Editor's PiCK

U.S. Senate crypto regulation draft specifies ‘limits on stablecoin interest’…Holding alone can’t generate yield

공유하기

Summary

- A draft U.S. Congress market structure bill for virtual assets reportedly includes a provision restricting the payment of interest solely for depositing stablecoins.

- The bill says rewards may be allowed, but only if tied to clear activities such as opening an account, executing transactions, staking, providing liquidity, posting collateral, or participating in network governance.

- The draft is seen as reflecting the traditional banking sector’s concerns over “stablecoin deposit interest,” though the text could still change before the vote.

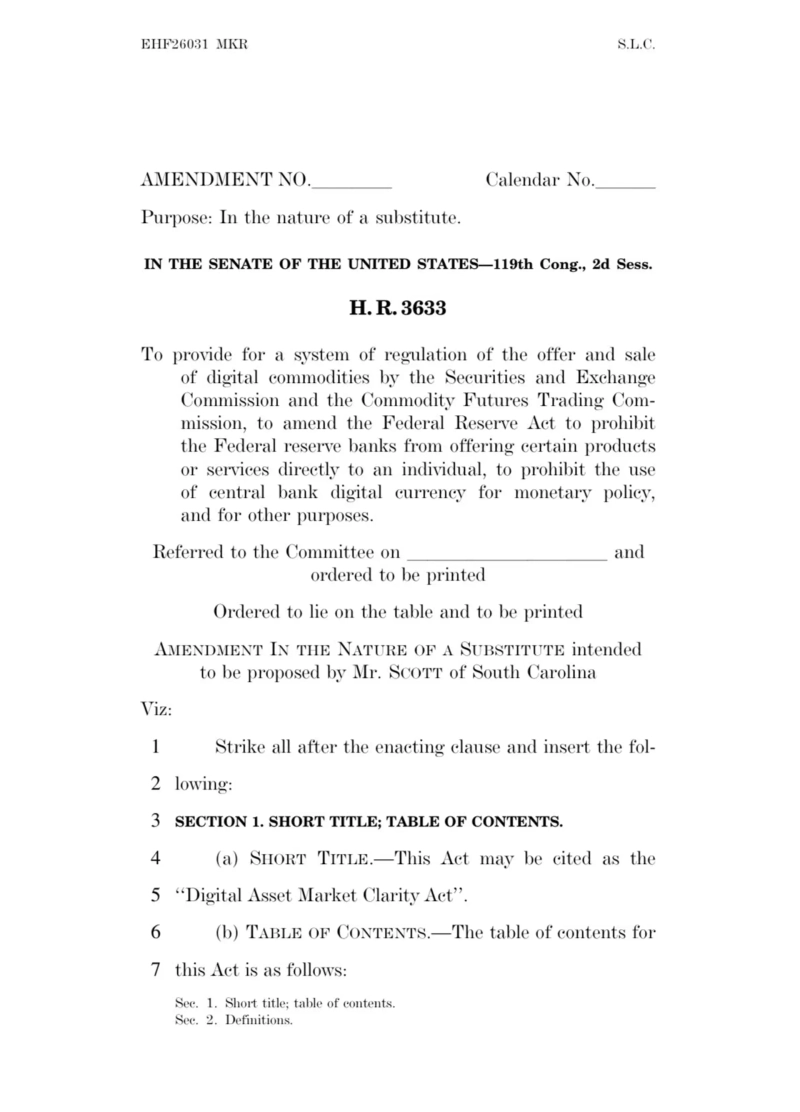

A draft market structure bill for virtual assets (cryptocurrencies) being discussed in the U.S. Congress is said to include provisions restricting the payment of interest solely for deposits. As a result, debate over stablecoin yield models is once again coming into focus.

According to Eleanor Terrett, host of Crypto in America, a recently released draft bill includes language stating that “interest cannot be paid simply because a balance is being held.” She explained that “rewards may be permitted, but they must be tied to clear activities such as opening an account, executing transactions, staking, providing liquidity, posting collateral, or participating in network governance.”

The draft is interpreted as reflecting, to some extent, the traditional banking sector’s long-standing concerns over “stablecoin deposit interest.” Banks have consistently argued for the need for regulation, warning that if stablecoins function like deposit-like interest products, they could encroach on the bank deposit market.

However, it remains uncertain whether the provision will be carried over unchanged into the final version. Terrett said that “senators were given a 48-hour amendment window, and the contents could still change before the vote on Thursday (the 15th).”