Editor's PiCK

Nokia investment, Kkanbu Chicken meeting... What is Jensen Huang's big picture? [Bin Nansae's Flawless Wall Street]

Summary

- NVIDIA announced its entry into the AI telecommunications infrastructure market by investing 1 billion dollars in Nokia.

- Jensen Huang emphasized the importance of the Korean market in preparing for the physical AI era, including prioritizing the supply of 260,000 Blackwell GPUs to Korea.

- It was suggested that NVIDIA's expansion of its own ecosystem and pursuit of leadership in AI and robotics industries could generate sustained demand.

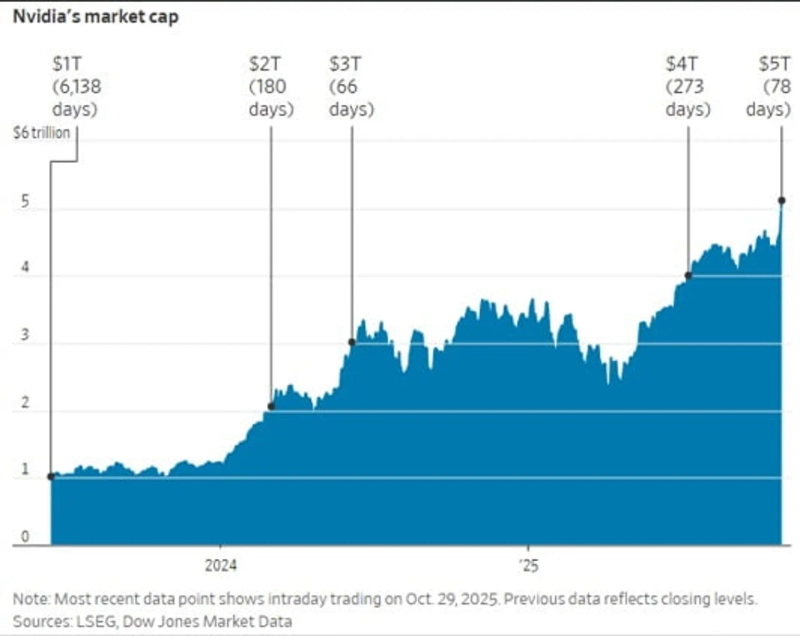

It would not be an exaggeration to say that last week the stock market was 'NVIDIA's week.' On October 29 (local time), NVIDIA made corporate history by becoming the first company ever to surpass a market capitalization of 5 trillion dollars. It was a record growth achieved just 78 days after crossing 4 trillion dollars in July of this year.

The reaction followed after Jensen Huang, NVIDIA's CEO, delivered a GTC keynote in Washington, DC on October 29 that raised revenue outlooks for AI data center GPUs, announced an equity investment in Nokia, and made other announcements that excited the market. NVIDIA is now worth more than the combined value of some 70 companies in the S&P 500 industrials sector.

Next, Jensen Huang flew to none other than South Korea. His 'chicken-and-beer' meeting with Samsung Electronics chairman Lee Jae-yong and Hyundai Motor Group chairman Chung Eui-sun, who had been heating up Korea, was just an appetiser. Jensen Huang told a gathering that included the heads of Korea's leading companies and President Lee Jae-myung that he would prioritize supplying 260,000 Blackwell GPUs to Korean companies and the government.

The 260,000 units are more than double the 120,000 AI chips Jensen Huang had promised to deploy in the U.K. when he accompanied President Trump on his visit to the U.K. last September. By the way, that 120,000 was already the largest in Europe. Ha Jung-woo, the Presidential Office's chief of AI future planning, explained, "If the original 40,000 GPUs (that Korea already had) plus 260,000 arrive, adding up to about 300,000 units, that number would make (Korea) one of the top three in the world in terms of GPU scale."

