Editor's PiCK

Bank of Korea: "Need to manage spillover effects between financial markets when virtual assets are institutionalized"

공유하기

- The Bank of Korea said there is a need to manage potential risks because the institutionalization of virtual assets could strengthen links with traditional financial markets.

- The report assessed that, due to a retail-investor-centered structure and a strict institutional environment, the domestic market's links with traditional financial markets are still at a lower level compared with the global market.

- It emphasized that if institutionalization of virtual assets proceeds, financial-market shock transmission channels could expand, so establishing related management systems is important.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

As the institutionalization of the global virtual asset (cryptocurrency) market progresses and links with traditional financial markets strengthen, the need to manage the transmission of shocks between financial markets has been raised if institutional arrangements are implemented domestically.

According to the Bank of Korea's Financial Stability Report for the second half of the year, released on the 23rd, the institutionalization of the virtual asset market can act as a factor that expands synchronization with traditional financial markets. The report pointed out, "As connection channels are being formed between virtual assets and traditional financial markets such as the stock market, potential risks arising from this should be managed to a tolerable level."

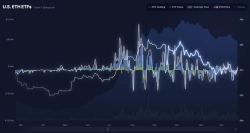

The report analyzed that, prompted by increased participation of corporations and institutional investors in the virtual asset market and the introduction of exchange-traded funds, price co-movement between virtual assets and traditional financial assets has been observed in the global market. In particular, it explained that spillover effects in which virtual asset price fluctuations affect traditional financial markets, centered on the stock market, have been confirmed, and that these phenomena have tended to be relatively large during macroeconomic shocks or phases of shifts in monetary policy stance.

Paths by which virtual asset price fluctuations are transmitted to traditional financial markets include impacts on financial soundness through financial institutions' virtual asset exposures, portfolio adjustments by institutional investors, changes in investor risk aversion, and share price fluctuations of companies holding virtual assets.

However, the report found that the level of spillover effects in the domestic virtual asset market is lower compared with the global market. It assessed that, due to a strict institutional environment such as restrictions on corporate market participation and regulations on the issuance of financial products, linkages between virtual assets and traditional financial markets have not been sufficiently formed.

The report also noted that the domestic market remains centered on individual investors, and that the limited participation of professional market makers and liquidity providers has repeatedly led to liquidity constraints and price dislocations. Accordingly, it analyzed that if institutionalization proceeds, consideration should be given to the possibility that new shock transmission channels could form along with expanded linkages between financial markets.

The report emphasized that, given the domestic market's institutional and structural characteristics that differ from global cases, it is important to concurrently build a system for managing inter-market linkages and spillover effects during the institutionalization of virtual assets.

![[Blooming Lunch] Chaerin Kim "Blockchain still has many opportunities to become a pioneer"](https://media.bloomingbit.io/PROD/news/f97d8e94-07f3-4ef7-a8b9-45e04d9bf5e1.webp?w=250)