Editor's PiCK

Florida to renew push for ‘crypto reserve’ bill… “investment cap removed”

공유하기

Summary

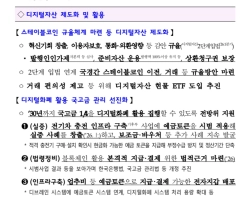

- Florida is renewing its push for a crypto reserve bill, introducing legislation to establish a cryptocurrency reserve fund and grant the CFO authority to invest in cryptocurrencies.

- The new bill sets no budget allocation for Bitcoin investment, unlike the previous 10% cap, allowing the CFO to decide the amount and timing of Bitcoin investments at their discretion.

- Florida’s CFO has described Bitcoin as “digital gold,” saying it could aid portfolio diversification and serve as a hedge against volatility in other major asset classes; if the bill passes, Florida could become one of the largest U.S. states to formally experiment with cryptocurrency reserve assets.

The State of Florida is renewing its push to enact legislation to establish a cryptocurrency reserve.

According to CoinDesk on the 8th (local time), U.S. Representative John Snyder introduced a bill (House Bill 1039) the previous day (the 7th) to create a state-level cryptocurrency reserve. The centerpiece of the bill is the creation of a cryptocurrency reserve fund under the state government and granting the chief financial officer (CFO) authority to invest in cryptocurrencies.

The bill does not set a separate budget allocation for investing in Bitcoin. This contrasts with Florida’s crypto reserve proposal introduced last year, which specified that up to 10% of a given budget could be invested in Bitcoin. The newly introduced bill would allow the CFO to determine the amount and timing of Bitcoin investments at their discretion.

Florida’s CFO has also taken a favorable view of building a crypto reserve. In 2024, Florida CFO Jimmy Patronis likened Bitcoin to “digital gold,” saying, “Bitcoin can help diversify the state’s portfolio and can serve as a hedge against volatility in other major asset classes.”

Meanwhile, the bill is expected to be reviewed during Florida’s legislative session this year. CoinDesk reported that “Florida’s governor is skeptical of central bank digital currencies (CBDCs) but open to decentralized alternatives,” adding that “if the bill passes, Florida could become one of the largest U.S. states to formally experiment with cryptocurrency reserve assets.”

![[Analysis] "Bitcoin open interest at its lowest level since 2022…could be a precursor to a rebound"](https://media.bloomingbit.io/PROD/news/a37221f6-d367-4cce-a3bf-9def20b45757.webp?w=250)

![Bitcoin Catches Its Breath… Ethereum ‘Holds the Line,’ XRP Wobbles [Lee Soo-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/6d85d4cc-2b47-496c-99fc-ef9463c1ca40.webp?w=250)