Stablecoin-themed stock Hecto Financial…"Did it top out?" Retail investors 'anxious' [Yun Hyun-ju's Staple Is Stocks]

Summary

- Hecto Financial recently surged 192%% as a stablecoin theme stock and then fell 30%%, drawing investor attention.

- The company announced growth strategies including global cross-border payment services and expansion of digital asset wallets.

- Shinhan Securities raised the target price to 21,000 won, assessing a 29.31%% upside from the current price.

Stablecoin-themed stock Hecto Financial

Rallied 192% from April to June then fell 30%

CEO Choi Jong-won: "Next year will be the first year of global expansion"

Entering Singapore, Taiwan after Japan

"Will enhance competitiveness through strategic M&A"

Shinhan Securities target price 21,000 won

The stock nearly tripled in just over two months, then dropped 30% from the peak and is taking a breather.

Individual investors who invested in Hecto Financial, a KOSDAQ-listed company grouped as a stablecoin-themed stock, are increasingly concerned. The company is the No.1 domestic fintech firm for account-based payment services (simple cash payments). It started in 2000 as "SettleBank," which provided virtual account services, and was acquired by Hecto Innovation in 2016, joining the Hecto Group.

Through network integration with 23 financial institutions including all commercial banks, it is the No.1 domestic account-based payment service that handles more than 1,200 trillion won in funds annually. In the PG (Payment Gateway) area, it holds the source for all payment methods including simple cash payments, credit cards, and mobile payments. Based on this, it provides PG services such as payment and settlement, operates prepaid payment methods for various platforms (backend services), and offers its own cash payment service "Naetongjang Payment." "Naetongjang Payment" is an in-house simple cash payment service where a customer registers their account once and can then easily pay using only a PIN; it has more than 10 million members.

Recently, it has been expanding onto the global stage with cross-border settlement (cross-border payment and settlement) services. This service remits foreign exchange for the difference between a global platform company's domestic sales and amounts payable domestically such as logistics and delivery fees. It started in 2023 through collaboration with six PSPs (Payment Service Providers) and is now used by 25 global PSPs.

CEO Choi Jong-won: "Next year will be the first year of global expansion…expand partnerships with major payment providers"

On the 1st, I conducted a written interview with CEO Choi Jong-won to hear the company's plan for next year. CEO Choi said, "As global commerce and digital asset payment demand is rapidly increasing, we will pursue qualitative growth and sustainable profitability simultaneously based on our technology and infrastructure." He added, "Domestically, we will expand the kiosk (unmanned terminal) business and actively pursue new businesses in line with external changes, such as billing payments (subscription payments) PG and entering the B2B payment market." He emphasized, "We will make next year the first year of global expansion and execute diverse overseas market entries and revenue stream advancement." To this end, the company has established a Japanese subsidiary and is sequentially proceeding with procedures to enter major financial hubs such as Abu Dhabi, Singapore, and Taiwan. CEO Choi explained, "We will expand partnerships with global platform companies and local major payment providers, and strengthen the cross-border settlement and cross-border payment network."

According to the Bank of Korea's "2024 Electronic Payment Service Usage Status," prepaid electronic payment means have seen daily average usage count (33.17 million transactions) and amounts (1,166.4 billion won) increase by 12.2% and 16% year-on-year, respectively, due to the expansion of simple payments and simple remittances, indicating the payment market is shifting weight from offline to online.

Looking at Statistics Korea's 2024 annual online shopping trends, last year's (online shopping) transaction amount grew 5.8% to 242.0897 trillion won, the largest since related statistics began in 2001. Also, according to the Bank of Korea, last year's electronic payment agency service usage amounted to a daily average of 29.36 million transactions and 1,367.6 billion won, increasing 12.9% and 11.3% year-on-year, respectively. This is a favorable business environment for Hecto Financial, which aims to capture both domestic and overseas markets.

New growth engines are also global expansion and stablecoins. He said, "Our three major strengths are △ownership of the source for all payment methods △top-level domestic account and foreign exchange processing capabilities △global-level risk and risk management capabilities," and added, "By combining these, we will expand global merchants and commercialize various service models through organic integration of currently provided banking and payment services."

He also said, "As our payment infrastructure and global network are strengths, if stablecoin regulation is established, stablecoin payment and settlement as well as serving as a hub for cross-border distribution of stablecoins will be possible," emphasizing, "We have already signed cross-border settlement contracts with 25 global PSP companies, so when the market opens, we can quickly start stablecoin distribution from domestic to overseas and from overseas to domestic."

Last September, the group's parent company Hecto Innovation acquired blockchain wallet technology company Willetone, enabling even more diverse services. CEO Choi explained, "If Hecto Financial's payment infrastructure is combined with a digital asset wallet, services can be expanded into various areas including on/off ramp (exchange between fiat currency and digital assets), and stablecoin charging, payment, and remittance."

