Editor's PiCK

Token securities bill clears the National Assembly hurdle…OTC exchange approval remains ‘in limbo’

공유하기

Summary

- The National Assembly passed amendments to the Capital Markets Act and the Electronic Securities Act aimed at establishing a legal framework for token securities (STOs), accelerating efforts to institutionalize South Korea’s token securities market.

- The amendments focus on allowing OTC market distribution of token securities and overhauling the issuance and distribution framework, with the industry expecting the domestic token securities market to be put on a full-fledged institutional footing.

- However, the Financial Services Commission’s licensing of an OTC token securities exchange has been delayed amid controversy over the fairness of the review process, leaving the selection of preliminary operators in limbo.

Legislation on token securities (STOs) has cleared the National Assembly. However, approval for an over-the-counter (OTC) token securities exchange was postponed amid controversy over the fairness of the review process.

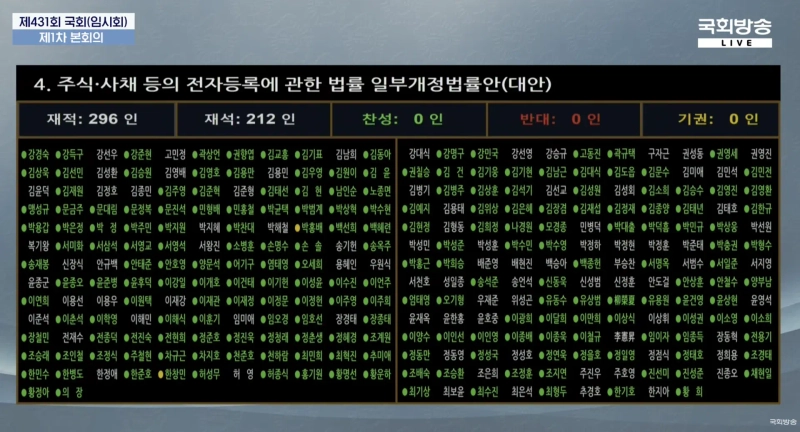

On the 15th, the National Assembly passed at a plenary session partial amendment bills to the “Financial Investment Services and Capital Markets Act (Capital Markets Act)” and the “Act on Electronic Registration of Stocks and Bonds, etc. (Electronic Securities Act),” aimed at establishing a legal framework for token securities. Passage had looked uncertain after the People Power Party signaled it would stage an unlimited debate (filibuster) on contentious bills, but last-minute negotiations between the ruling and opposition parties accelerated the bill’s approval.

A key element of the amendments is allowing distribution of token securities in the OTC market. The revisions also include measures to overhaul the issuance and distribution framework for token securities. The industry expects the amendments to put South Korea’s token securities market on a full-fledged institutional footing.

However, the financial authorities’ decision on licensing an OTC token securities exchange has fallen into uncertainty. Token securities startup Lucentblock recently raised concerns over the fairness of the Financial Services Commission’s review process for the OTC exchange.

The FSC had initially planned to finalize preliminary operators for the OTC token securities exchange at its regular meeting held the previous day (14th), but postponed deliberations. The FSC is also said to have not yet finalized plans to put the agenda back on the docket. FSC regular meetings are held once or twice a month.

Jinwook, Junhyeong Lee, Bloomingbit reporters wook9629@bloomingbit.io

![Bank of Korea governor: “Rate held steady with FX in mind”... hints easing cycle may be over [Wrap-up]](https://media.bloomingbit.io/PROD/news/944dfdce-5d7b-4218-8300-e850cdc5d7ac.webp?w=250)