Summary

- The U.S. SEC said the Solana-based 'Fuse Energy' token issuance is not a security.

- The SEC stated that the Fuse token's value is directly linked to utility within the network, so it does not meet the requirements for an investment contract.

- It said the Fuse token was designed for actual use for network operation and energy infrastructure.

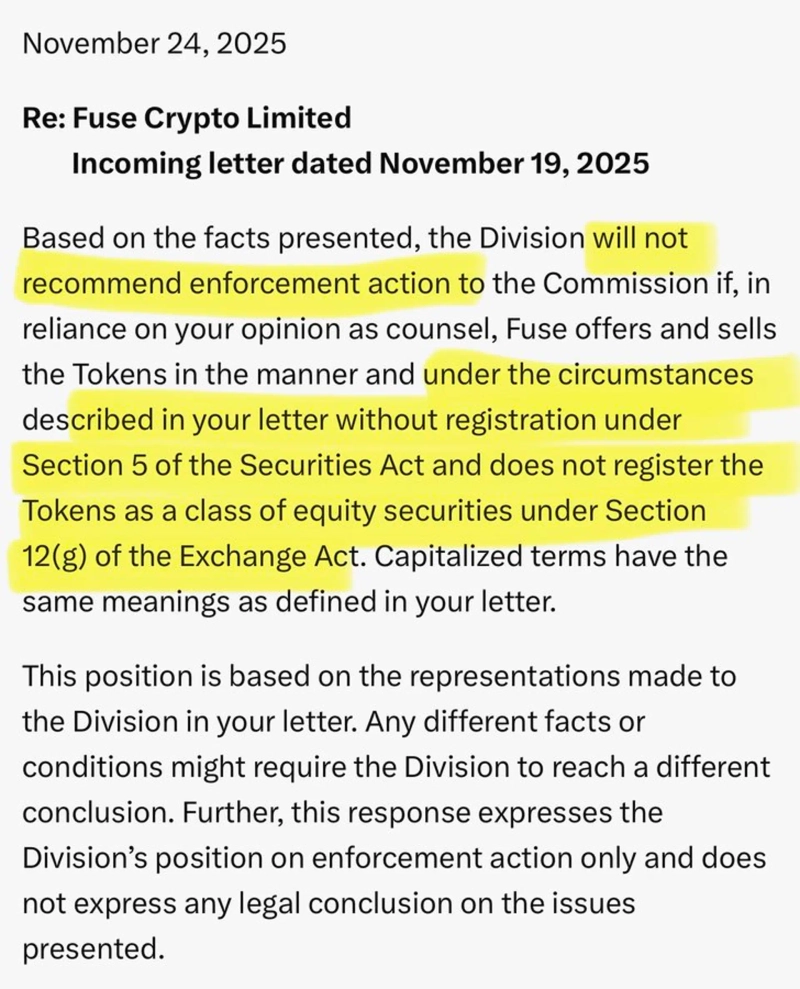

The U.S. Securities and Exchange Commission (SEC) has expressed the view that the token issuance of Fuse Energy, a Solana (SOL)-based decentralized energy grid project, is not a security.

On the 25th (local time), according to Eleanor Terrett, host of Crypto in America, the SEC issued a no-action letter and determined that Fuse Energy's token issuance does not constitute an 'investment contract' under the securities laws.

The SEC stated as the basis for its determination that the value of the Fuse token is directly linked to utility within the network, not investor profit expectations. In other words, the SEC found that the token was designed based on actual use for network operation and energy infrastructure usage, and is not structured so that purchasers would expect profits based on others' 'management·operational efforts.'

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)