Editor's PiCK

Bitcoin revived on rate-cut hopes... Is the bull market already over? [Lee Su-hyun's Coin Radar]

Summary

- Bitcoin recovered the $90,000 level backed by expectations of rate cuts and strength in tech stocks, but some analyses pointed to a possible end of the bull market citing the 200-day moving average decline.

- Ethereum maintained buying interest supported by spot ETF inflows and a 26-month high in apparent demand, while increased exchange deposits highlighted short-term selling pressure.

- Ondo Finance showed mid- to long-term growth potential through RWA-based portfolio expansion and surpassing $1 billion in cumulative trading volume, but short-term volatility and rate/regulatory variables warrant caution.

<Lee Su-hyun's Coin Radar> is a corner that reviews the weekly flow of the virtual asset (cryptocurrency) market and explains the background. Beyond a simple listing of prices, it provides a three-dimensional analysis of global economic issues and investor movements, offering insights to gauge the market's direction.

Major Coins

1. Bitcoin (BTC)

Bitcoin, which experienced a sharp correction last week, has rebounded this week. Buying interest revived around the 25th, reclaiming the $90,000 level. As of the 28th, Bitcoin is trading above $91,000 on CoinMarketCap.

The rebound is primarily attributed to strength across tech stocks. Google's newly released AI model 'Gemini 3' received positive market evaluations, temporarily easing concerns about an AI bubble. Funds that had flowed into tech stocks appear to have spilled over into Bitcoin, contributing to the rebound.

The increased expectation of rate cuts also supported Bitcoin's recovery. After John Williams, president of the New York Federal Reserve, left open the possibility of an additional cut in December, Fed Governor Christopher Waller and Mary Daly, president of the San Francisco Fed, also mentioned the need for cuts citing labor market cooling. Moreover, Scott Bessent, the Treasury Secretary, said "Fed officials are tilting toward cuts," further expanding expectations for a December rate cut.

Indicators also showed signs of weakening labor demand. The ADP National Employment Report said private sector jobs decreased by an average of 13,500 per week over the past four weeks. Worsening employment is interpreted as creating an environment in which the Fed could implement rate cuts, serving as a catalyst for Bitcoin's rebound. The Fed Beige Book released on the 26th (local time) also noted that "employment levels fell slightly and labor demand weakened in half of the districts," and Goldman Sachs analyzed that "there is almost nothing to prevent a December cut."

However, market interpretations remain divided. After the 200-day moving average, a key long-term Bitcoin indicator, turned downward, some analysts even suggested the bull market has already ended. Crypto₿irb evaluated that "from a technical perspective the Bitcoin bull market is over," citing recent high volatility, surging trading volume, higher-than-average price swings, and increased time spent below the 200-day line as evidence.

Markus Thielen, Head of Research at 10x Research, also said, "Bitcoin has unquestionably entered a bear market," characterizing the current situation as a 'bear market rebound phase.' On the other hand, Henrik Andersen, CIO of Apollo Capital, argued the opposite, saying, "Although long-term accumulation has diminished, it should not be immediately concluded that this is entry into a bear market."

