Editor's PiCK

Bitcoin capped despite easing of Trump’s ‘Greenland risk’…downside pressure builds [Kang Min-seung’s Trade Now]

공유하기

Summary

- Bitcoin has continued to stall near $90,000, failing to respond even to easing geopolitical tensions, and this has increased downside risk, the report said.

- Experts warned that a rebound could be possible if Bitcoin breaks above $98,000, $93,000, and $91,350, while cautioning that additional declines could follow if it falls below $88,000, $86,500, and $84,000.

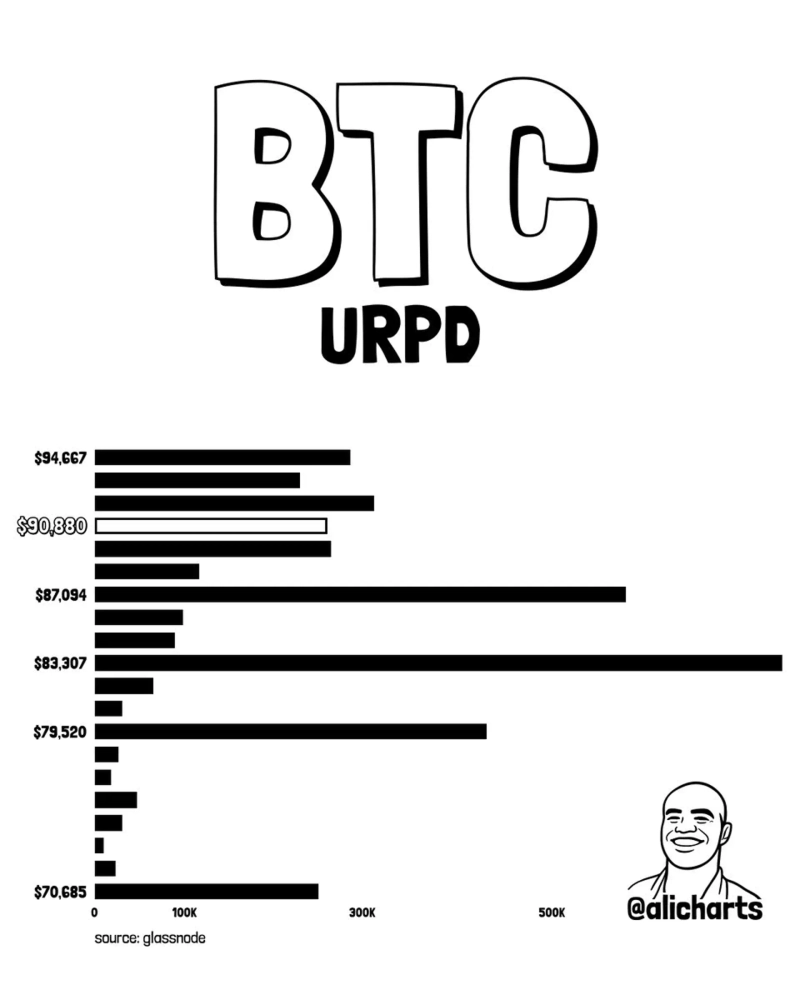

- On-chain analysis indicated $87,094, $83,307, and $79,520 as key support zones, and noted past instances where upside momentum strengthened after reclaiming the $98,365 short-term holder realized price level.

Global equities rebounded as risks tied to U.S. President Donald Trump’s proposed “Greenland tariffs” receded, but Bitcoin (BTC) has failed to follow suit, remaining rangebound near $90,000. The fact that it did not respond even as geopolitical uncertainty eased is tilting market focus back toward downside risks.

With uncertainty still lingering around Federal Reserve (Fed) policy and Japan-driven rate variables, the near-term outlook is that a volatility-heavy market dominated by downside pressure is likely to persist for Bitcoin. Analysts say a break above $98,000 is needed to signal a trend reversal. Conversely, there are warnings that if support at $88,000 breaks, selling pressure could intensify rapidly.

As of 13:19 on the 22nd, Bitcoin was trading at $89,927 on Binance’s USDT market, up 0.82% from the previous day. On Upbit’s KRW market, it was priced at 133.22 million won, while the kimchi premium (the price gap between overseas and domestic exchanges) stood at 0.81%.

Fed, Japan uncertainty persists even as tariff overhang eases

Global financial markets staged a relief rally after President Trump’s comments about rolling back tariffs, but the crypto market showed comparatively weaker price action. While global stocks bounced after the reversal on planned tariffs, the recovery in digital assets remained relatively limited.

