Editor's PiCK

"Korea’s biggest risk factor is the exchange rate"…economists ‘warn’ FX authorities

공유하기

Summary

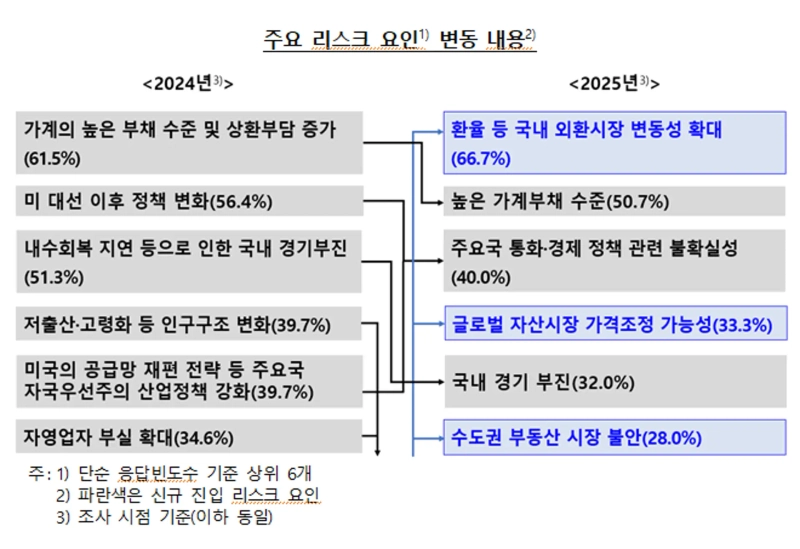

- Some 66.7% of economists said increased volatility in the domestic FX market, including the exchange rate, is the biggest risk factor.

- Experts said household debt, a sluggish domestic economy, and the possibility of a global asset-market price adjustment are major risks.

- Respondents called for stronger stabilization of FX and asset markets, risk management, and clear and transparent communication.

This is the result of a survey of 75 economists who were asked to rank Korea’s five risk factors in order. Concerns were raised that volatility in the foreign-exchange market is likely to increase. Experts pointed out that “FX authorities need to communicate clearly and transparently.”

According to the Bank of Korea’s ‘Systemic Risk Survey Results’ released on the 23rd, the top risk factor was cited as “increased volatility in the domestic FX market, including the exchange rate.” This is based on responses from 75 economists who ranked Korea’s five risk factors. Some 66.7% pointed to the exchange rate, and 26.7% ranked it as the No. 1 risk. Many respondents viewed mainly domestic factors as risks, such as the high level of household debt (50.7%) and a sluggish domestic economy (32.0%). External factors cited included uncertainty over monetary policy in major economies (40.0%) and the possibility of a global asset-market price adjustment (33.3%).

Respondents said an exchange-rate move and a global asset-market price adjustment are likely to occur. Household debt was identified as a factor with a major impact on the financial system.

Compared with last year, the factors ranking near the top changed significantly. Last year, household debt, shifts in US policy, economic weakness, demographic changes, US supply-chain reshoring, and stress among self-employed borrowers were cited as concerns, but demographic and self-employment issues were pushed down the list. This year, worries about the exchange rate, global asset markets, and real estate in the Seoul metropolitan area newly moved into the top tier.

Still, the likelihood of shocks that could undermine financial-system stability was assessed to have declined. The share of respondents who said a shock is likely within one year fell to 12.0% from 15.4% last year, and those who expected a shock within a 1–3 year horizon declined to 24.0% from 34.6%.

Respondents called for risk management to brace for domestic and external uncertainty, and for policies to bolster credibility and predictability as ways to enhance the stability of Korea’s financial system. Specifically, they cited the need to stabilize and more closely monitor the FX and asset markets, and for policy authorities to communicate clearly and transparently.

They also mentioned the need for a consistent policy mix to manage household debt in a stable manner and institutional efforts to address structural vulnerabilities by borrower segment and financial sector, as well as the need for an orderly restructuring of so-called zombie companies.

By Kang Jin-kyu josep@hankyung.com

![Two-day relief rally as Greenland tensions ease… Tesla surges [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/3fdba95e-9847-4c13-b13d-ba4b16d949bd.webp?w=250)