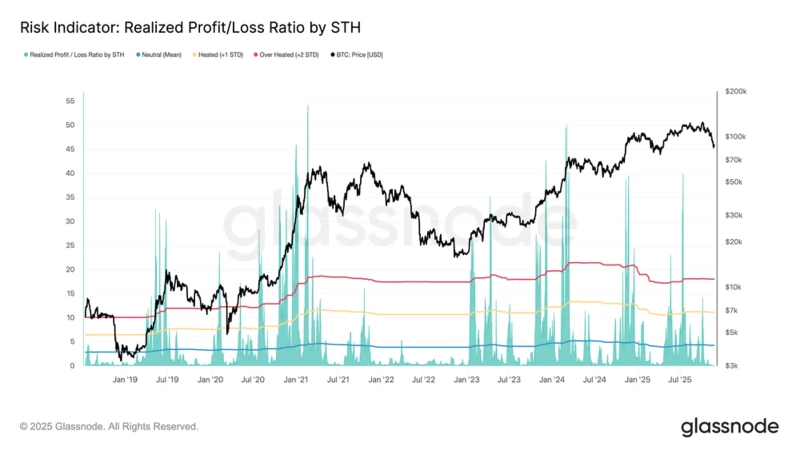

On-chain indicators show downside risks for Bitcoin remain. Glassnode analyzed that "Bitcoin has recently been trapped in a narrow range between $81,000 and $89,000," and that "this range is very similar to the post-2022 all-time-high shift into a bearish phase." The short-term holder SOPR (spent output profit ratio) fell to 0.07x, indicating loss-making positions dominate the market. This is interpreted to mean that with weakened liquidity, the price could be pushed below $81,000.

Separately from structural on-chain bearish signals, analysts say there is ample room for additional rebounds if buying interest mounts. Crypto analyst Skew said, "If the $88,000 level holds, short-term upside attempts are possible," and warned, "if this level breaks, this rebound has failed." Skew added, "The market is currently forming the 'main battleground' between $90,000 and $92,000 that will determine the mid-term trend," emphasizing the importance of defending $90,000. Ultimately, $90,000 is the first hurdle, and if it fails, support at $88,000 must be confirmed to expect further rebounds.

2. Ethereum (ETH)

Ethereum (ETH) reclaimed $3,000 again this week. Unlike general market volatility, ETH has shown relatively stable flows with clear demand of its own.

A notable feature is that buying interest has flowed in even during price corrections. According to Capriol Investment, Ethereum's 'Apparent Demand' reached a 26-month high. Demand, which was about 37,000 on the 22nd, surged to over 90,000, indicating buying interest during the market downturn.

Institutional and whale net purchases have been steady. Ethereum spot ETFs recorded net inflows for four consecutive trading days. In particular, on the 25th, net inflows into Ethereum spot ETFs ($60.8 million) exceeded those into Bitcoin spot ETFs ($21.1 million). Digital asset treasury strategists (DAT) are also continuing accumulation. Bitmain added about 70,000 (69,822 ETH) more in the past week. SharpLink Gaming also added 443 ETH through staking rewards, bringing its accumulated holdings to 7,846 ETH.

From a network perspective, there was a change: Ethereum's gas limit was raised from 45 million to 60 million, laying the groundwork for smoother transaction processing in traffic-congested periods. This is seen as a measure to improve mainnet performance over the long term rather than to lower short-term gas fees.

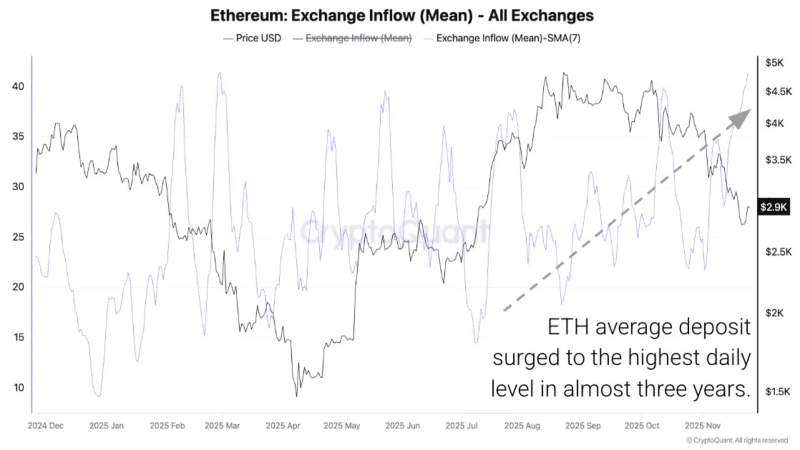

However, increased exchange inflows raise concerns about short-term selling pressure. According to CryptoQuant, the average exchange deposit this week was 41.7 ETH, the highest in about three years.

