Editor's PiCK

Digital-asset investment products see $1.73bn in weekly net outflows…U.S.-led selling persists

공유하기

Summary

- Global digital-asset investment products saw $1.73bn in net outflows over the past week, the largest since mid-November last year.

- While the U.S. recorded about $1.8bn in net outflows, Switzerland, Germany and Canada posted net inflows, which was interpreted as some regional investors viewing the recent price pullback as a buying opportunity.

- Bitcoin, ether and XRP posted large net outflows, while products tied to Solana, Binance and Chainlink saw inflows, showing divergent trends by asset.

Large-scale capital withdrawals from digital-asset investment products are continuing. With bearish sentiment lingering across markets, selling pressure is concentrating on bitcoin and ether.

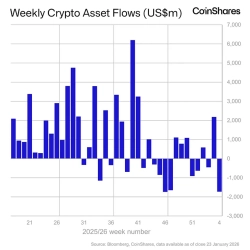

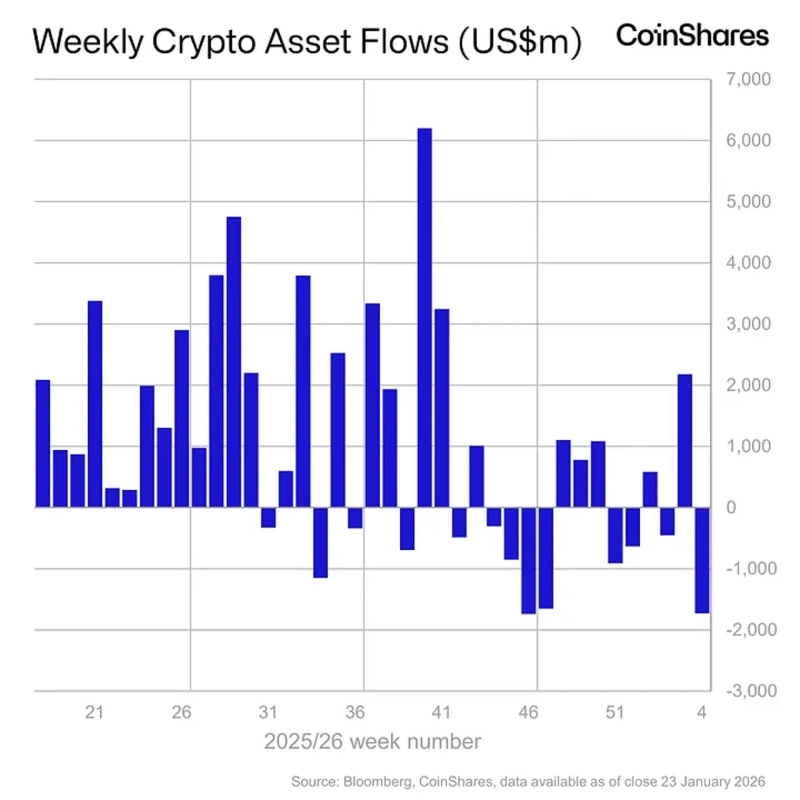

According to CoinShares’ weekly fund flows report released on the 26th, global digital-asset investment products recorded net outflows totaling $1.73bn over the past week. This marks the largest weekly outflow since mid-November last year.

By region, the U.S. alone saw about $1.8bn leave, driving the overall outflows. In contrast, Switzerland, Germany and Canada posted net inflows of $32.5m, $19.1m and $33.5m, respectively, showing divergent trends. CoinShares interpreted this as investors in some European countries and Canada viewing the recent price pullback as a buying opportunity.

By asset, bitcoin (BTC) investment products led the decline with $1.09bn in net outflows, the highest level since mid-November last year. However, short-bitcoin products saw a modest $0.5m in net inflows, suggesting some demand for defensive positioning against downside risk.

Ether (ETH) also joined the risk-off trend, with $0.63bn in outflows. XRP investment products recorded $18.2m in net outflows as well, indicating that negative sentiment has spread broadly rather than being confined to a specific asset.

By contrast, Solana (SOL) recorded net inflows of $17.1m, the only major asset to attract capital. Small inflows were also confirmed in Binance-related products and Chainlink investment products, at $4.6m and $3.8m, respectively.

CoinShares said, “These outflows were driven by a combination of fading expectations for policy-rate cuts, slowing price momentum, and disappointment that digital assets have yet to play a clear role as an inflation hedge.” It also pointed to the fact that market sentiment has not clearly recovered since the sharp drop in October last year as a factor influencing the latest moves.