Trump said on the 21st (local time), shortly after attending the Davos forum, that he had “decided not to impose tariffs” on eight European countries that had deployed troops in opposition to the U.S. annexation of Greenland. While reiterating in his Davos speech that Greenland should be owned by the United States, Trump drew a line by saying he would not use military force to achieve it. Previously, on the 17th, he had warned those countries he would impose U.S. tariffs of 10% starting next month on the 1st and 25% starting June 1.

The New York Times (NYT) said that “this is not the first time Trump has backed away from tariff plans after a strong market reaction,” adding that he has “repeatedly toggled between implementing and withdrawing harsh tariff measures.” The Financial Times (FT) described the situation as “the most serious U.S.-Europe rift in decades.” Commentary also followed that strategic tensions and diplomatic uncertainty surrounding Greenland remain ongoing.

In Asia, Japan’s political calendar is emerging as another variable. With Japanese Prime Minister Sanae Takaichi effectively confirming an early general election next month, competition over fiscal expansion pledges is gaining momentum. Japan’s 40-year government bond yield broke above 4% in an unusual move, and caution is also being voiced over the unwinding of yen carry trades. The market view is that pressures surrounding Japan’s fiscal outlook could persist for some time regardless of the election outcome.

Attention is now turning back to the January Federal Open Market Committee (FOMC) meeting. While the U.S. December Consumer Price Index (CPI) rose 2.7%, indicating a stable trend, uncertainty around policy decisions remains, given the large data gaps caused by the federal government shutdown (temporary suspension of operations). According to CME FedWatch, the probability that the Fed will hold rates steady at the FOMC on the 28th is 95%, versus 5% for a cut.

Investor sentiment recovery limited despite larger ETF inflows

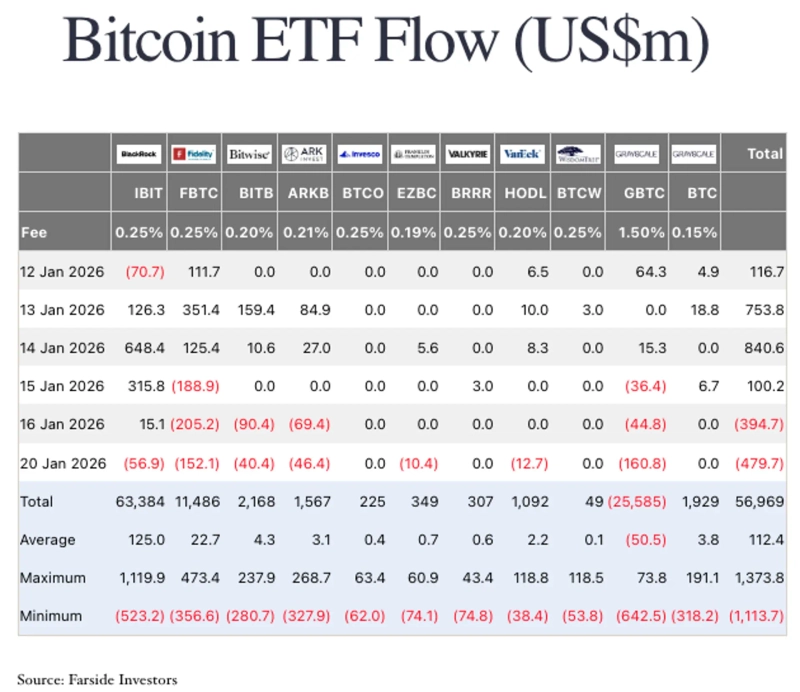

Spot Bitcoin ETFs posted net inflows of $1.41666 billion last week, the largest since October last year. Still, geopolitical factors around Greenland and broader macro uncertainty are curbing a recovery in risk appetite.

Bitfinex, a global crypto exchange, said in its weekly research report on the 19th that “selling by long-term Bitcoin holders has fallen to about 12,800 BTC per week, significantly easing overhead supply compared with periods last year when weekly selling exceeded 100,000 BTC.” It added that “the slowdown in distribution by long-term holders is opening the door to a rebound in the first quarter,” while cautioning that “to break through the $93,000 to $110,000 range, additional easing in long-term holder selling pressure will be necessary.”

