Summary

- An analysis said whether Bitcoin reaches $100,000 depends on the decision-making of short-term holders.

- It noted that the average realized price for short-term holders is about $102,000, meaning many short-term investors are in loss territory.

- It explained that if Bitcoin reclaims the short-term holder realized price, upward momentum could re-accelerate, but if it cannot, it may remain in a recovery phase.

As Bitcoin (BTC) has staged a midweek rebound, market attention is focused on whether it can reach $100,000. An analysis suggests that short-term holders’ decisions will be critical to hitting the $100,000 mark.

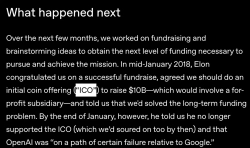

On the 17th (Korea time), a Darkfost CryptoQuant contributor wrote on X (formerly Twitter) that “a key inflection point for Bitcoin reaching $100,000 is the average realized price of short-term holders,” adding that “whether short-term Bitcoin holders sell at profit-taking levels or continue to hold could shape the price path going forward.”

The average realized price for short-term holders refers to the average entry price of investors who bought Bitcoin within the past 1–3 months. It is currently estimated at around $102,000. This indicates that a large number of short-term investors are still sitting in loss territory.

Chris Beamish, an analyst at Glassnode, also called the short-term holder realized price “a key gauge for assessing market direction,” explaining that “if Bitcoin recovers that level, recent buying will move back into profit, potentially re-accelerating upside momentum; but if it fails to clear it, the market is likely to remain in a recovery phase.”

As of 7:50 p.m. this afternoon, Bitcoin was down 0.23% from the previous day at $95,062, according to CoinMarketCap.

![[Analysis] "Bitcoin’s $100,000 target hinges on short-term holders"](https://media.bloomingbit.io/PROD/news/14472a43-fc08-441b-8cf2-4cf1b880ad31.webp?w=250)