Editor's PiCK

Wintermute: ‘Crypto’s four-year cycle has effectively ended… shifting to an institution-led market’

공유하기

Summary

- Wintermute said the crypto market’s traditional four-year bull cycle is no longer valid and that it has entered a new phase led by institutional investors.

- The report said that spot Bitcoin ETFs and digital asset treasury companies (DAT) have driven liquidity to concentrate in a handful of large-cap assets such as Bitcoin and Ethereum, leaving many altcoins relatively sluggish.

- Wintermute said a 23% increase in institutional investors, an expanded ETF investable universe, strong gains in Bitcoin and Ethereum, and whether retail capital returns will be key variables for a market recovery in 2026.

An analysis suggests that the crypto (digital asset) market’s traditional four-year cycle has effectively come to an end.

According to crypto-focused outlet CryptoNews on the 24th (Korea time), Wintermute, a crypto market-making firm, said in a report released on the 13th that “the crypto market is moving away from a speculation-driven cyclical structure and entering a new phase led by institutional investors,” adding that “the four-year bull cycle that long applied to the crypto market is no longer valid.”

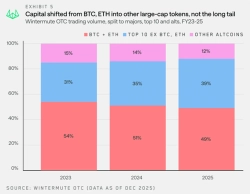

Wintermute assessed that a shift in market structure began in 2025. The report explained that “the previous pattern—funds rotating from Bitcoin (BTC) into altcoins after a Bitcoin rally—has weakened, while liquidity has increasingly concentrated in a handful of large-cap assets such as Bitcoin and Ethereum.”

It pointed to spot Bitcoin exchange-traded funds (ETFs) and digital asset treasury companies (DAT) as drivers of the change. Wintermute said, “These products created steady demand for large-cap crypto assets, but they also reinforced a structure in which capital stays within a limited set of assets rather than spreading across the broader market,” adding that “as a result, many altcoins remained relatively sluggish.”

Market seasonality also appears to have weakened. Wintermute said, “In 2025, recurring rally patterns such as the year-end rally or the so-called ‘Uptober’ did not materialize,” adding that “price action reacted in the short term to the macro environment and policy and political issues, and the duration of altcoin upswings fell sharply year on year, averaging 19 days.”

Meanwhile, institutional participation expanded. Wintermute said in the report that “the number of institutional investors in 2025 rose 23% from a year earlier, and trading shifted away from short-term speculation toward hedging and yield management,” adding that “an expanded universe for ETF investment, strong gains in Bitcoin and Ethereum, and whether retail capital flows back in will be key variables for a market recovery in 2026.”

![Wall Street focuses on Fed chair nomination and Big Tech earnings…Shanghai stocks enter an earnings-driven market [New York·Shanghai stock outlook]](https://media.bloomingbit.io/PROD/news/b7d7a0aa-abf6-46e4-bbca-4270d970641d.webp?w=250)

![Slips at the threshold of 5,000—will Big Tech, Samsung Electronics and SK Hynix earnings help the KOSPI settle in? [Weekly outlook]](https://media.bloomingbit.io/PROD/news/0959d876-faef-43d8-bc75-8454efc24296.webp?w=250)