected next year's average exchange rate to remain high.

Practically using foreign exchange reserves

Reduced domestic investment weakens economic strength

After the Korea-U.S. tariff negotiations were concluded, the won-dollar exchange rate fell slightly over two days. This is analyzed as resulting from the continued dollar strength and the view that concerns related to investment to the U.S. have not been completely resolved.

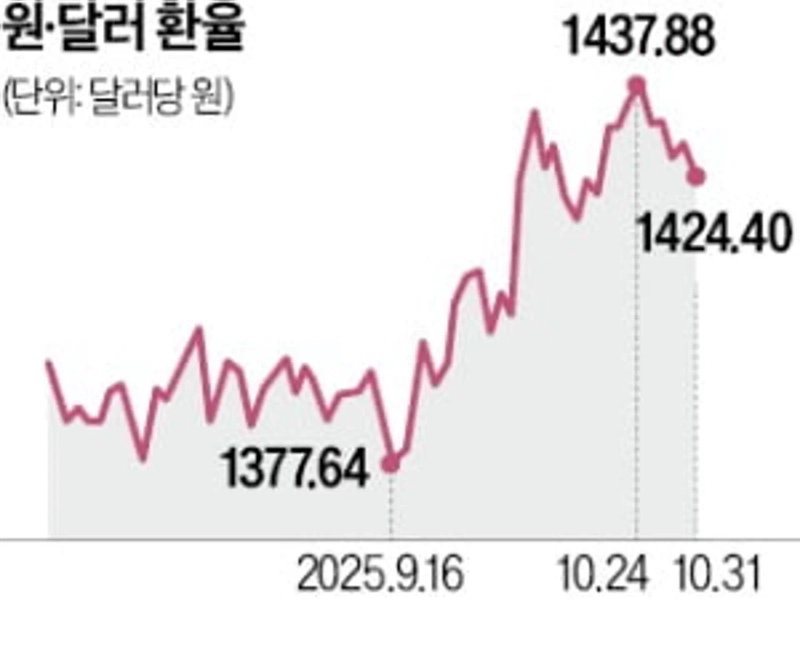

On the 31st in the Seoul foreign exchange market, the won-dollar exchange rate (as of 3:30 p.m.) closed the week's trading at 1424.40 won, down 2.10 won from the previous day. It fell for two consecutive days from 1431.70 won on the 29th, when the tariff negotiations were concluded. The decline over the two days was limited to 7.30 won.

That day the exchange rate opened at 1430 won, up 3.50 won from the previous day, then turned to a decline during the trading session. Selling by foreign investors in the stock market led to the exchange rate's fall. It was also reported that exporters' month-end dollar sales were considerable.

The resolution of uncertainty following the tariff negotiation settlement has helped improve sentiment. However, there are also views that annual $20 billion direct investment to the U.S. will inevitably affect the foreign exchange market in the medium to long term. Yoon-soo Lee, a professor in the Department of Economics at Sogang University, said, "Because it is sending abroad foreign exchange that would be used elsewhere, such as to increase foreign exchange reserves, it will affect the foreign exchange market with a time lag." Jin-il Kim, a professor in the Department of Economics at Korea University, added, "Judging by the range of exchange rate fluctuations after the trade agreement was announced, it seems the market does not view it as having no impact."

There are also concerns that exports could decrease as companies relocate factories overseas instead of investing domestically. If the link that brings dollars earned from exports back to the country for investment is broken, the size of the current account surplus could shrink, and from a supply-demand perspective dollar strength could be maintained. Also, if domestic production declines and growth weakens, Korea's economic fundamentals could deteriorate, causing the won's value to fall.

Ye-chan Choi, an analyst at Sangsangin Securities, said, "Even if funds are not raised through the spot FX market, a decline in foreign exchange reserves could lead to a deterioration in national credit, a rise in credit default swap (CDS) premiums, and outflows of foreign capital," and "I forecast next year's average exchange rate at 1441 won, which is more than 100 won higher than the appropriate rate of 1330 won per dollar."

Kang Jin-kyu, reporter josep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)