Editor's PiCK

"Bitcoin on alert over yen intervention risk…historically rebounded after as much as a 30% pullback"

공유하기

Summary

- It said that if Japanese authorities’ yen intervention materializes, Bitcoin could see about a 30% pullback from its peak.

- It noted that during past yen interventions, Bitcoin fell about 30% before rebounding more than 100%, and added that some expect it could slide into the $65,000–$70,000 range this time as well.

- It explained that while the on-chain NUPL indicator is still above zero—meaning it is not yet a full capitulation phase—such periods have often provided an important buying opportunity over the medium to long term.

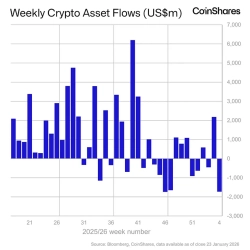

As the possibility of Japan stepping into currency markets to support the yen (JPY) is being discussed, concerns are growing that Bitcoin (BTC) could face additional downside.

According to cryptocurrency-focused media outlet Cointelegraph on the 26th, some observers say that if Japanese authorities move to intervene in the foreign-exchange market, Bitcoin could see a pullback of around 30% from its peak. In fact, during two previous bouts of yen intervention, Bitcoin fell about 30% from its highs before forming a bottom, then went on to rebound by more than 100%.

Yen intervention refers to measures by the Japanese government to sell dollars and buy yen to curb sharp yen depreciation. Market caution has intensified after remarks about FX coordination between the U.S. Federal Reserve and Japanese authorities, along with signs of a so-called “rate check” surrounding the USD/JPY exchange rate.

Crypto analyst Mikybull Crypto said “the same scenario could play out again,” adding that “Bitcoin may drop first and then rebound.” Some forecasts also suggest Bitcoin could slide into the $65,000–$70,000 range.

On-chain indicators still lean toward the view that a clear bottom signal has yet to emerge. According to data analytics firm Alphractal, the Net Unrealized Profit/Loss (NUPL) indicator is trending lower but remains above zero, suggesting many market participants are still sitting on unrealized gains.

Alphractal said that “in past cycles, Bitcoin’s true bottom formed only after NUPL turned negative,” adding that “it is still difficult to view the current situation as a full-blown capitulation phase.” It noted, however, that “while the process can be painful, it has often provided an important medium- to long-term buying opportunity.”