Editor's PiCK

Digital asset investment products saw about 666.7 billion won in net outflows last week…weakened expectations for US rate cuts weighed

공유하기

Summary

- Digital asset investment products saw total net outflows of $454 million last week, reversing most of the year-to-date net inflows, the report said.

- It said expectations for early Fed rate cuts weakened after recent macroeconomic data releases, sharply damping investor sentiment.

- While major outflows continued in bitcoin and ethereum, net inflows were reported in XRP, Solana and Sui, it said.

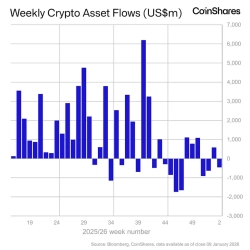

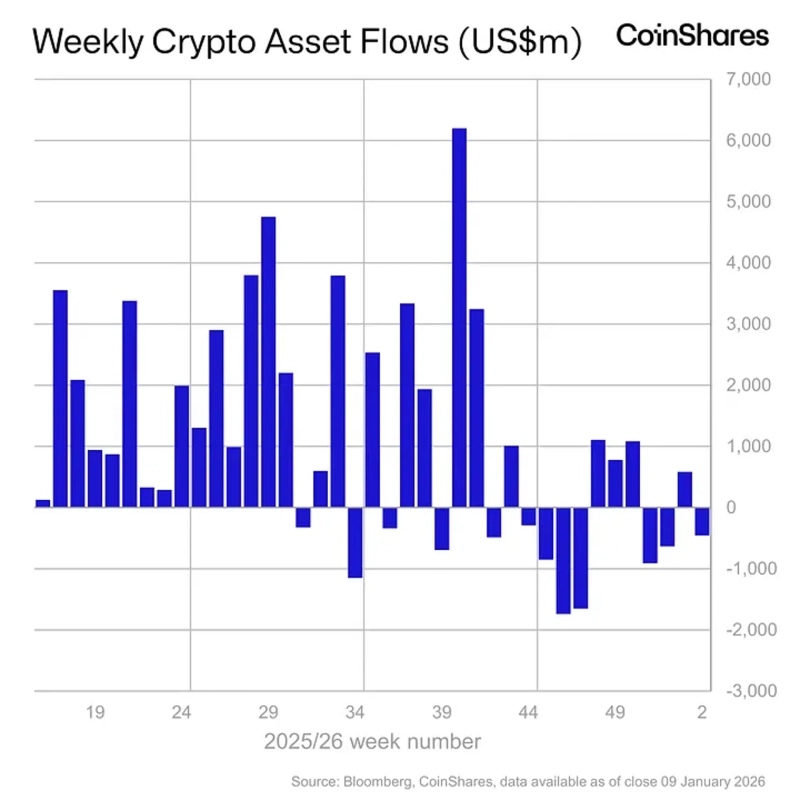

Last week, the market for digital asset investment products saw large net outflows. The move effectively reversed most of this year’s inflows to date, a trend attributed to fading expectations that the US central bank—the Federal Reserve (Fed)—will deliver an early rate cut.

According to CoinShares, a cryptocurrency-focused asset manager, digital asset investment products recorded total net outflows of $454 million (about 666.7 billion won) last week. Funds exited for four consecutive days, pushing cumulative outflows to $1.3 billion—nearly offsetting the $1.5 billion in net inflows logged over two days earlier this year.

CoinShares said investor sentiment deteriorated sharply as perceptions spread that the likelihood of a policy rate cut in March has diminished following recently released macroeconomic indicators.

By region, the US led the outflows. The US market posted net outflows of $569 million, the only market to record negative fund flows.

By asset, bitcoin (BTC) was hit the hardest. Bitcoin investment products saw net outflows of $405 million last week. However, short bitcoin products—used to bet on a decline—also recorded $9.2 million in outflows, suggesting mixed views on market direction.

Ethereum (ETH) investment products also posted $116 million in net outflows, while multi-asset products saw $21 million leave. Products linked to Binance and Aave (AAVE) recorded modest outflows of $3.7 million and $1.7 million, respectively.

Meanwhile, some altcoins continued to draw inflows. XRP recorded $45.8 million, Solana (SOL) $32.8 million, and Sui (SUI) $7.6 million in net inflows, showing relatively resilient momentum.