Editor's PiCK

A 370 trillion won market opens... Token securities bill passes National Assembly plenary session

공유하기

Summary

- The National Assembly plenary session passed amendments to the Capital Markets Act and the Electronic Securities Act related to token securities (STOs), enabling regulated issuance and distribution from January next year.

- Citigroup and BCG projected that the global token securities market will grow to $5 trillion by 2030, while the domestic market will reach 367 trillion won.

- However, concerns were raised that the overall market launch timeline could be affected as controversy continues over procedural fairness and delays in preliminary approval for a token-securities-dedicated OTC exchange.

Capital Markets Act and Electronic Securities Act pass plenary session

Token securities brought into the regulated framework... to take effect in January next year

OTC exchange licensing controversy remains a variable

A bill to bring token securities (STOs) into the regulated framework has passed the National Assembly plenary session. With a path opening for qualified issuers to issue and distribute token securities using blockchain technology such as distributed ledgers, the rollout of the related market is expected to accelerate.

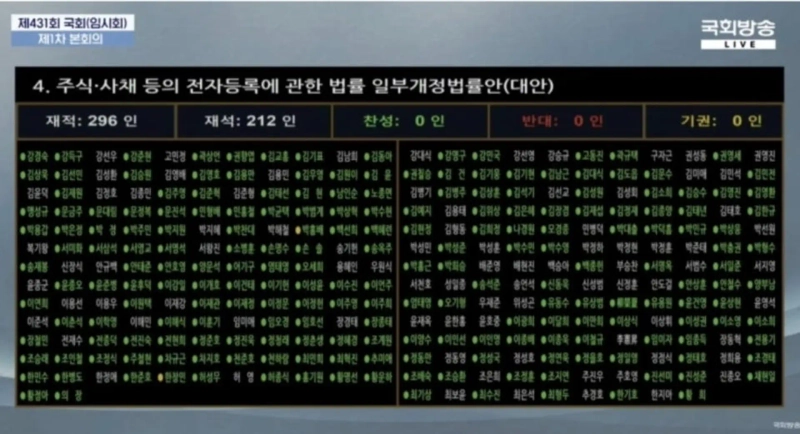

On the 15th, the National Assembly convened the 1st plenary session of the 431st National Assembly (extraordinary session) and passed by consensus the "Partial Amendment Bill to the Financial Investment Services and Capital Markets Act (Capital Markets Act)" and the "Partial Amendment Bill to the Act on the Electronic Registration of Stocks and Bonds, etc. (Electronic Securities Act)."

The passed bills are set to take effect from January next year after a one-year preparation period. Until the law takes effect, detailed制度 improvements will be made, including building distributed-ledger-based securities account management infrastructure and refining investor protection measures. The Financial Services Commission plans to launch preparatory work by forming a "Token Securities Consultative Body" together with the Financial Supervisory Service, Korea Securities Depository, Korea Financial Investment Association, and others so that the token securities market can begin operating as soon as the制度 comes into force.

Issuance and distribution brought into the regulated framework... token securities market opens

This amendment to the Capital Markets Act is seen as a key legal mechanism for bringing the distribution of investment contract securities, including token securities, into the regulated framework. Until now, investment contract securities were recognized as securities only at the issuance stage, but the amendment deletes that proviso, placing not only issuance but also distribution under the scope of the Capital Markets Act.

In addition, it establishes a legal basis for the token securities secondary market by allowing multilateral over-the-counter trading via associations, comprehensive financial investment business operators, and OTC brokerage firms. Licensed OTC brokers will not be subject to dual-business regulations and certain rules on investment solicitation and credit provision, which is expected to further ease the entry of token-securities-dedicated distribution platforms into the regulated system.

The Electronic Securities Act will serve to refine the legal foundation for issuing token securities. By including token securities such as beneficiary certificates issued by trust companies within the scope of mandatory electronic registration, it ensures that rights relationships are managed within the electronic securities system even if issuance is carried out on a blockchain. However, the scope of application is limited to licensed trust companies, suggesting that a step-by-step approach to fostering token securities centered on the regulated sector will be maintained.

Shin Beom-jun, chair of the Token Securities Council at the Korea Fintech Industry Association, said, "It is highly meaningful in that a long-standing wish across the entire token securities industry has been resolved," adding, "The bill’s passage is a signal that a market the public and private sectors have prepared for years is now entering the full-scale execution phase."

"Growing to 367 trillion won"... industry already finished preparations

The financial investment industry has already completed preparations to enter the market. Mirae Asset Securities formed the "Next Finance Initiative (NFI)" with Hana Financial Group and SK Telecom and has completed development of its own token securities mainnet.

Hana Securities participated in a testbed construction project led by the Korea Securities Depository, and Shinhan Investment Corp. is pushing to build an "all-in-one service" for token securities through the collaborative initiative "PULSE" with SK Securities and LS Securities. NH Investment & Securities and KB Securities are also preparing to enter the market by establishing their respective cooperation models.

The reason the industry is focusing on token securities as a new growth engine is the market’s size and growth potential. Citigroup forecast that the global token securities market could reach $5 trillion by 2030. Consulting firm Quinlan & Associates projected that token securities will account for about 43% of total securities trading value in the same year.

In line with this, expectations are rising that Korea’s token securities market will also grow rapidly. Boston Consulting Group (BCG) estimated that the domestic token securities market could reach 367 trillion won by 2030.

OTC exchange licensing controversy remains a variable

Controversy surrounding preliminary licensing for a token-securities-dedicated OTC exchange remains a variable. Lucentblock, a fractional investment platform, raised issues over procedural fairness after failing to obtain preliminary approval and filed a complaint with the Korea Fair Trade Commission alleging technology theft by alternative trading system Nextrade (NXT).

As the controversy spreads, the Financial Services Commission’s preliminary approval decision is also being delayed. The FSC had planned to announce preliminary approval recipients at its regular meeting on the 14th, but did not table the relevant agenda item. The industry believes the FSC has withheld judgment in consideration of the controversy over licensing the OTC exchange.

There are also concerns in the market that a licensing delay could affect the overall timeline for launching the token securities market. The Korea Fintech Industry Association urged the FSC to make a prompt decision, saying, "If the withholding of the licensing decision is prolonged, the broader fractional investment industry could shrink. We must not miss the golden time for the transition to next-generation finance."

Hwang Doo-hyun, Bloomingbit reporter cow5361@bloomingbit.io

![Bank of Korea governor: “Rate held steady with FX in mind”... hints easing cycle may be over [Wrap-up]](https://media.bloomingbit.io/PROD/news/944dfdce-5d7b-4218-8300-e850cdc5d7ac.webp?w=250)