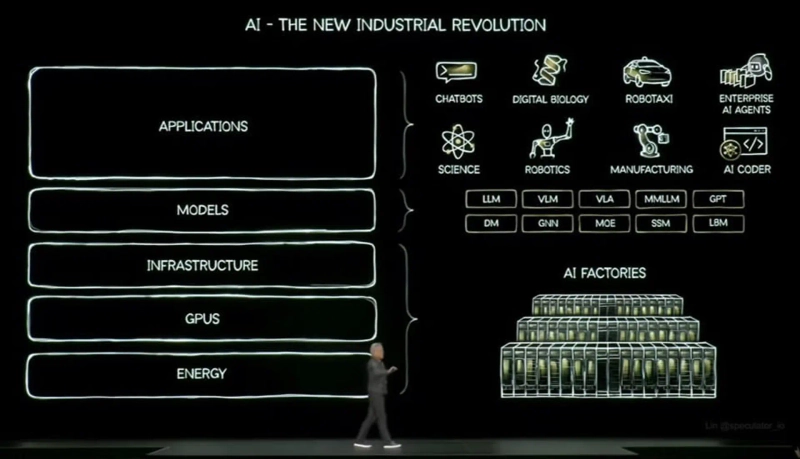

Why is Jensen Huang so keen on the Korean market? Why is NVIDIA's next investment destination after OpenAI and Intel Nokia? Jensen Huang, who has argued that "NVIDIA is not simply a GPU company but a company building an 'AI factory' (a factory that produces intelligence)," what is the picture he is painting?

"NVIDIA is still cheap"

First, we look at the decisive catalyst for NVIDIA's monumental share surge: Jensen Huang's GTC keynote. Wall Street firms that must calculate valuations in concrete figures reacted to the GPU revenue outlook for AI data centers presented by Jensen Huang that day.

At the event Jensen Huang said that cumulative revenue and bookings for Blackwell and Rubin GPUs could reach 500 billion dollars (20 million GPUs) by the end of next year. This far surpasses the previous generation Hopper's three-year cumulative shipments (100 billion dollars; 4 million units).

Bernstein said, "If this continues, next year's data center revenue could exceed the previous estimate of 250 billion dollars and be at least 300 billion dollars," calling it a narrative that dismisses concerns about an AI bubble. "Because of investor worries about AI overheating or a bubble, NVIDIA's stock has lagged behind many other AI stocks, but it is becoming increasingly clear that now is not the time to worry," it said. Cantor Fitzgerald, which maintains a target price of 300 dollars for NVIDIA, also argued that "NVIDIA stock is still cheap."

What investors should actually pay more attention to, however, is the driving force that can enable such enormous revenue. The question is what big picture will allow NVIDIA to further spread AI and solidify its dominance in the industry.

Among Cantor Fitzgerald's analysis, two factors stand out. First, NVIDIA can use its CUDA-X libraries to open new markets and spread AI according to its own standards. CUDA-X is like a software toolbox for AI accelerators created by NVIDIA. The company has developed more than 350 libraries so that enterprises or developers can immediately use specialized functions for their purposes—whether for model training, autonomous driving, or robot control—without having to program GPUs directly. This is a core asset that enables the 'NVIDIA ecosystem' and is hard for competitors to catch up with.

Physical AI era, AI evolving into 'workers'

