Summary

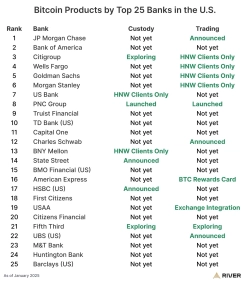

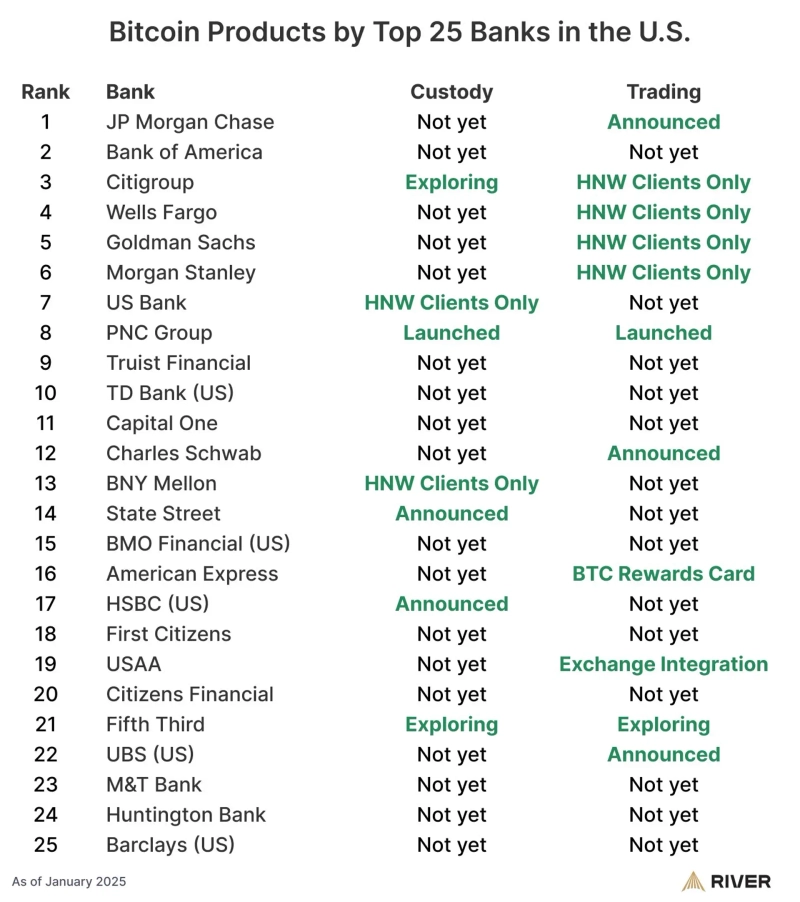

- It said that about 60% of the top 25 U.S. banks already offer Bitcoin trading or custody services, or have announced plans to introduce them.

- CEO Brian Armstrong said many bank CEOs view digital assets as an important business opportunity and an issue tied to survival.

- It said major U.S. banks such as JPMorgan Chase, Wells Fargo, and Citigroup are reviewing and moving ahead with introducing and expanding Bitcoin and digital-asset services.

A view has been raised that many major U.S. banks are preparing to introduce, or already offering, services related to Bitcoin (BTC).

According to digital-asset outlet Cointelegraph on the 27th (KST), Coinbase CEO Brian Armstrong said after attending the World Economic Forum in Davos, Switzerland, that "most of the bank CEOs I met showed a very friendly attitude toward digital assets."

Armstrong said, "Some are still cautious, but many see digital assets as an important business opportunity," adding that "the CEO of one of the world’s top 10 banks sees digital assets as the top priority and said it is also tied to the bank’s survival."

In fact, discussions of Bitcoin-related businesses are spreading rapidly among large U.S. banks. Bitcoin financial services firm River said on X (formerly Twitter) that of the top 25 banks operating in the U.S., about 60% already offer related services—such as Bitcoin trading or custody—or have announced plans to introduce them.

Among the U.S. "Big 4" banks, JPMorgan Chase is reviewing the introduction of digital-asset trading, while Wells Fargo is offering Bitcoin-backed loans to institutional clients. Citigroup is also exploring entry into digital-asset custody services for institutions. However, some major banks, including Bank of America (BoA), have yet to formally outline plans for Bitcoin-related services.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.