Editor's PiCK

"Bitcoin rebounds as yen carry trade fears ease…ETF outflows are a burden"

공유하기

- Bitcoin showed a short-term rebound as concerns about yen carry trade liquidations eased along with an interpretation of the BOJ's dovish policy.

- However, spot Bitcoin ETF outflows amounted to $479,000,000 on a weekly basis and were still cited as a key variable for the price.

- The analyst said that whether the $80,000 support holds will be the turning point for short- and mid-term trend changes, and that if expectations for a rate cut persist, the 6–12 month target is $150,000.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Bitcoin (BTC) is showing a short-term rebound as, after the Bank of Japan (BOJ)'s rate hike, the policy path was interpreted as more dovish than expected, easing some concerns about yen carry trade liquidations.

On the 22nd, FXPro analyst Bob Mason said in a research report, "Bitcoin rebounded around $84,500, and the BOJ's cautious stance on the future policy path despite raising rates eased concerns about the yen carry trade."

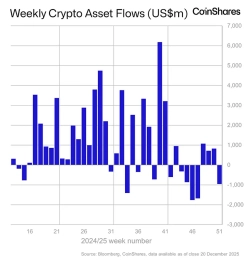

He explained that the BOJ's dovish tone pushed the dollar/yen rate higher and partially restored risk-on sentiment, and that Bitcoin rebounded alongside this. However, he pointed out, "In the U.S. spot Bitcoin ETF market, there was a weekly net outflow of $479,000,000," adding, "ETF flows remain a key variable for Bitcoin's price."

In fact, during the reporting period, outflows were confirmed from major ETFs such as BlackRock's IBIT, Bitwise's BITB, and ARK's ARKB. As a result, despite Bitcoin's more than 3% one-day rebound due to the BOJ effect, it was roughly flat on a weekly basis.

From a medium-term perspective, he analyzed that expectations for rate cuts by the U.S. central bank, the Federal Reserve (Fed), eased concerns over yen carry trade liquidations, and progress in crypto-friendly legislation are providing a favorable environment for Bitcoin. He stated, "Short-term volatility will persist, but if the $80,000 support holds, the overall direction remains positive."

However, he cited downside risks including ▲a re-emergence of a hawkish Fed stance ▲signs of further tightening from the BOJ ▲expanded ETF outflows. He warned that if these factors materialize, Bitcoin could come under renewed pressure down to the early $80,000s.

Technically, Bitcoin still remains below the 50-day and 200-day moving averages. Mason said, "Fundamentals have begun to diverge from the technical trend," and forecasted, "Whether the $80,000 support holds will be the turning point for short- and medium-term trend reversals."

Meanwhile, the market is also focused on the Fed's future policy path. The analyst added, "If expectations for a rate cut in March next year persist, Bitcoin's 6–12 month target could be open up to $150,000."

!["US employment down by 20,000 a month…labor market contracting" [People of Wall Street Park Shin-young met]](https://media.bloomingbit.io/PROD/news/22d1d91a-31d8-4b08-8e05-14a0982c0bf3.webp?w=250)