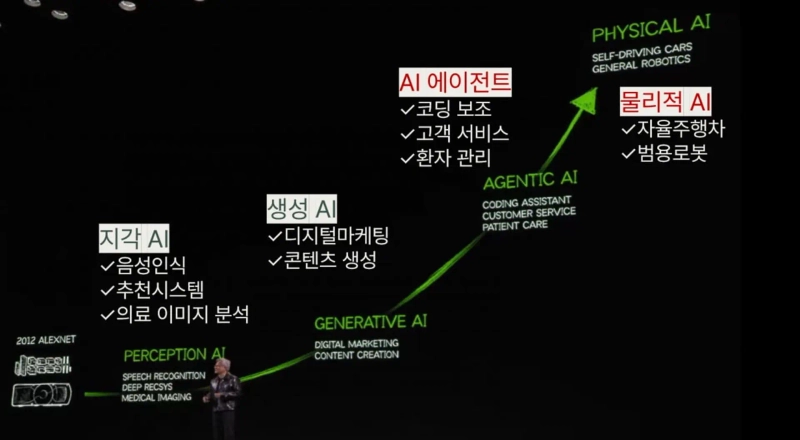

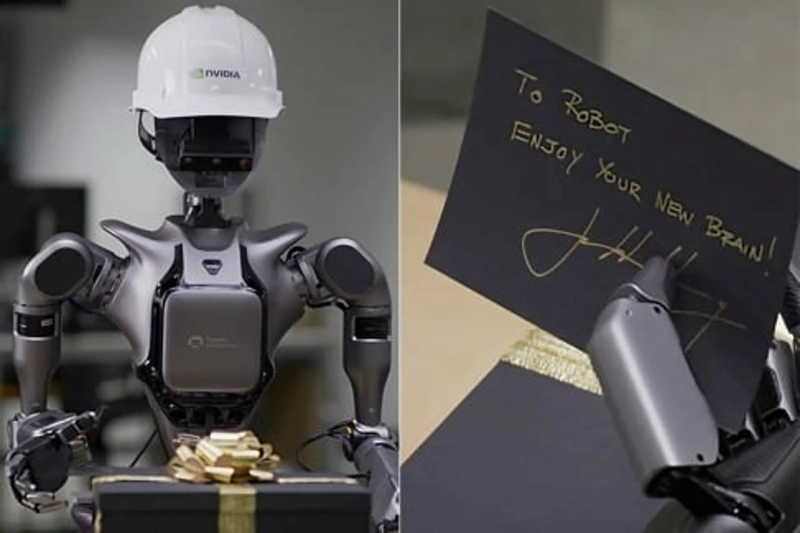

Second, Jensen Huang is painting a picture to make NVIDIA the core of an ecosystem even as AI evolves from being a 'tool' to becoming a 'worker.'

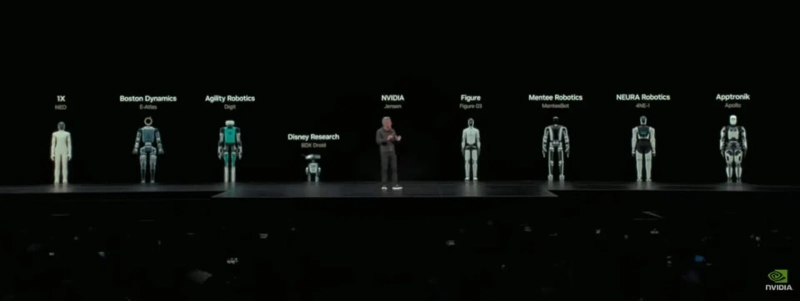

In his keynote, Jensen Huang said, "AI is not a tool but work itself; it is a worker that actually does jobs." If generative AI led by ChatGPT was the phase of learning and generating language patterns, the next phase—'AI agents' and ultimately 'physical AI' endowed with bodies—would be when AI drives cars, moves robots, and designs and manufactures factories.

As a 'tool,' AI corresponds to at most a 1 trillion dollar IT software and database market, but Jensen Huang argues that if AI attains autonomy and physical form and participates in all economic domains as a 'worker'—raising productivity—the AI market could become a 100 trillion dollar industry comparable to global GDP.

This also leads to a surge in demand for NVIDIA GPUs. There will be a huge increase in inference computing demand to support smarter AI. And as AI becomes smarter and contributes to productivity improvements and revenue generation, more companies will adopt it, which will again increase computing demand (scaling laws), completing a virtuous cycle.

Lowering costs at the same time is also a core goal. "If everyone adopts AI factories, whoever builds the more 'cost-efficient' factory will control future energy and industry," Jensen Huang says. His emphasis that "Blackwell server racks are expensive but ultimately the best value because of their performance," and NVIDIA's active investment in photonics—using light instead of electrical signals to transmit data to increase energy efficiency—fit into this context.

