Summary

- Arthur Hayes warned that Tether's operational strategy is vulnerable to a U.S. Fed rate cut.

- He analyzed that in the event of a rate cut, Tether's main revenue source, interest income from government bonds, would decrease, causing financial pressure.

- He warned that even a 30% decline in the value of Tether's gold+Bitcoin position could lead to equity evaporation, and pointed out the possibility of insolvency.

Arthur Hayes, co-founder of BitMEX, warned that Tether(Tether)'s current operating strategy is structured to be vulnerable to interest rate changes.

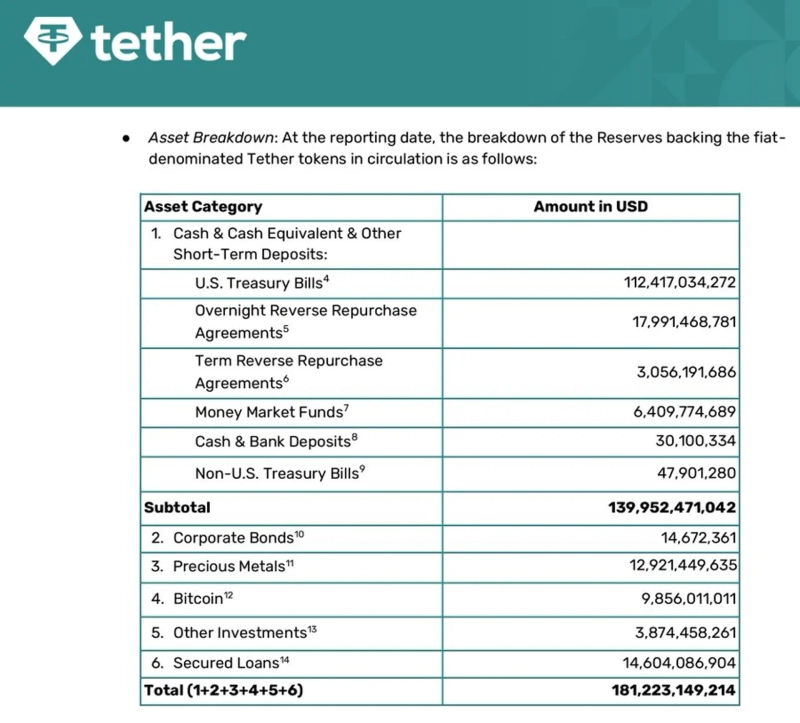

On the 30th (local time), Hayes referenced Tether's reserve report via X, analyzing that "a rate cut by the Federal Reserve (Fed) would immediately put pressure on Tether's interest income."

Hayes explained that when authorities begin cutting rates, Tether's main revenue source, interest income from government bonds, would decline, and that Tether is increasing purchases of gold and Bitcoin in response.

He pointed out the possibility of insolvency, saying, "While it is theoretically plausible that demand for gold and Bitcoin would surge in a falling-rate environment, if the value of Tether's gold+Bitcoin position declines by about 30%, its equity could be entirely wiped out." He also mentioned the possibility that some large holders and exchanges might demand real-time balance sheet disclosure from Tether.

Hayes predicted that this issue could become an attack point for mainstream media. He noted that Commerce Secretary Howard Lutnick, a figure close to the Trump administration, and his financial firm Cantor Fitzgerald are known as key partners of Tether, predicting "there is a high likelihood of critical reporting framed politically."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)