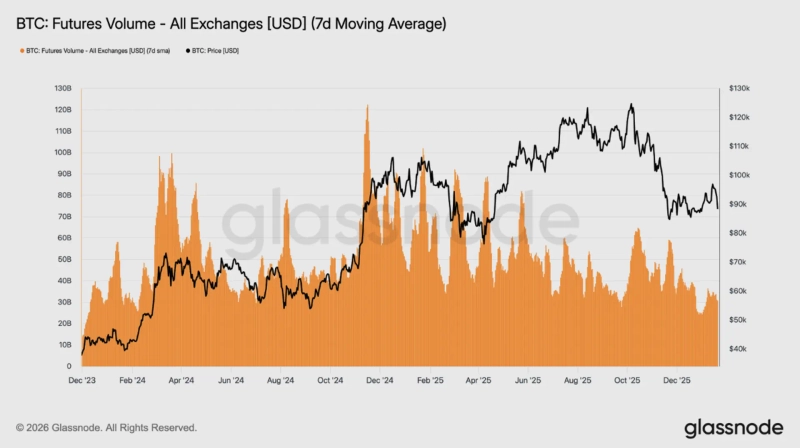

On-chain analytics firm Glassnode said in its weekly report on the 21st that “Bitcoin is currently structured in a way that upside attempts can easily translate into distribution, as positions held by recent buyers and long-term holders overlap near the top.” It added that “while selling pressure has eased somewhat in spot markets, inflows from Digital Asset Treasury (DAT) strategy firms and participation in derivatives remain limited,” concluding that “overall, a low-participation correction-and-consolidation phase is persisting amid a lack of investor conviction.”

Crypto analytics platform 10x Research also said in a research report on the 21st that “Bitcoin is trading below long-term support, with price signals mixed,” and that “capital in the market is moving away from simple holding toward certain risk assets with clear stop-loss levels and greater profit convexity.” It added, “We have maintained a constructive view on Bitcoin since late December, but in this zone that constructive view may no longer hold.”

Options markets are also reflecting investors’ caution. Crypto services provider Matrixport said in a report on the 21st that “as macro uncertainty expands, demand for put options is rising and defensive positioning is strengthening,” adding that “Bitcoin is behaving less like a safe haven and more like a risk-management tool for institutional investors, leaving it under correction pressure.”

Bitcoin’s rebound momentum weakens…$88,000 support in focus

Analysts say resistance in the low-$91,000s and support at $88,000 are key levels that will determine the near-term direction.

Ayush Jindal, a NewsBTC researcher, said, “Bitcoin fell to as low as $87,200 intraday and retraced part of the drop, but it has not been able to establish itself firmly at $90,000,” adding, “Support on the downside is at $88,000, followed by the $87,200 level.” He said, “A break above resistance at $91,350 would allow an attempt to rebound above $93,000,” while adding that “if it falls below $85,500, downside pressure could strengthen further.”

In the near term, the prevailing view is that sellers have the upper hand. Rakesh Upadhyay, a Cointelegraph analyst, said, “Bitcoin’s upside is being capped as selling pressure comes in on every rebound attempt,” adding that “if support at $86,500 breaks, the door could open for a further drop to $84,000.” He added, “If it breaks above $91,786 in a sustained move, recovery attempts could extend to $94,789 and then $97,924,” and said that “if it clears major resistance levels in sequence, the possibility of a shift back to an uptrend could also emerge.”

Some also argue that Bitcoin’s role as a refuge is weakening. Alex Kuptsikevich, Senior Market Analyst at FxPro, said, “The crypto market has entered another vulnerable phase as the early-year rebound has broken down,” adding that “Bitcoin is showing weaker price action than equities even amid tariff uncertainty.” He said, “With the rebound technically constrained, downside pressure is rising again,” and added that “Bitcoin may retest the mid-term support zone of $80,000 to $84,000.”

On-chain analyst Ali Martinez said, “Bitcoin’s major support zones narrow to $87,094, $83,307, and $79,520.” He added, “The short-term holder realized price (STH realized price) is around $98,365,” noting that “in the past, there have been repeated cases where upward momentum strengthened after reclaiming this zone.”

Kang Min-seung, Bloomingbit reporter minriver@bloomingbit.io

![Bitcoin capped despite easing of Trump’s ‘Greenland risk’…downside pressure builds [Kang Min-seung’s Trade Now]](https://media.bloomingbit.io/PROD/news/2d34a988-f3f1-4f64-b9ab-236c352e3812.webp?w=250)