Securing communications infrastructure for physical AI

NVIDIA's investment in network equipment maker Nokia to enter the telecommunications infrastructure market can be seen as a move to prepare for the physical AI era. NVIDIA said it would invest 1 billion dollars (a 2.9% stake) in Nokia and build a new AI radio access network (RAN) hardware called 'NVIDIA Arc' together with Nokia.

Arc is a communications-network AI accelerator computer that can perform wireless communication, data processing, and AI computations simultaneously. It is not a simple communications device; it is a product that puts AI into the network and can effectively turn a base station into a small AI data center.

If AI directly adjusts communication quality and optimizes frequency allocation according to traffic and weather to improve spectrum efficiency, power consumption can be dramatically reduced. In addition, just as we use cloud computing systems built on the Internet, it becomes possible to build edge industrial robotics clouds on top of wireless networks. Without massive data centers, AI can run by performing data processing and inference at regional base stations. It could become the core infrastructure of the physical AI era.

"Korea has software, manufacturing, and AI"

Jensen Huang's push into the Korean market can also be interpreted as part of this 'physical AI' era strategy. Korea has ultra-high-speed broadband networks and companies with world-class hardware manufacturing capabilities. It is an optimal market both for the spread of physical AI and for producing physical AI.

Samsung has not only semiconductors but also communications equipment and consumer electronics (Samsung Electronics), sensors, glass substrates, and camera modules (Samsung Electro-Mechanics), data centers (Samsung SDS), and robotics (Rainbow Robotics), encompassing advanced manufacturing technologies across the board. Hyundai Motor, apart from Tesla and Chinese EV companies, is virtually the only carmaker with software-defined vehicle (SDV) manufacturing capabilities essential for autonomous driving. In addition, it has industrial robots (Hyundai Wia, Hyundai Rotem), quadruped and humanoid robots (Boston Dynamics), and robot control and digital twin (Hyundai AutoEver), covering both hardware and software technologies.

SK has top-tier semiconductor technology (SK Hynix) and also Korea's most extensive backbone network and base station network (SK Telecom). It has already secured physical competitive advantages favorable for data center and AI infrastructure expansion. Naver is also investing in various AI infrastructure technologies such as cloud, digital twins, and robotics. Numerous company ecosystems that cooperate with these conglomerates are densely built.

Jensen Huang said, "Korea is one of the few countries that possesses software, manufacturing, and AI," adding, "Combining software and manufacturing capabilities increases opportunities for robotics applications. This is the next model of physical AI." This explains why Jensen Huang came to Korea, had chicken and beer, and prioritized allotting 260,000 GPUs while doing sales.

Creating demand through an 'NVIDIA-led' ecosystem

Jensen Huang is also attempting to build an 'NVIDIA-led' ecosystem in the future technology field of quantum computing. The announcement of NVQLink, which directly connects NVIDIA GPUs (classical computers) and QPUs (quantum processing units), is part of that effort. NVIDIA is not directly making quantum computing hardware, but it intends to encourage quantum computer startups and researchers to develop technologies that interoperate with NVIDIA's classical supercomputers, thereby creating lock-in.

Ultimately, the reason NVIDIA was able to break through concerns about a stock peak and intensifying GPU competition to surpass a market cap of 5 trillion dollars is that the market recognized its ability to foresee several moves ahead and lead ecosystems. In particular, Jensen Huang is directly creating continuous demand for NVIDIA GPUs by encouraging expansion into the physical AI and robotics world, where explosive computing demand is expected.

If this picture indeed comes true, NVIDIA may not be the most explosively growing AI stock in the future, but it could be the company that survives most tenaciously. Investors, too, may be able to capture opportunities from companies that can grow alongside NVIDIA's ecosystem. It is time to find gems of the physical AI era not only in the U.S. but also among Korean companies.

Reporter Bin Nansae binthere@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)