Prospects are mixed. Cointelegraph sees room for a short-term rebound to $3,600 based on demand recovery and ETF inflows. Conversely, Ken Lab trading analysts warned that "if $3,000 does not turn into support, further declines are possible."

3. XRP (XRP)

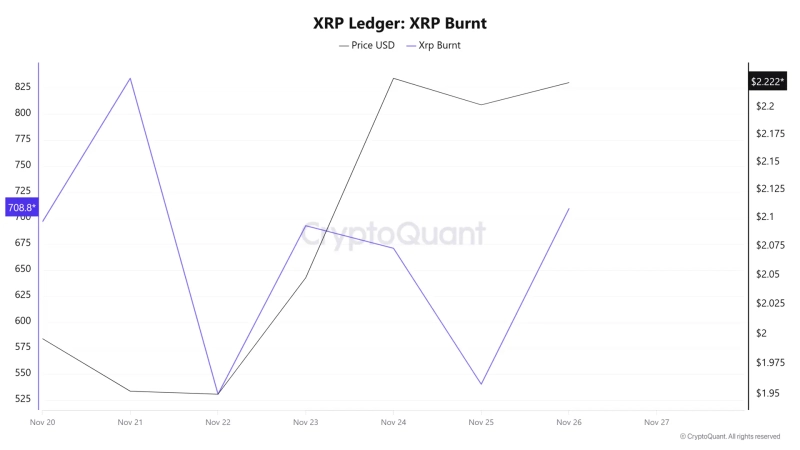

XRP showed the steadiest performance among major coins this week. It rose nearly 10% weekly on CoinMarketCap and held the $2.1 level. Recent increases in token burns are analyzed as a price support factor. On the 25th–26th, the daily burn rate surged by 31%, burning about 780.8 million XRP in a single day. The clear reduction in supply naturally supported the price.

ETF debuts also lifted demand. Four new XRP spot ETFs, including Grayscale and Franklin Templeton, launched on the 24th and absorbed about 8 million XRP in one day. Since ETF-absorbed tokens leave market circulation, increased demand translates to upward price pressure.

Additionally, Ripple's stablecoin 'RippleUSD (RLUSD)' being approved as an official settlement asset by Abu Dhabi's financial regulator is also viewed as positive. On the 25th, the Financial Services Regulatory Authority (FSRA) of the Abu Dhabi Global Market (ADGM) approved RLUSD as a settlement asset. ADGM-authorized institutions can now use RLUSD as a means of payment, collateral, and settlement if regulatory requirements are met. With Abu Dhabi recently emerging as a global crypto hub, expectations for ecosystem expansion are rising.

Technically, $2.25–$2.35 is the key resistance zone. CoinDesk says breaking this range would open the possibility of a short-term rebound to $2.60, while Cointelegraph warned that "if $2.20 is not quickly recovered, further corrections to $2.10 or even $2.00 are possible."

Issue Coins

1. Ondo Finance (ONDO)

Ondo Finance (ONDO) showed meaningful flows in the real-world asset (RWA) sector this week. It rose about 5% on CoinMarketCap and is currently trading around $0.51.

Ondo recently added $25 million of YLDS, a stablecoin issued by Figure Technologies, expanding its portfolio. YLDS is not a simple dollar-pegged token but a structure that distributes U.S. Treasury interest, giving it a different character from Ondo's existing asset composition.

Ondo already holds tokenized bonds from traditional financial institutions such as BlackRock and Franklin Templeton. This purchase is interpreted as a strategy to operate cash-like and yield-generating assets simultaneously in addition to Treasury-centered assets.

Ondo's global market trading volume is also rapidly increasing. Cumulative trading volume has exceeded $1 billion, and issuance/redemption transactions for on-chain versions of stocks and ETFs offered to non-U.S. investors alone amount to $450 million. This is evidence that real use cases in the RWA market are expanding.

The market views Ondo as a mid- to long-term growth axis, but given the large correction this year, short-term volatility may continue. Interest rates, regulation, and liquidity variables are likely to be key factors for future flows.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)