Editor's PiCK

US spot Ethereum ETFs saw $600 million in net outflows last week…BlackRock accounts for the lion’s share

공유하기

Summary

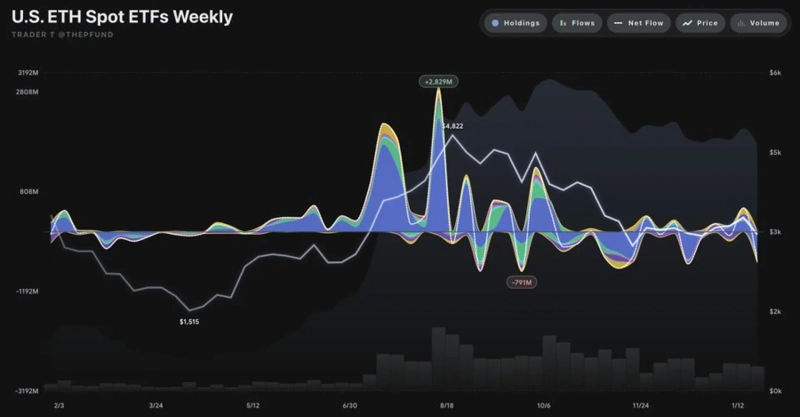

- Net outflows of about $606 million were recorded from US spot Ethereum ETFs last week.

- Large outflows were concentrated at BlackRock, Grayscale, and Bitwise.

- The market interprets this as position trimming for short-term risk management amid Ethereum price weakness.

Capital continues to flow out of US spot Ethereum (ETH) exchange-traded funds (ETFs), following a similar trend in Bitcoin (BTC).

According to Trader T on the 26th (local time), spot Ethereum ETFs recorded net outflows of about $606 million last week (roughly 872.6 billion won). Total trading volume over the same period came to about $7 billion.

Outflows were concentrated in specific asset managers. BlackRock posted the largest net outflow at about $437 million, followed by Grayscale with about $78 million and Bitwise with about $46 million.

The market sees this as reflecting short-term institutional risk-management via spot ETFs amid Ethereum’s price weakness. With trading volume holding up, the view is that this is more about position trimming during a corrective phase than a structural drop in demand.

![[Today's Key Economic & Crypto Calendar] U.S. Dallas Fed Manufacturing Index, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)