"Virtual asset market shows signs of market capitulation…a rebound will soon be seen"

공유하기

Summary

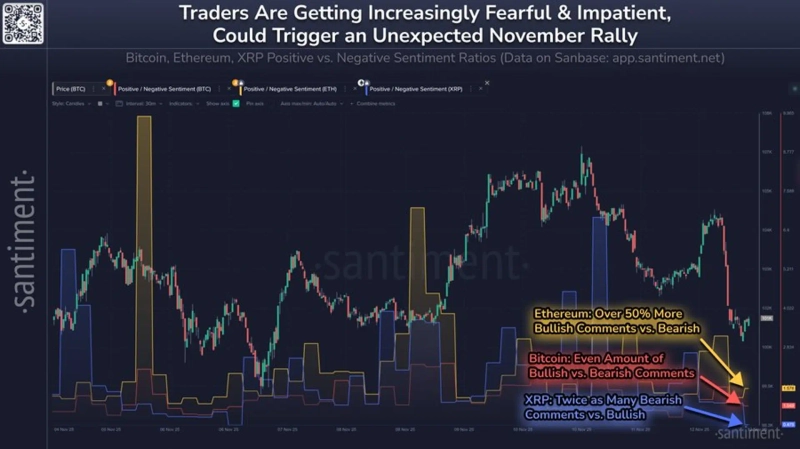

- Santiment said that investor sentiment toward the "virtual asset market" is weakening.

- It reported that, according to social media indicators, bullish tones for major market-cap assets such as Bitcoin (BTC), Ethereum (ETH), and XRP (XRP) have decreased.

- Santiment explained that this market pessimistic sentiment could, conversely, spur buying by major holders and soon lead to a price rebound.

Although investors' sentiment toward the virtual asset (cryptocurrency) market has weakened, analysis suggests this could actually trigger a rebound.

On the 13th (local time), on-chain analytics firm Santiment diagnosed, "Traders' sentiment toward the virtual asset market is gradually weakening. This is a positive signal for patient investors." According to Santiment, optimistic tones toward major coins have generally decreased on social media reaction indicators. Bitcoin (BTC) saw the ratio of bullish to bearish opinions fall to similar levels, Ethereum (ETH) had about 50% more bullish opinions than bearish ones but was lower than the historical average. In the case of XRP (XRP), bullish opinions were less than half of the total.

Santiment explained, "When the public turns pessimistic on the market, especially when this occurs in the top market-cap assets, it is a sign that the market is approaching a capitulation stage," and added, "A pattern has often repeated where institutions and major holders buy back the volume sold by retail investors, leading to a price rebound." It added, "This is not a matter of 'if' but of 'when'," and "The point at which sentiment is excessively depressed is likely to be the starting point of a future rebound."