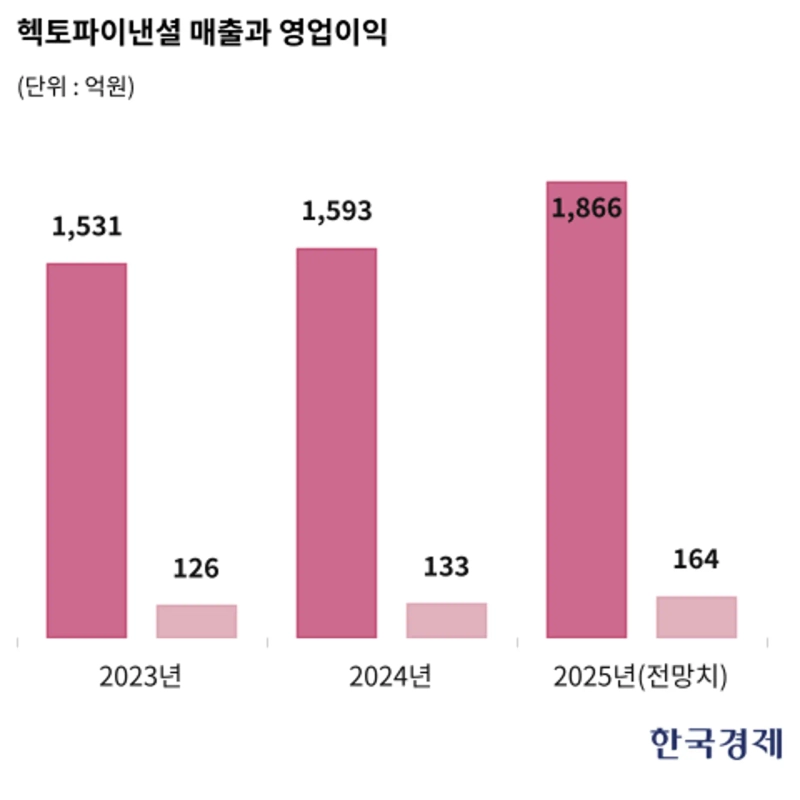

Revenue in 2020 was 78.1 billion won and operating profit 10.7 billion won, and last year revenue was 159.3 billion won and operating profit 13.3 billion won, increasing by 103.97% and 24.3% respectively over four years. Shinhan Investment Corp. forecasts this year's revenue at 186.6 billion won and operating profit at 16.4 billion won.

According to the Korea Exchange on the 1st, the stock price was 16,240 won, up only 10.63% year-to-date. However, grouped as a stablecoin-themed stock since spring, it surged 192.34% from the low of 7,950 won on April 7 (reflecting the free share issue) to the high of 23,242 won on June 24. For those who bought at that time, their stock accounts have fallen 30.13%.

The total number of shares is 13,970,656, and the largest shareholder is Hecto Innovation (38.5% stake) with four other related parties holding 40.58%. As of the second quarter, cash equivalents were 247.4 billion won, exceeding the market capitalization (226.9 billion won). The debt ratio is 192.26% and the capital reserve ratio is 3,651.17%.

"Cash equivalents overwhelm market cap … seeking strategic M&A"

Asked about measures to boost the stock price, he said, "Since listing in 2019, we have paid dividends every year," and explained, "To increase predictability of shareholder returns, we announced a four-year shareholder return policy to gradually expand the payout ratio up to 25% of consolidated net income." He also said, "This year in Q3 we carried out a bonus issue of 0.5 new shares per existing share, accompanied by the cancellation effect of about 3.6 billion won of treasury shares held at that time." After the bonus issue, the treasury stock ratio fell from 4.4% to 2.99%. In particular, he said, "We are continuously seeking strategic M&A opportunities that can create synergies with core businesses," and emphasized, "We will ensure that investment and strategy lead to stable performance growth."

Dreaming of leaping from a representative Korean fintech platform to a fintech company leading global standards, CEO Choi said, "Based on an account-based payment infrastructure directly linked with all domestic commercial banks and 23 financial institutions, we are growing rapidly in line with market changes such as simple cash payments and global cross-border settlement." He added, "We manage data across all payment and settlement processes internally and have internalized an AML (anti-money laundering) system to secure both stability and scalability."

He also evaluated the parent Hecto Innovation's acquisition of digital asset wallet company Willetone (47.15% stake, 9.3 billion won). He said, "At the Hecto Group level, we have secured blockchain wallet technology," and asserted, "Through this, Hecto Financial can, based on group fintech and payment infrastructure synergies, enter the stablecoin ecosystem that is emerging as a next-generation payment method." However, due to the nature of the electronic financial business, strengthening financial and security regulations and country-by-country licensing remain ongoing risk factors.

"Selected as Circle's only domestic partner"… target price 21,000 won

Sangheon Lee, a research analyst at iM Securities, evaluated, "With the acquisition of Willetone, it seems Hecto Financial has secured a basis to strengthen stablecoin distribution and the global economic network by combining the 'Naetongjang Payment' infrastructure with Willetone's wallet technology." Accordingly, he explained, "A global cross-border payment hub network is planned to be built in connection with overseas subsidiaries such as Japan and Taiwan." He argued, "When the stablecoin market opens, Hecto Financial can secure a leading position leveraging its existing payment infrastructure strengths, accelerating growth in the payment and settlement field."

Hyunwoo Park of Shinhan Investment Corp. said, "Currently the PER (price-to-earnings ratio) is positioned near the upper end of the 12MF PER band within three years but new business expectations should be considered," and raised the target price to 21,000 won. That implies a 29.31% upside from the current price.

Hyungyeom Kim of KB Securities positively evaluated that "U.S. leading stablecoin company Circle announced on the 28th of last month (local time) the release of the Arc public testnet, a Layer 1 blockchain based on USDC, and announced participation by about 100 global companies, and Hecto Financial was selected as the only domestic participating company in the payment, technology, and fintech ecosystem." He added, "Among domestic fintech companies, this appears to recognize Hecto Financial as a reference in the expanding cross-border payment and settlement field," expecting a first-mover advantage ahead of domestic and international financial institutions.

Reporter Yun Hyun-ju hyunju@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)