Editor's PiCK

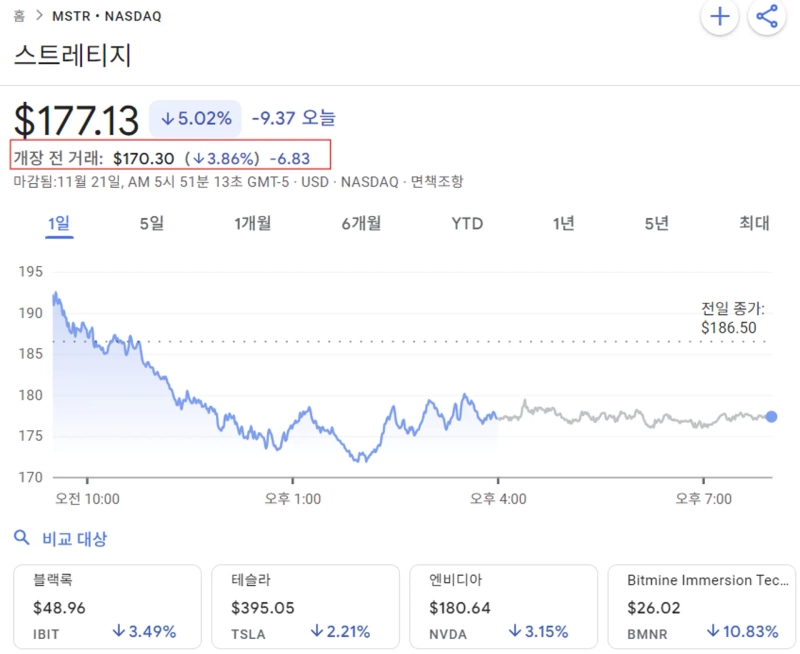

'Last bastion' Strategy falls 3.86% in pre-market trading

Summary

- Strategy is a listed company with large Bitcoin holdings, and its stock also fell 3.86% following Bitcoin's decline.

- Bitcoin fell 9.96% due to reduced expectations for rate cuts and whale selling, raising the possibility of short-term strategic changes for Strategy.

- JPMorgan warned that institutional flow volatility could increase if exclusion from the MSCI index is confirmed.

Amid a deepening decline in the leading crypto asset Bitcoin (BTC), Strategy (formerly MicroStrategy) is seeing its stock weaken.

On the 21st (Korean time) at 7:51 p.m. in the Nasdaq pre-market, Strategy is trading at 170.30 dollars, down 3.86% from the previous day.

Strategy is the listed company that holds the most Bitcoin among publicly traded firms. As Bitcoin weakens, Strategy's stock is also weakening, analysts say. At the same time, Bitcoin is trading at 82,576 dollars, down 9.96% from the previous day, according to CoinMarketCap.

On the day, Bitcoin widened its losses due to intensified selling by a large whale and reduced expectations for interest rate cuts. Earlier, the large whale Owen Gundon deposited 230,000,000 dollars' worth of Bitcoin to the exchange Kraken and sold all the Bitcoin he held.

Meanwhile, the market is paying attention to Strategy's stance. Strategy has maintained a strategy of additional Bitcoin purchases, but observers say that the possibility of large impairment losses and a deterioration in borrowing conditions could lead to changes in short-term decision-making.

JPMorgan said, "If Strategy's exclusion from the MSCI index is confirmed, institutional flow volatility could increase further."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)