Editor's PiCK

[Exclusive] Banks could make 'won stablecoin Co.' a subsidiary

공유하기

- Financial authorities are considering adding the "won stablecoin issuance" business to banks' subsidiary industries, which would allow banks to hold more than 15%% of related firms' equity.

- Large-scale alliances centered on the five major domestic banks with platforms, virtual asset exchanges, and securities firms are expected to intensify competition.

- The key to success is securing platforms and distribution channels, and securities and card companies are actively seeking collaboration opportunities.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Authorities add the industry to banks' subsidiaries

Possible to hold more than 15% of shares

A path appears to be opening for banks to hold more than 15% of the equity of issuers of won-denominated stablecoins. With the government's submission of the 'Digital Asset Framework Act' imminent, it is expected that alliances and consolidations between banks and fintech firms over stablecoin issuance will accelerate.

On the 6th, sources in the financial sector said financial authorities are strongly considering adding 'stablecoin (value-stabilized digital asset) issuance' to the list of businesses eligible for banks' subsidiaries. They are looking at revising bank supervision regulations or issuing an authoritative interpretation.

The authorities moved because a potential conflict between the Bank Act and the Digital Asset Framework Act was raised. The government has settled on allowing won-denominated stablecoin issuance from bank-centered consortia (50%+1 share). The problem is that under the Bank Act, banks can only hold up to 15% of another company's equity. This led to points that at least four banks would have to join to form a consortium in which banks hold '50%+1 share'.

To resolve this issue, the financial authorities plan to add stablecoin issuance to the industries listed as banks' subsidiaries in the bank supervision regulations, which are currently limited to businesses such as financial investment, insurance, and savings banks. Under the Bank Act, banks can hold more than 15% in subsidiaries only in industries designated by the Financial Services Commission.

A source in the financial sector said, "Theoretically, an issuer wholly owned 100% by a single bank could be established," adding, "However, considering the scalability of stablecoins, it is expected that consortia with securities firms, cryptocurrency exchanges, and fintech firms will be more common than single-bank establishments."

Five major banks "racing to secure won coins"…platforms and exchanges begin alliances

Banks' calculations become more complex…intense competition to secure platform users

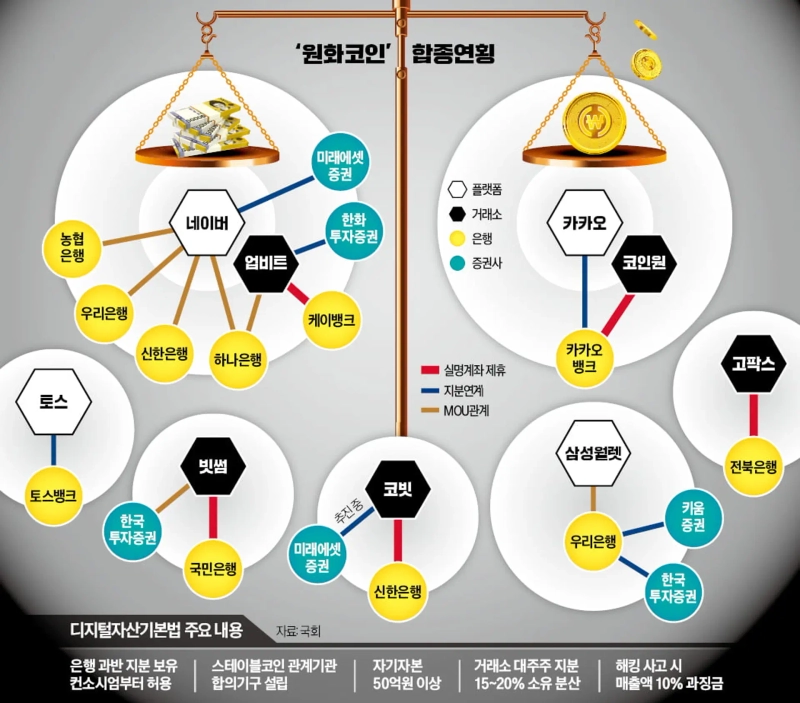

The domestic financial sector's war over 'won stablecoins' is on the verge of a full-scale opening. The contours of the Digital Asset Framework Act, which will set the rules of the game, are gradually emerging. Centered on the five major banks—Kookmin, Shinhan, Hana, Woori, and Nonghyup—large-scale alliances involving platforms, virtual asset exchanges, securities firms, and card companies are expected, intensifying competitive maneuvers in the financial sector.

