Editor's PiCK

U.S. Bitcoin spot ETFs, 142,090,000 dollars net outflow the previous day… three consecutive trading days

공유하기

- U.S. Bitcoin spot ETFs reported net outflows totaling 142,090,000 dollars over three consecutive trading days.

- Only BlackRock's IBIT showed net inflows of 6,100,000 dollars, while other major ETFs such as BITB, ARKB, HODL, GBTC experienced large net outflows.

- Other products had no net inflows or outflows.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

U.S. Bitcoin (BTC) spot exchange-traded funds (ETFs) recorded net outflows of over 100 million dollars the previous day.

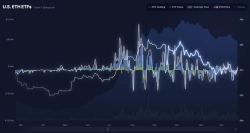

On the 23rd (local time), according to TraderT, the total one-day net outflow of U.S. Bitcoin spot ETFs was 142,090,000 dollars (about 210 billion won). This is the third consecutive trading day of net outflows.

By product, BlackRock's IBIT recorded net inflows of 6,100,000 dollars, the only fund to see inflows. In contrast, Bitwise's BITB saw 34,960,000 dollars withdrawn, and ARK Invest's ARKB saw 21,360,000 dollars withdrawn. VanEck's HODL also experienced net outflows of 33,640,000 dollars.

In addition, Grayscale's GBTC had net outflows of 28,990,000 dollars, and Grayscale Mini BTC had 25,400,000 dollars in net outflows. Fidelity's FBTC also recorded net outflows of 3,840,000 dollars. The remaining products had no net inflows or outflows.

![[Blooming Lunch] Chaerin Kim "Blockchain still has many opportunities to become a pioneer"](https://media.bloomingbit.io/PROD/news/f97d8e94-07f3-4ef7-a8b9-45e04d9bf5e1.webp?w=250)