Editor's PiCK

Grayscale releases 36 altcoins on its Q1 watchlist…including ARIA Protocol and others

공유하기

Summary

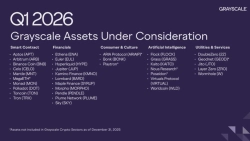

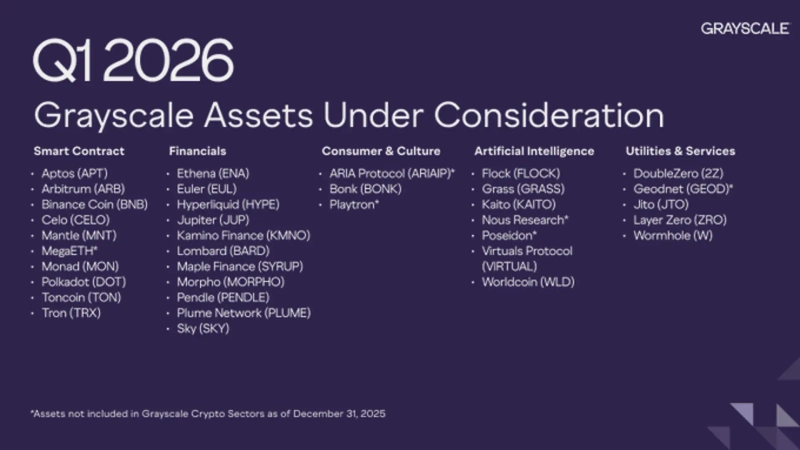

- Grayscale said it included a total of 36 altcoins in its Q1 2026 Assets Under Consideration list.

- It said this quarter’s candidates are divided into five sectors: smart contracts, financials, consumer & culture, artificial intelligence (AI), and utilities & services.

- It added that Tron (TRX) was included in the smart-contracts segment, while ARIA Protocol was added to consumer & culture and Nous Research, Poseidon, and DoubleZero were included in AI- and infrastructure-related segments.

Global asset manager Grayscale has released a list of altcoins it is reviewing as potential investment products for Q1 2026, highlighting sector trends it is watching from an institutional-investor perspective.

According to crypto asset (cryptocurrency) media outlet BeInCrypto on the 13th, Grayscale included a total of 36 altcoins in its Q1 2026 “Assets Under Consideration” list. The list is regularly updated within about 15 days after the end of each quarter and serves as a pre-screening of assets that may be eligible for inclusion in future investment products.

In an official blog post, Grayscale explained, “The assets under consideration list represents digital assets that are not currently included in Grayscale investment products, but are being evaluated internally with potential product inclusion in mind.” It added, however, that inclusion on the list does not guarantee an actual product launch or inclusion.

This quarter’s candidates are divided into five sectors: smart contracts, financials, consumer & culture, artificial intelligence (AI), and utilities & services. Among them, smart contracts and financials account for the largest share. In the smart-contracts segment, Tron (TRX) was newly added, while the consumer & culture sector includes ARIA Protocol, which promotes intellectual property (IP) tokenization.

In the AI segment, Nous Research and Poseidon were newly added, while Prime Intellect, previously a candidate, was removed. In utilities & services, DoubleZero, a decentralized physical infrastructure network (DePIN) project, was added. Overall, the move is seen as reflecting continued interest in tokenization, AI, and infrastructure-related projects.

The altcoins Grayscale classified as under investment review for Q1 2026 are grouped by sector into smart contracts, financials, consumer & culture, artificial intelligence (AI), and utilities & services.

The smart-contracts segment includes Aptos (APT), Arbitrum (ARB), Binance Coin (BNB), Celo (CELO), Mantle (MNT), MegaETH (MegaETH), Monad (MON), Polkadot (DOT), Toncoin (TON), and Tron (TRX).

The financials sector lists Ethena (ENA), Euler (EUL), Hyperliquid (HYPE), Jupiter (JUP), Kamino Finance (KMNO), Lombard (BARD), Maple Finance (SYRUP), Morpho (MORPHO), Pendle (PENDLE), Plume Network (PLUME), and Sky (SKY).

The consumer & culture segment includes ARIA Protocol (ARIAIP), Bonk (BONK), and Playtron (Playtron). The artificial intelligence (AI) sector selected Flock (FLOCK), Grass (GRASS), Kaito (KAITO), Nous Research (Nous Research), Poseidon (Poseidon), Virtual Protocol (VIRTUAL), and Worldcoin (WLD).

The utilities & services segment includes DoubleZero (2Z), Geodnet (GEOD), IOTA (IOT), LayerZero (ZRO), and Wormhole (W), bringing the total number of assets under consideration to 36.