◇ Underwater competition surfaces

On the 6th, sources in the financial sector said that as the authorities settled on including won stablecoin issuance in the list of banks' subsidiary industries to apply an exception to the '15% ownership rule under the Bank Act', banks' calculations became more complicated. Won stablecoins are not a simple new business but an area that requires a comprehensive redesign of payment, platform, and digital asset strategies.

Although banks could effectively directly own issuer equity, single-bank establishment is expected to be ruled out. The success of won stablecoins depends more on use cases and securing distribution channels than on issuance itself. A senior financial sector official said, "Initially, whether won stablecoins take root is likely to depend on whether they are linked with platforms or exchanges that have large user bases," adding, "From a bank's perspective, a consortium structure to diversify market risk and maximize network effects is a realistic option."

◇ Platform partnerships are key

While banks are expected to take the lead, analyses say the key to success will depend on which party secures the platforms. Scenarios of alliances and consolidations based on realistic partnerships among banks are being discussed.

The biggest point of interest is which bank will join the Naver–Dunamu alliance. Each ranks first in the platform and virtual asset exchange markets, respectively, making them a combination that could start overwhelmingly in terms of user base and distribution channels. Hana Bank has overlap with both Naver and Dunamu. With Naver, it jointly launched a platform-linked demand deposit account. With Dunamu, it recently signed an MOU for joint development of financial services using blockchain technology. It would be difficult for Hana Bank to secure a majority stake in a consortium alone, so attention is on which bank it will partner with. Naver also has collaborative relationships with Shinhan, Woori, and Nonghyup banks.

Kakao and Toss are also considered powerful partners in the won stablecoin competition. Both platforms have internet banks as subsidiaries, but direct equity relationships or strategic alliances with the five major banks are limited. Therefore, if won stablecoin regulation is formalized, banks are expected to speed up negotiation competition with these platforms.

Kookmin Bank has been repeatedly mentioned as a possible collaborator with Bithumb due to account partnerships that create touchpoints. A tie-up with Bithumb, which has a large user base, could accelerate coin adoption. Shinhan Bank's account partner Korbit is a natural choice, but scenarios of alliances with other banks are also discussed. Woori Bank's collaboration with Samsung Wallet has attracted market attention.

As the four major domestic financial groups this year unanimously set securing the digital asset ecosystem as a core goal, the won stablecoin competition is expected to become more pronounced. Yang Jong-hee, chairman of KB Financial Group, emphasized in his New Year's address, "We must secure customers and business opportunities first in newly forming digital assets." Jin Ok-dong, chairman of Shinhan Financial, also stated, "We must secure leadership in the digital asset ecosystem." Ham Young-joo, chairman of Hana Financial, said, "We should proactively design the complete ecosystem (of won stablecoins)," and Im Jong-ryong of Woori Financial said, "We will take preemptive measures against institutional changes surrounding digital assets."

◇ Securities and card firms also eye opportunities

Securities firms and card companies are also actively moving. Mirae Asset is targeting the entire digital asset value chain, pursuing both the Naver–Dunamu alliance and the acquisition of Korbit. Korea Investment & Securities recently signed an MOU with Bithumb to strengthen cooperation.

Hanwha Investment & Securities and Kiwoom Securities are tied by equity relationships to Dunamu and Woori Financial, respectively, so collaboration can be expected. A securities industry source said, "Securities firms have strengths in designing investment products, token securities (STO), and distribution structures, so they can play an important role in the won stablecoin ecosystem." Major card companies are also reported to be in talks with banks exploring opportunities.

Seo Hyeong-gyo/Jo Mi-hyun seogyo@hankyung.com