Editor's PiCK

U.S. spot Bitcoin ETFs see $1.3bn in net outflows last week, led by BlackRock and Fidelity

공유하기

Summary

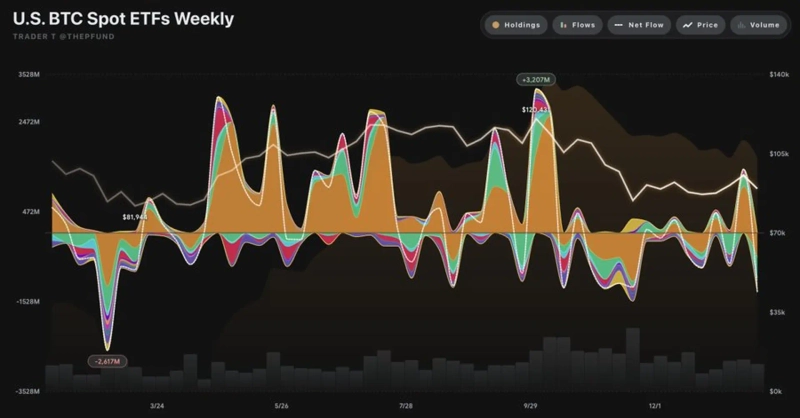

- U.S. spot Bitcoin ETFs recorded about $1.323bn in net outflows last week.

- Outflows of several hundred million dollars were concentrated in BlackRock, Fidelity, and Grayscale ETFs, respectively.

- The market interpreted the short-term pullback in institutional flows as driven by a Bitcoin price correction, derivatives deleveraging, and macroeconomic uncertainty.

Large-scale fund outflows from U.S. Bitcoin (BTC) exchange-traded funds (ETFs) are continuing.

According to Trader T on the 26th (local time), spot Bitcoin ETFs saw net outflows of about $1.323bn last week (about KRW 1.9043tn). Trading volume over the same period was tallied at $17.0bn.

Outflows were concentrated in ETFs run by major asset managers. BlackRock posted net outflows of about $536m, while Fidelity recorded about $452m. Grayscale also saw about $172m leave.

Market participants say institutional money pulled back in the short term as Bitcoin’s recent price correction coincided with derivatives deleveraging and broader macroeconomic uncertainty. However, with trading volume still holding at elevated levels, the move is being read less as a full-blown demand collapse and more as a risk-off driven round of position adjustments.

![[Today's Key Economic & Crypto Calendar] U.S. Dallas Fed Manufacturing Index, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![Is the ‘Mar-a-Lago Accord’ being put into action?…US may jointly intervene to support the yen and won [Issue+]](https://media.bloomingbit.io/PROD/news/3ce368de-a9c1-413f-bedb-6d835ff96051.webp?w=250)